Crypto Fundraising Recap: November 2023

Executive Summary:

-

Alongside the rise in cryptocurrency prices, crypto fundraising significantly increased in November, surpassing October's fundraising by 180%.

-

The average size of a funding round has grown from $1-3 million to $3-10 million.

-

A total of 111 deals worth $1.67 billion were closed, with the highest funding amounts going to Blockchain Service ($1.02BM) and DeFi ($310.3M).

-

If the next several months will show even greater funding gains, it could signal the beginning of a bull run.

-

The top five biggest rounds in November made it the most significant month of the year in terms of total raised amount.

Fundraising Activity Has Upward Trend

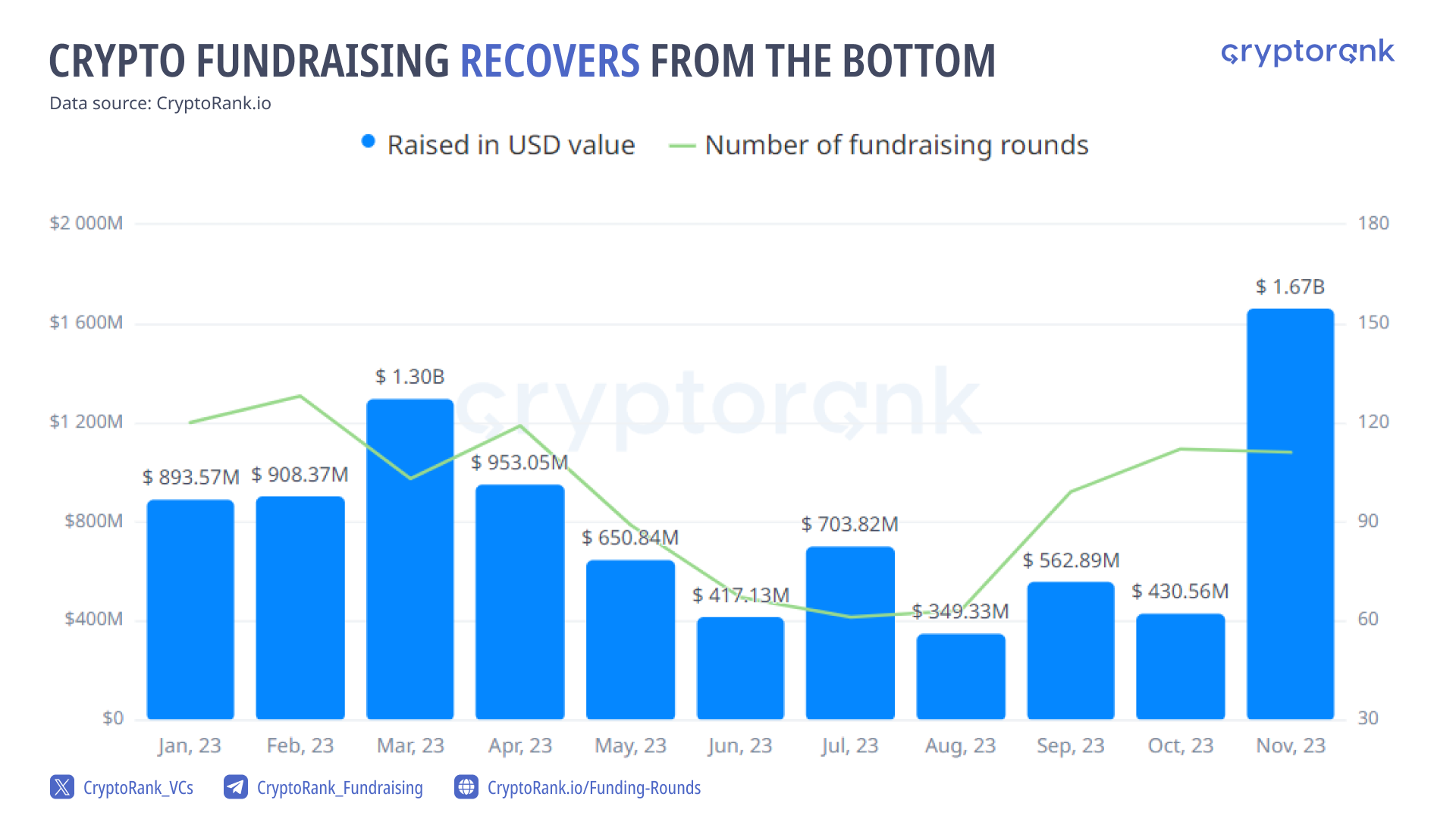

In November, $1.67 billion was invested in crypto projects, reaching an eight-month high. The number of projects receiving investments is also on the rise, reaching 111. Overall, an upward trend in crypto startups funding has emerged.

Data source: https://cryptorank.io/ico-analytics

As of the end of November, the price of Bitcoin has risen from $34,400 to around $38,000, inducing a fear of missing out and fueling investor greed and even broke $41,000 in the beginning of December. The price rally can be attributed to the anticipation of the approval of a spot Bitcoin ETF and the upcoming Bitcoin halving. These events have been driving the current surge in prices, consequently boosting fundraising activity.

As mentioned in the previous month's fundraising recap, November was anticipated to set the tone for crypto fundraising dynamics in the coming months. It indeed demonstrated a 180% increase in the amount raised, signaling heightened interest in investing in crypto projects.

