How to Find Underrated Gems using CryptoRank

If you're familiar with our other guide “Guide: How to Find Next 100x Gem”, you'll find it helpful in some sense.

Searching for underrated gems is more difficult than finding new ones, and the chance of choosing the right one is significantly lower. However, tokens that are already trading may bring you colossal returns in case the crowd becomes interested in them.

The token generation event (TGE) is the most successful period of life for many projects. Most projects actually live only for this short moment. During the bull market those who managed to get an allocation are almost guaranteed to get at least a small return on their investment at TGE. It is hard to lose in this game if you don’t marry your bags and overstay in the token.

It's a different story with underrated gems. Most tokens will never reach previous all-time highs or even get close to them. You need to acknowledge the fact that most of them are not undervalued but priced correctly, actually. Thus, the process of seeking an underrated token is like searching for a needle in a haystack that is indeed underpriced. And it is better to have a good explanation of why this needle ended up there and why the market made a mistake by underpricing it.

What Makes Token Underrated?

That is the great question and the first one to answer, because it's not obvious. A token can drop 50% from its recent highs, and psychologically, it will seem to be underrated. But it is not that simple; a token can fall another 50% and still not be undervalued but actually correctly valued at the current moment. An underrated token is one that does not show price dynamics corresponding to market sentiment, while your fundamental analysis says that it should be worth more.

Why Can Token Be Underrated?

If we are talking about a good quality project and not pump-and-dump rubbish, there can be many reasons why it was undervalued at the time it was found. Most often, it happens due to poor marketing, bad launch timing, or a combination of both.

The bad timing of the launch is either related to a bearish sentiment or the fact that the product came ahead of its time and the market was simply not ready to embrace it. The second option is preferable; it means that the project will have a competitive advantage over new projects when the right time comes. As for bad marketing, predicting that it suddenly becomes good is impossible without insider information. Therefore, it is better to take this off the table.

Ultimately, you have to answer yourself why exactly your picked token is undervalued and also try to answer the question of why that is going to change. To achieve that, you have to understand current and foresee future crypto trends.

How Do You Foresee Crypto Trends?

You can start with current trends and identify categories with the best performance. To do so, in the "Categories" section on CryptoRank, examine the performance of categories on several timeframes. Filter via layout as you see fit. It is better to choose large timeframes, such as a year, half a year, or a month, because days and weeks are unrepresentative.

To learn more about trends and narratives, check out our article “Most Popular Crypto Narratives”.

