Do Buybacks Work in 2025?

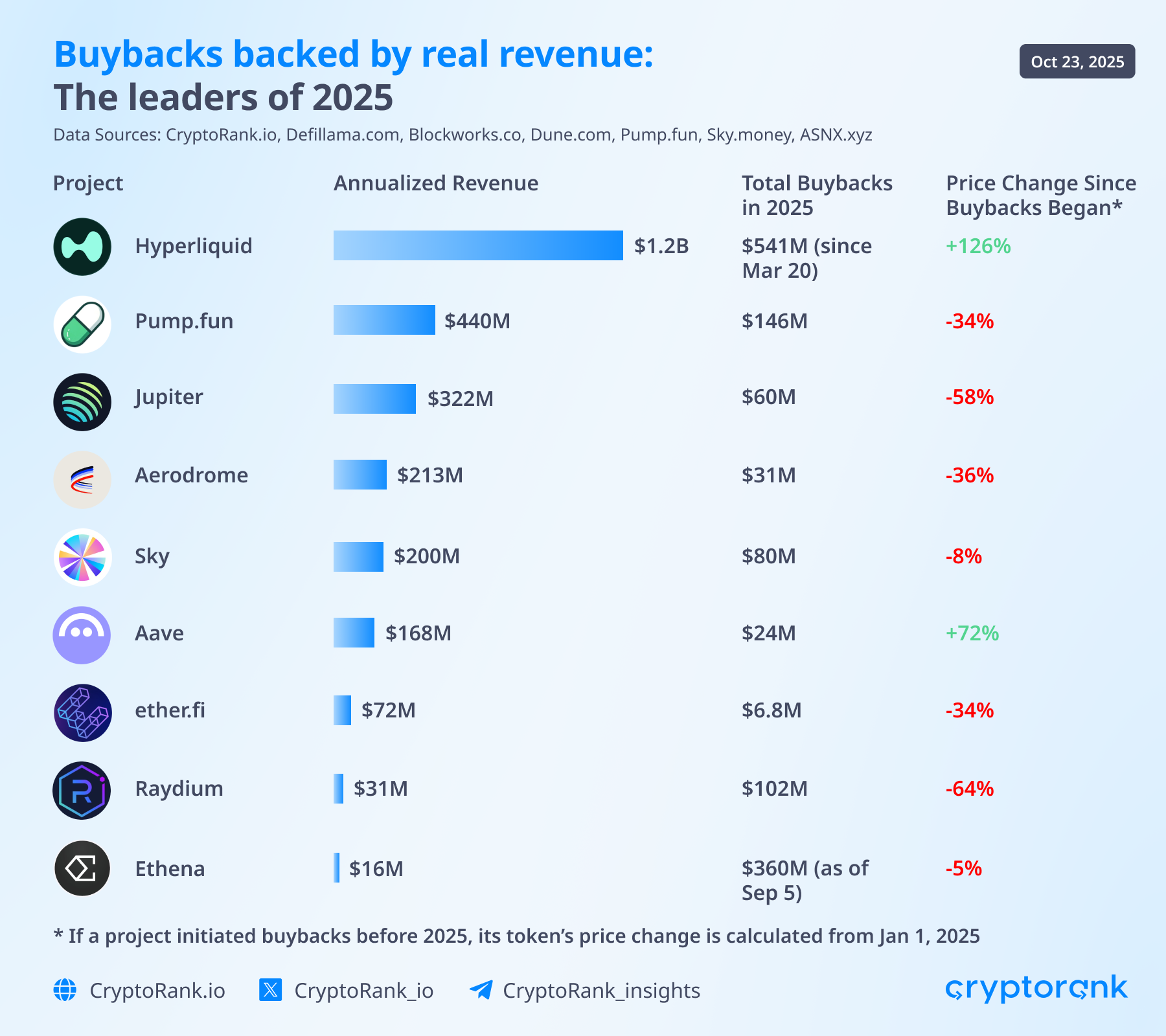

This year, many major projects have launched token buyback programs. Most of them share a single goal – to reduce the circulating supply and, in turn, support or increase the token price. To see whether buybacks have a long-term effect on token performance, we analyzed nine projects with consistent revenue and evaluated the effectiveness of their buyback programs.

Results

It turned out that only two tokens managed to grow and maintain their positions since the start of the buybacks, HYPE and AAVE. HYPE increased by 126% since the end of March, when the Hyperliquid Assistance Fund began actively buying the token. A one-time $20M buyback was one of the reasons HYPE relatively calmly withstood the recent market crash. Aave grew by 72% since April.

Most of the other tokens showed growth soon after the buybacks started, but failed to hold their prices and later even dropped below initial levels. The drop on October 11 influenced the dynamics, yet the downward trend remains even when analyzing data from earlier periods.

Tokens that failed to sustain growth:

At the same time, for JUP, RAY, and ETHFI, buybacks had no even short-term effect, and these tokens continued to fall, a decline that had already started before the buybacks began. Incidentally, the Jupiter team has already acknowledged the inefficiency of their approach and is preparing changes: reducing the unstaking period from 30 to 7 days, decreasing the number of votes, and potentially burning 121M JUP (pending DAO approval).

Conclusion

For 7 out of 9 projects, buybacks did not bring results, and token prices continued falling over a period of more than 4 months. Buybacks are not a magic button to pump tokens and do not work for every project. For buybacks to make sense, the token’s value must be tied to the project’s goals, and its role/utility in the ecosystem must be clearly defined. Otherwise, buybacks risk turning into a bottomless money pit.

This raises the question: is it worth it for projects to invest tens of millions in buying back their tokens? Or are there better ways to invest revenues? For example, product growth, scaling, or ecosystem development.

Everyone has their own approach: some will continue or even expand their buyback programs, while others, like Jupiter, will raise these very questions. Who is right, only time will tell.

For an ordinary trader, the launch of buybacks by a project may create a short-term earning opportunity. However, holding such tokens for several months is much more risky.