The Top Five Rounds Made November the Best Month in Terms of Fundraising Amounts

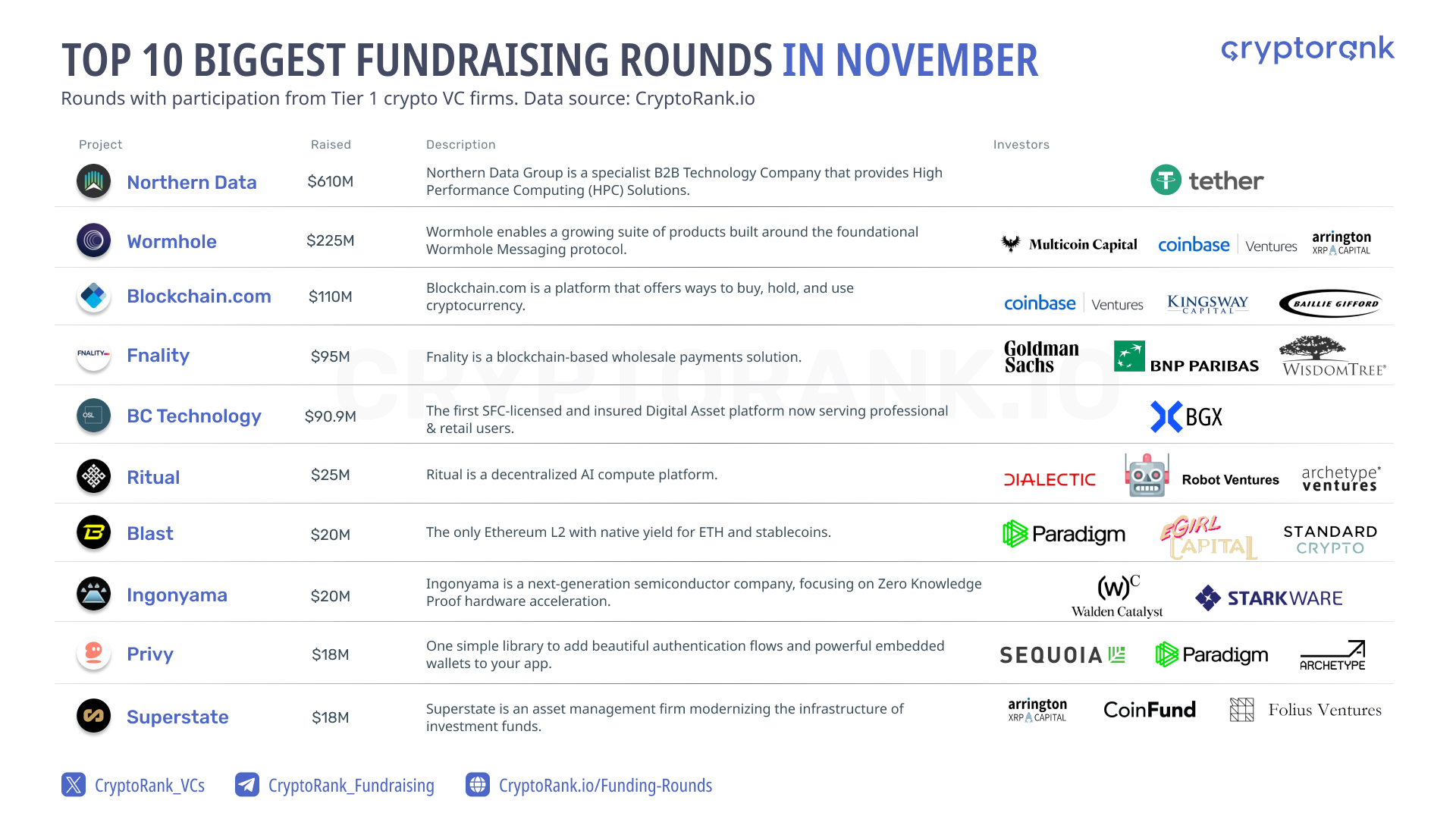

November is noteworthy for both significant investment rounds and multiple M&A deals. The top 10 largest rounds in November accumulated a total of $1.2 billion, constituting 71% of all VC investment for that month.

Data source: https://cryptorank.io/funding-rounds

Now, let's take a closer look at the top 3 leaders:

-

Wormhole serves as a 'bridge,' efficiently facilitating the movement of digital assets between different blockchain networks. The portal enables users on top-tier decentralized platforms such as Ethereum, BNB Chain, Solana, Polygon, etc., to communicate seamlessly through a transparent interface. Notably, the $225 million funding round, with participants including Coinbase Ventures, Jump Trading, Multicoin Capital, and Arrington XRP Capital, did not have a specific leading investor. Their stakes will comprise token warrants for a cryptocurrency yet to be unveiled.

-

Blockchain.com stands as the premier global crypto infrastructure platform catering to both consumers and institutions. Remarkably, its revenue has surged by approximately 1500% in the last four years, a growth rate significantly surpassing the 275% uptick observed in the global crypto market during the same period. Notably, nearly 33% of all Bitcoin transactions have been processed through a wallet managed by Blockchain.com.

-

Fnality applies blockchain technology to offer institutions a robust method for utilizing central bank funds across diverse scenarios, including instantaneous cross-border payments, collateral management, and security transactions. The company's primary objective is to develop digital versions of major currencies for use in wholesale payments and transactions involving digital securities.