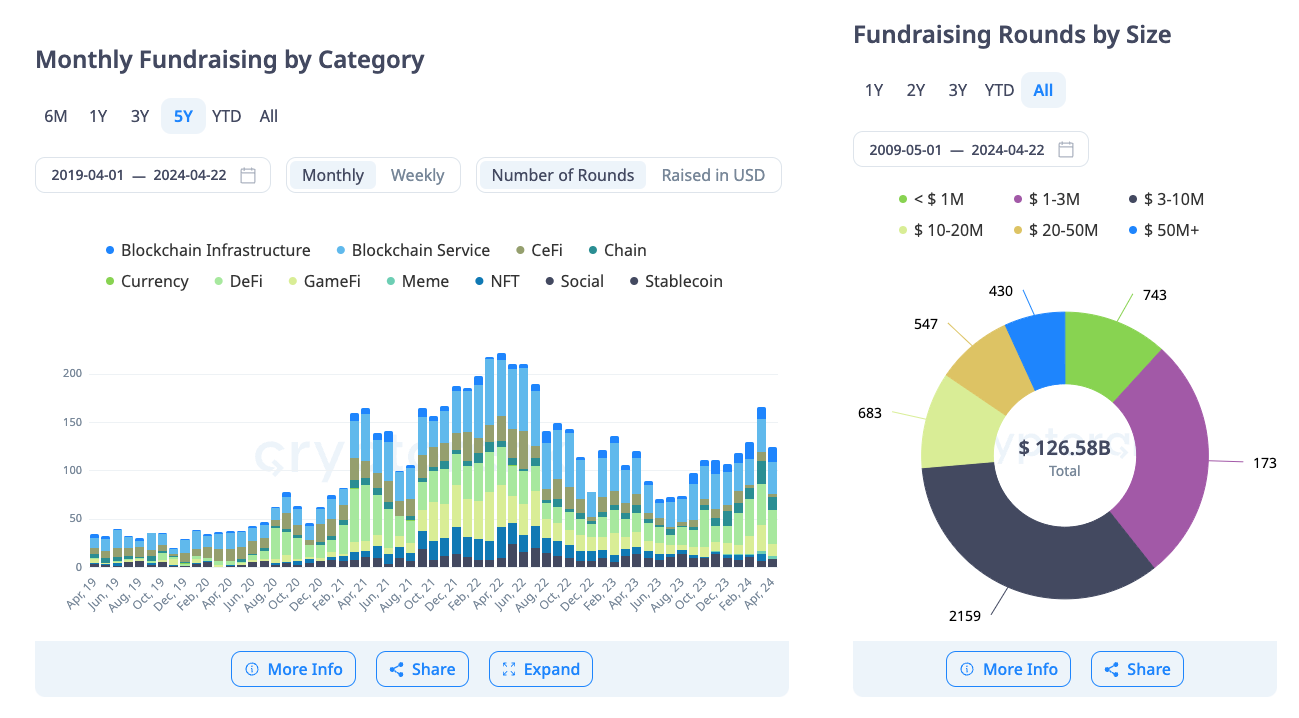

Continue your research by exploring our fundraising dashboards. They should help you determine which categories are favored by investment funds. Many venture capital funds bet on future trends rather than current ones, that’s a smart move.

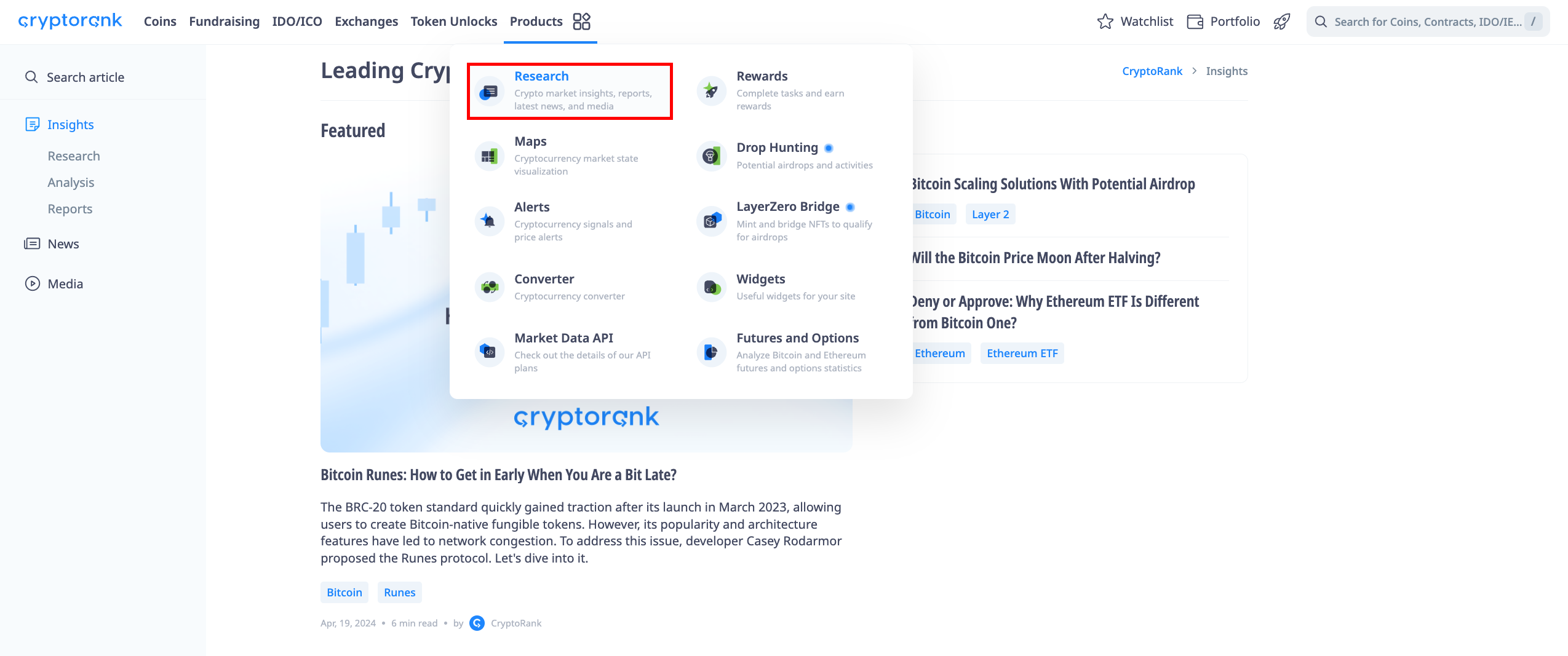

Predicting future trends will require a deep understanding of the entire crypto industry. If you are constantly on-chain and keep an ear to the ground, then you understand where crypto is moving and what it lacks. Our “Research” section would be handy.