Venture Capitals Are Ready to Make a Big Bets on Crypto Projects

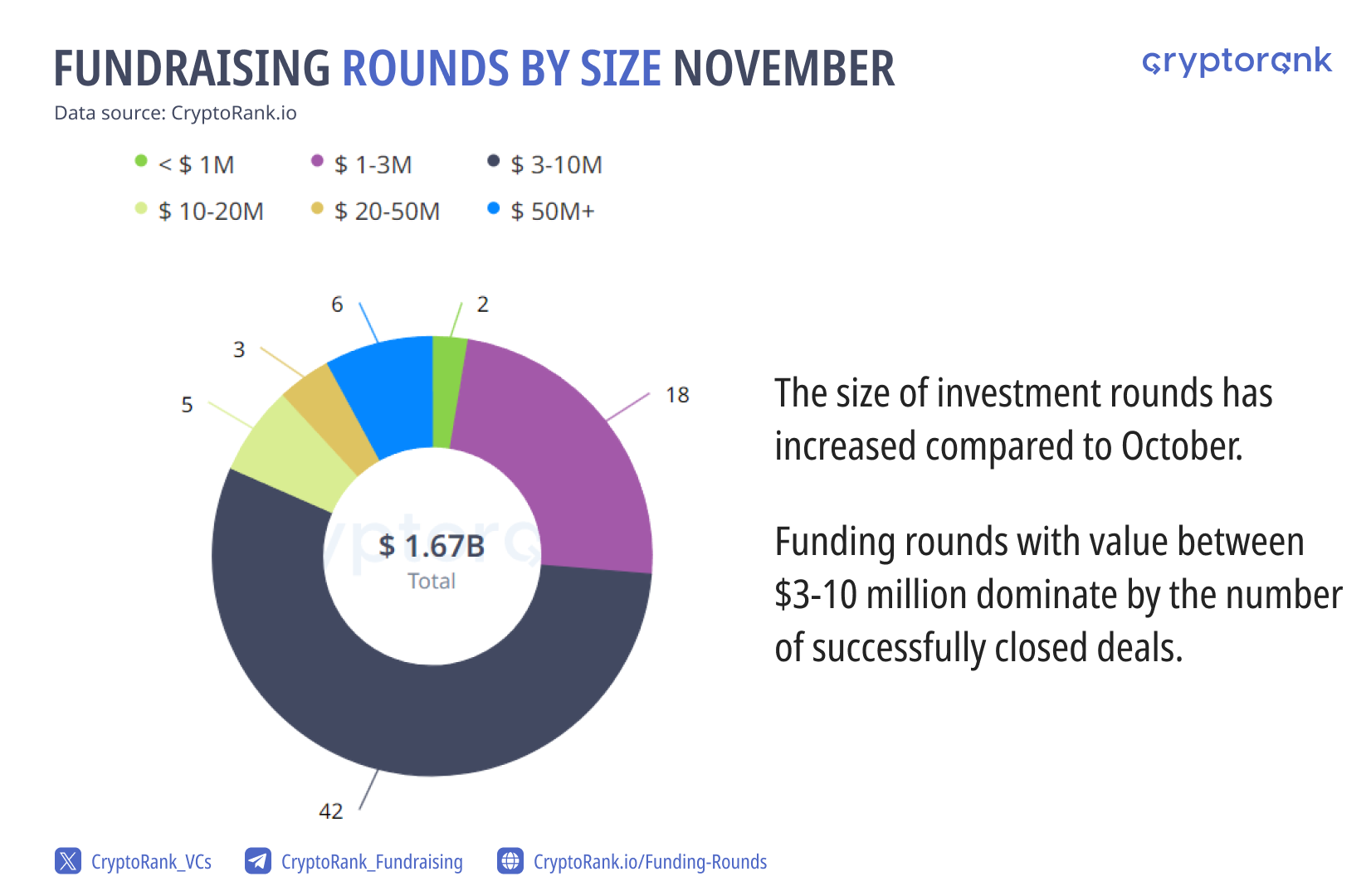

The size of funding rounds has increased, with the average investment size rising from $1-3 million the previous month to $3-10 million. In October, there were 22 deals with funds invested below $1 million, whereas in November, only one such deal occurred. In contrast, November saw 4 deals exceeding $50 million, whereas none were reported in October.