How to Pick the Needle in a Haystack?

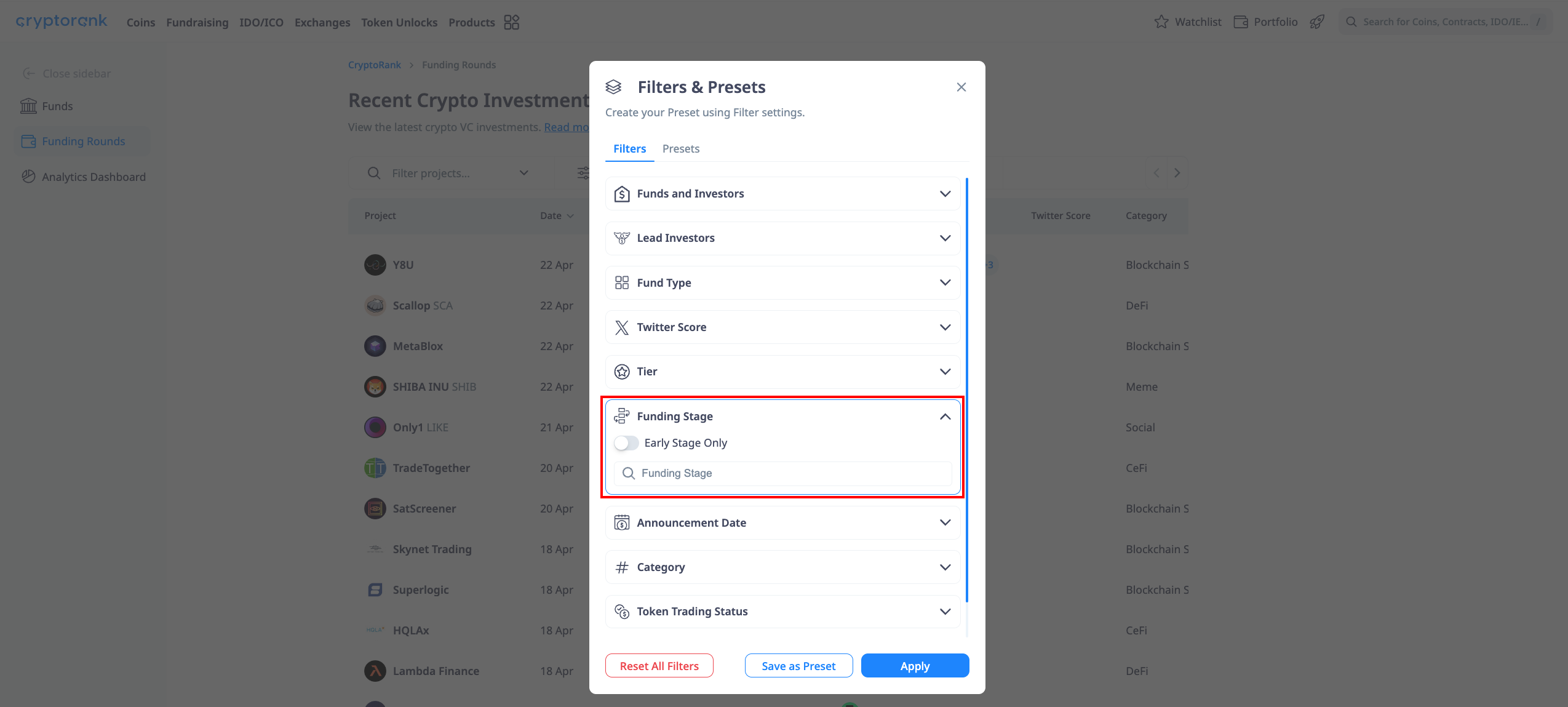

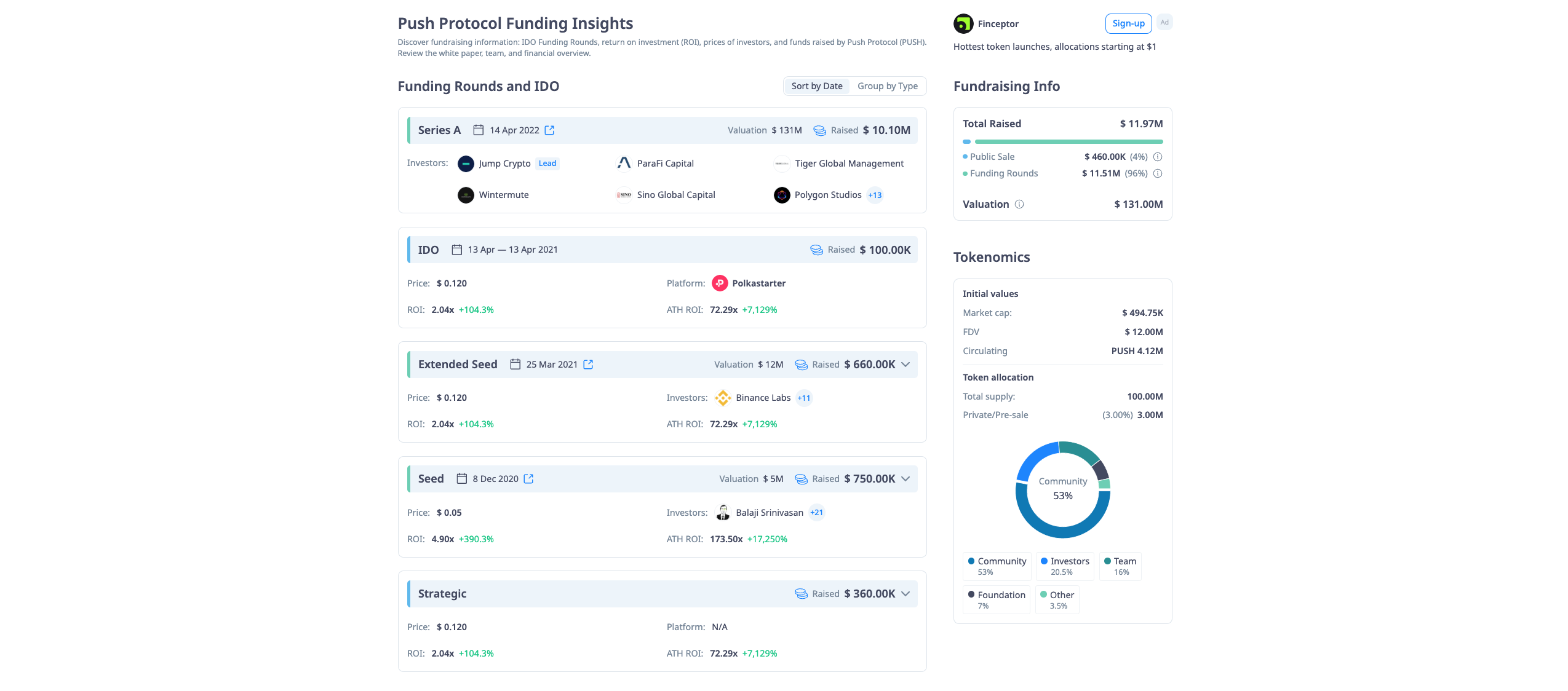

You can start with sorting projects by the time periods when they raised funds. It is best to choose bearish time frames. Many projects manage to raise millions of dollars when everything is going up and the market is in euphoria. But it takes an effort to raise a round in a bear market, and those that have been able to are definitely worth your attention. Don’t forget to turn off the “Early Stage Only” button and choose the “Traded” token status!

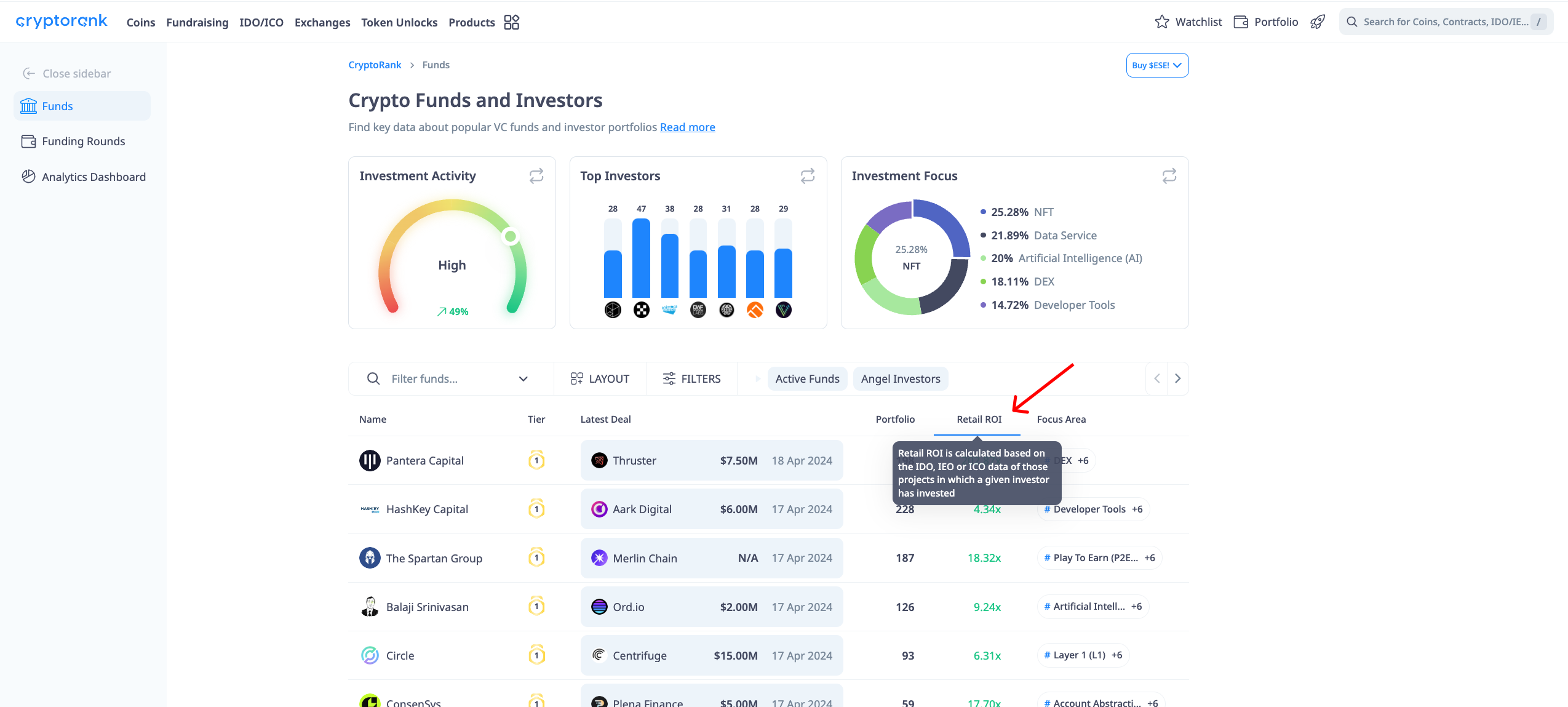

Furthermore, you can compare fund statistics in the “Funds” tab by retail ROI, select the best ones, and study their portfolios. The portfolios of the most profitable investors are unlikely to contain anything underrated, as many retail investors are eager to enter a project just by seeing a cool VC name. Many projects in those VC portfolios can even be overvalued, and this effect becomes cumulative. Still, you can give it a try to find something under radar.

After finding interesting projects, add them to the watchlist so that you don't lose them. Once the selection is complete, closely study each project by visiting its official web page, using the protocol itself, and checking for activity on social media (especially X (Twitter)). It's also important to check the project's GitHub for activity, such as learning the time of the last commit. After that, you are ready to make more specific decisions.

Action Plan

Execution can become a challenge here. Even if you hit the mark and have found a true underrated gem, there are multiple ways to screw up. Buying during bad market conditions or buying with market orders will definitely ruin your game.

Wait for a pullback. The time for altcoins often comes after major Bitcoin upward moves, more specifically after following corrective pullbacks. Undervalued altcoins are no exception in this sense; you should look for entry points on corrective pullbacks, just like with any other asset. If the market is overheated and an undervalued gem has not shown any results, it is better to avoid getting in before the corrective movement.