Data source: https://cryptorank.io/ico-analytics

VC Keeps Interested In Seed Funding Rounds

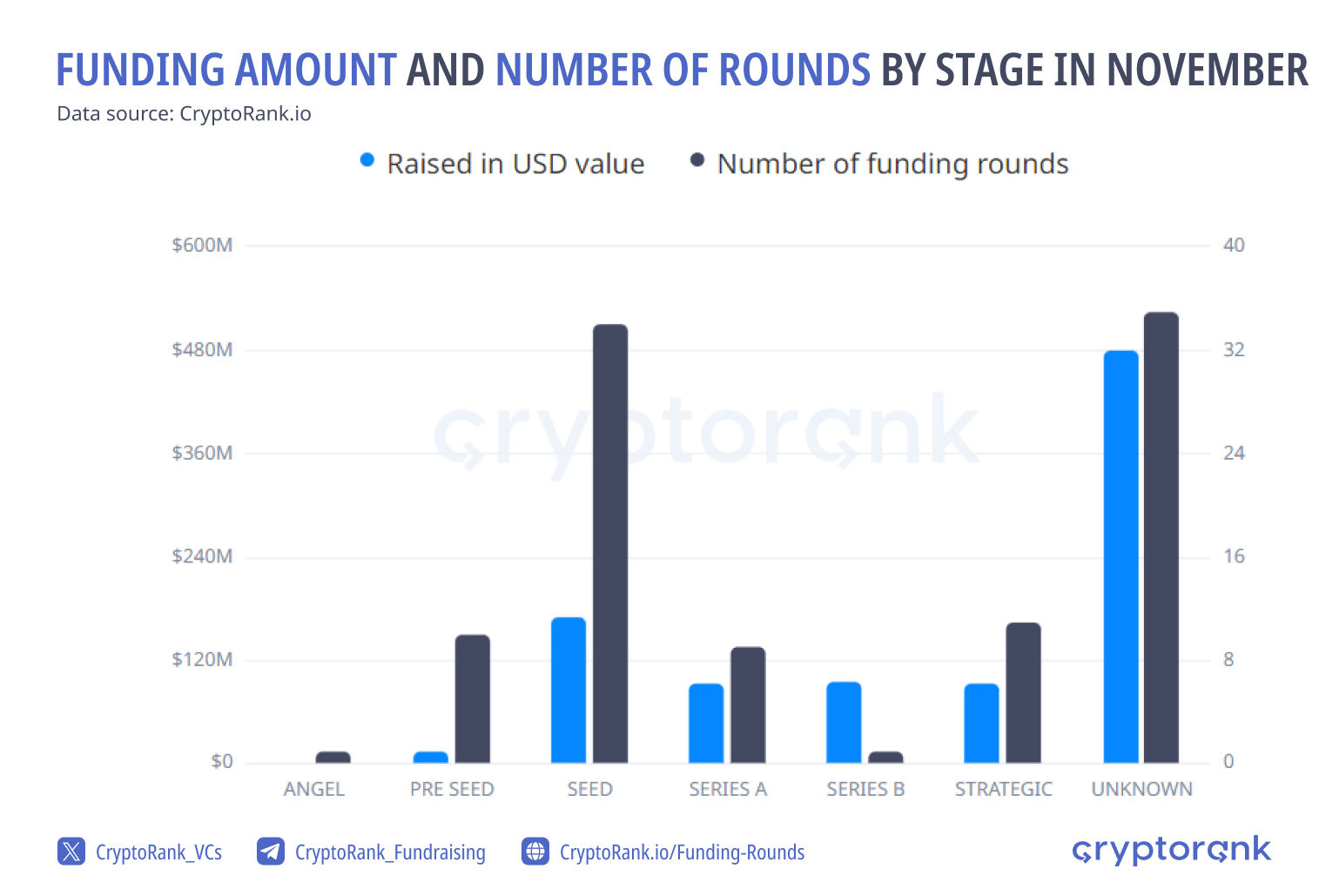

Seed investment rounds are the most commonly financed stage of projects, with earlier stages receiving comparatively fewer investments. Late stages are financed more infrequently However, in terms of funds invested, they are almost equivalent to seed funding.

Data source: https://cryptorank.io/ico-analytics

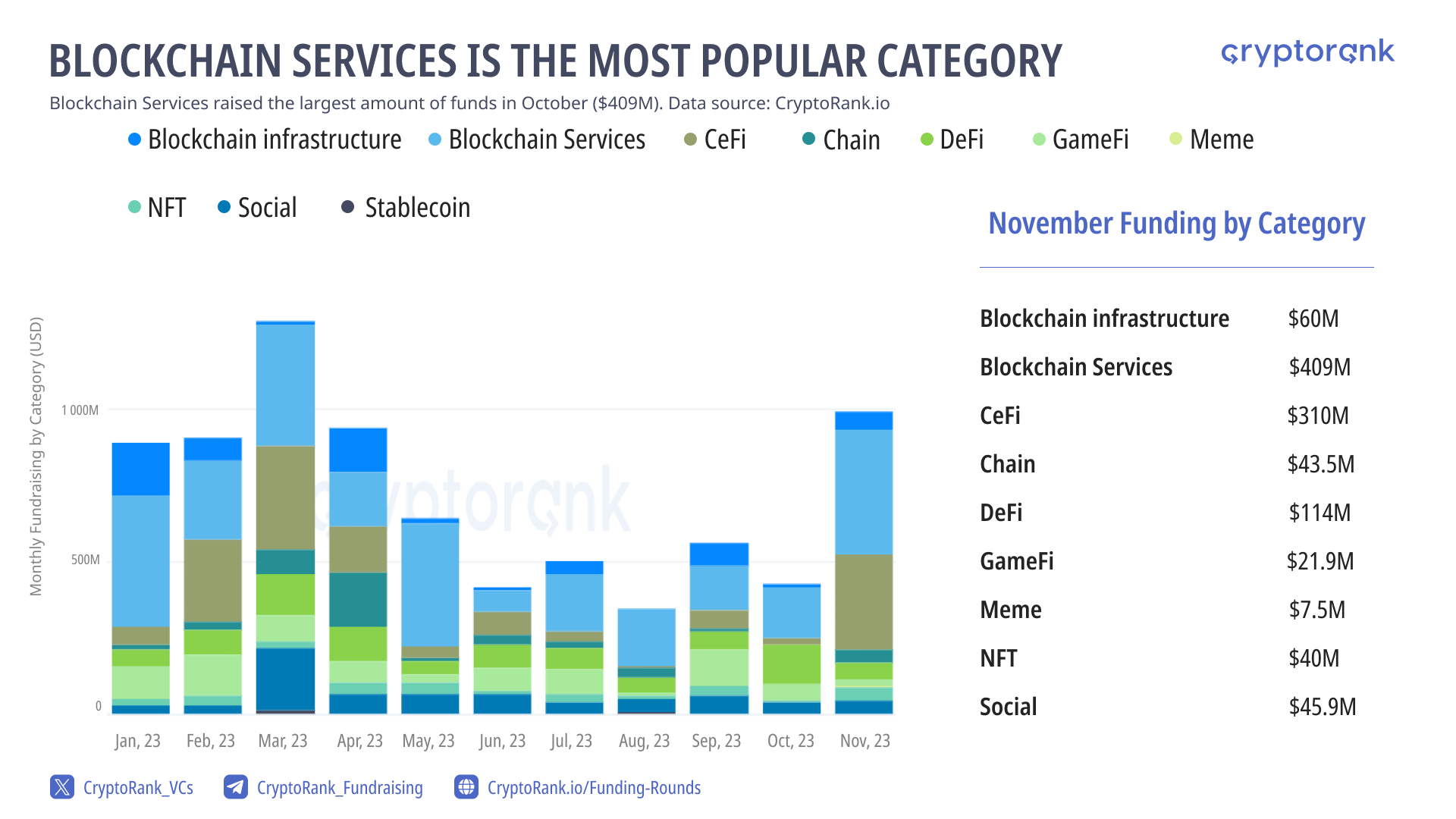

Blockchain Services is the Most Trending Category in November

In November, Blockchain Services emerged as the most popular category in terms of funding rounds, totaling 37. It was followed by DeFi with 17 rounds, and Social with 14 rounds. In regard to the amount of money raised, the Blockchain Service category took the lead, securing $1.02 billion last month. Startups in the CeFi and DeFi sectors raised $310.3 million and $114.3 million, respectively.