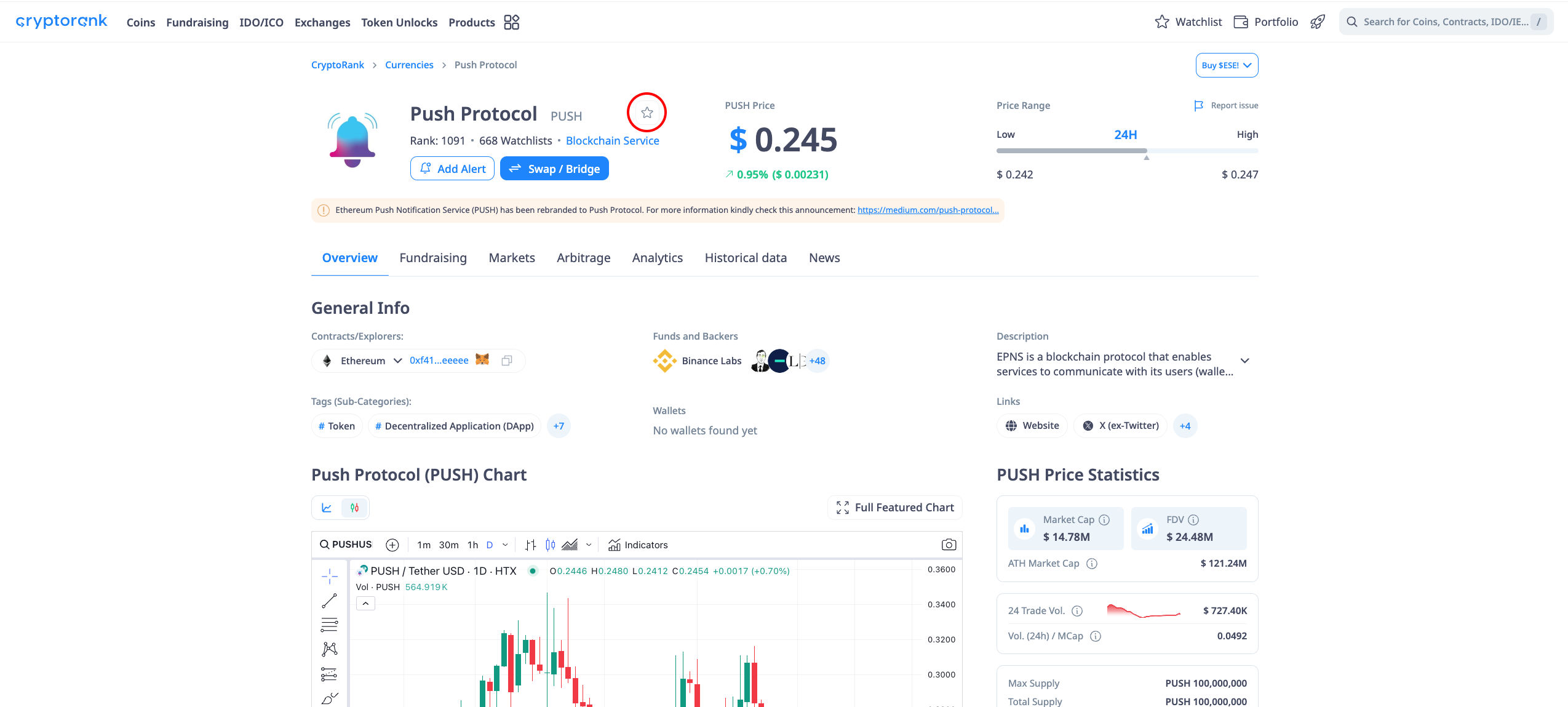

Define your entry points and place limit orders. To determine entry points, you can start by looking at the prices of private and public sales of the token. If the project held a token sale, the prices of public rounds are always known. At the same time, the prices of private rounds are not regularly disclosed, but it happens. The "Fundrising" tab will come in handy. Then, on Trading View, mark the key support zones on the higher timeframes and set limit orders on an exchange.

Mistakes to Avoid

-

Don’t invest life savings. That can cost everything. You should invest only what you can afford to lose;

-

Don’t merry your bags. Even if the chosen gem shows multiple gains, it can fall back below your entry point even faster, and you will find yourself locked in. Claim what you have invested as soon as possible.

-

Don’t buy an underrated gem with market orders. Even if you find a genuinely underrated gem that seems to be lying at the bottom, it doesn't mean that it can't refresh the bottom three more times before the growth starts. Resist the urge to get in right away; there is no need to hurry; it is better to place limit orders.

-

Don’t sit in the assets forever. You could be wrong, and the gem you find will never grow. Determine your stop losses.

Output

Searching for an underrated crypto gem is a challenging but potentially rewarding venture. It requires diligent research, keen market insight, and a clear understanding of both the asset's fundamental value and the broader market dynamics. Successful hunters of these hidden treasures must look through numerous tokens, identifying those with real potential that the market has indeed overlooked, not priced correctly.

However, finding the right gem is only half the battle. Even with the right token in sight, you can fail with a poor execution. You must be patient, waiting for the right market conditions, and set limit orders to avoid common pitfalls. Recognizing the risks, be ready to adapt to market changes, and DYOR.

Read More