Data source: https://cryptorank.io/ico-analytics

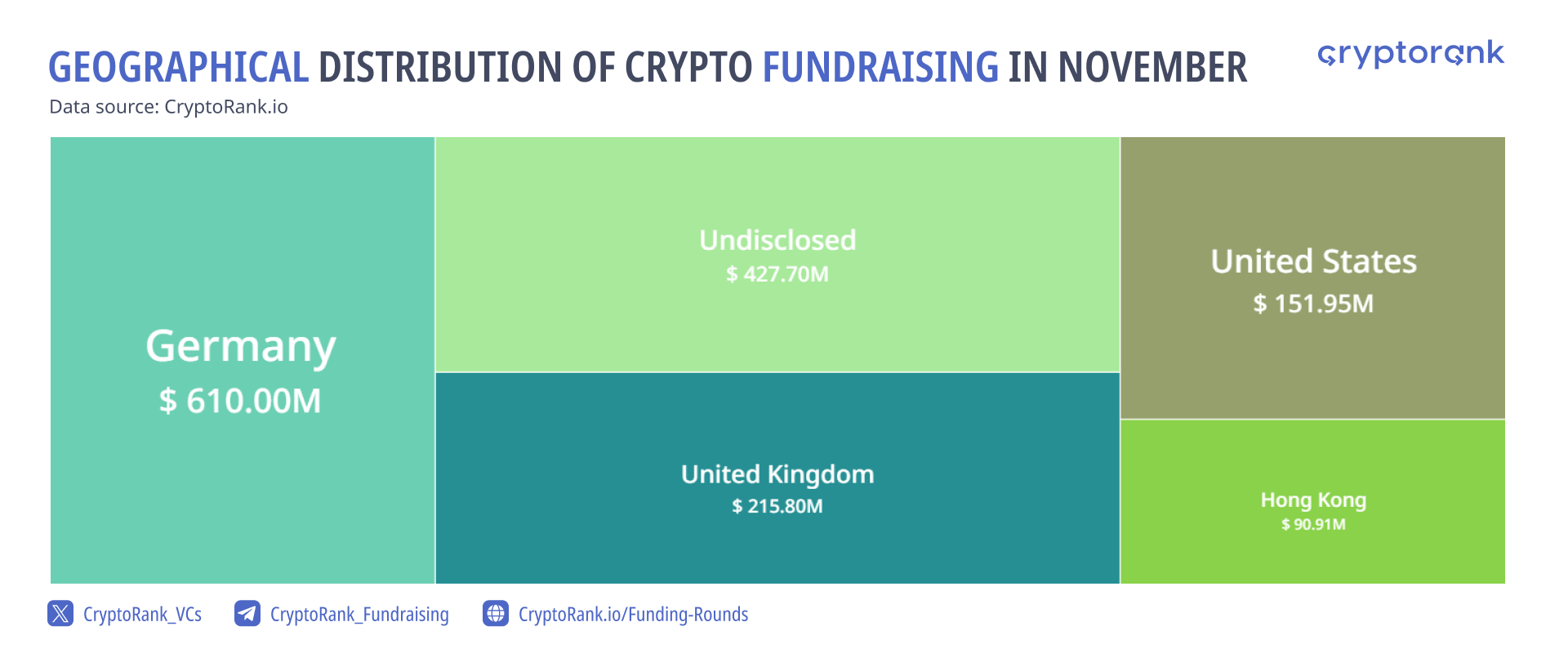

Germany Leads Crypto Fundraising in November

In November, Germany emerged as the most popular jurisdiction for crypto fundraising, leading with secured funds totaling $610 million due to one huge round of Northern Data Group. The United Kingdom and the United States secured $215.8 million and $151.9 million, respectively. The emergence of European nations signifies changes in the crypto fundraising landscape, as the United States previously held the leading position. A significant amount of deals, equivalent to $427.7 million, remained undisclosed.

Data source: https://cryptorank.io/ico-analytics

The Bottom Line

In November, crypto fundraising rebounded significantly, driven by rising cryptocurrency prices and waning recession fears in the U.S. November became the most significant month of the year for fundraising, thanks to the top five largest rounds. The potential approval of a spot Bitcoin ETF fueled investor interest, resulting in a 180% increase in funding compared to October. Blockchain Service projects led the way with $1.02 billion in funding, and Germany emerged as the top jurisdiction for crypto fundraising in terms of the amount of money raised, securing $610 million. The surge in average round sizes and increased venture capital engagement signal a positive outlook for the crypto market.