Will Solana Price Get Much Needed Boost With These Uniquely Timed ETF Filings?

Compartir:

In recent Solana news, Fidelity and Canary Capital SOL ETF just made their debut. And their timing could not have been better.

SOL price may be on the verge of recovering from bearish tantrums which briefly pushed the cryptocurrency into oversold territory earlier this week.

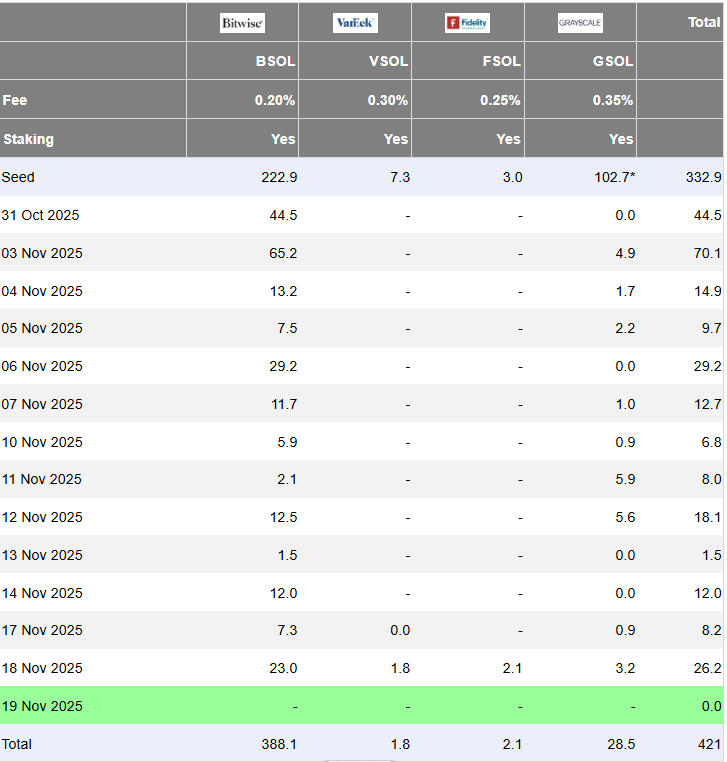

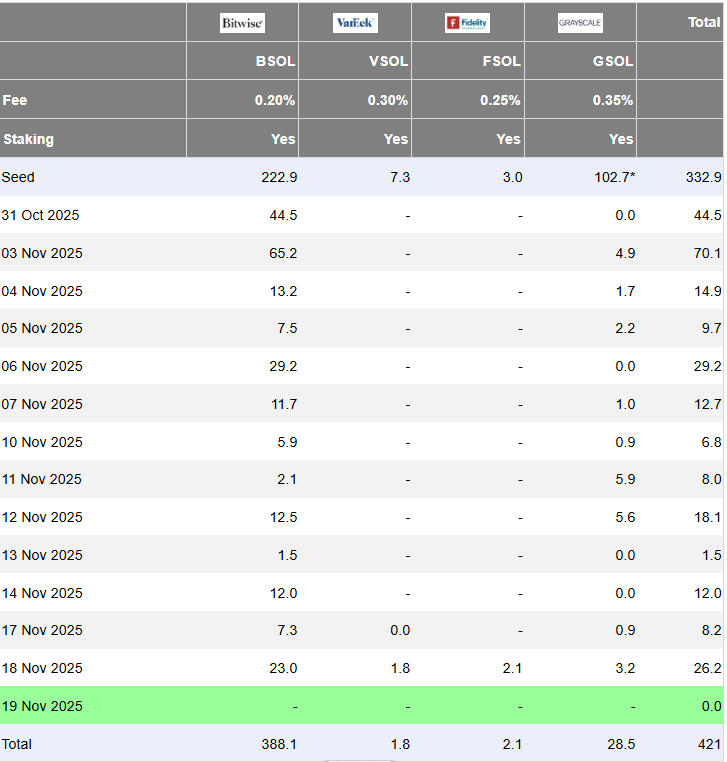

Bitwise and Grayscale Solana ETF made headlines in the first half of November for maintaining positive flows despite the bearish market headwinds.

However, their demand was relatively weak, and barely had much of an impact on SOL price.

Well, this week, Fidelity, VanEck, and Canary Capital Solana ETFs were launched this week, adding to the list of companies interested in the cryptocurrency.

VanEck and Fidelity contributed to $3.9 million worth of SOL demand on Tuesday. The total inflows for the day amounted to just over $26 million, marking the 4th largest Solana ETFs inflows on Tuesday.

Why a SOL Price Bullish Relief Could Be on the Cards

Solana ETFs have so far maintained a streak of positive flows since their launch, with no days in the red. This indicates that the ETF companies continued to buy the dip even as prices pushed lower.

The sustained demand may aid in building up confidence especially after the recently discounted levels. Beyond the ETF scope, SOL price demonstrated a bit of liquidity injection after the latest dip.

SOL price kicked off the week in oversold territory on Monday, after dropping as far as $128. Its MFI indicator also registered a slight uptick, confirming a noteworthy demand spike near its recent lows.

SOL on-chain data revealed relatively weak demand from the whales. However, it did align with the recent accumulation demonstrated by the MFI.

Meanwhile, liquidation data revealed a bias in favor of a bullish pivot. Roughly $25 million worth of SOL longs will be liquidated if the price pushes as low as $130.

On the flip side, more than $127 million in short positions will be liquidated if SOL pushes back above $145.

The SOL liquidation map suggests that there are more shorts at liquidation risk compared to longs, hence upside incentive.

However, the market is not driven by incentive alone, hence the need to check on demand and supply characteristics.

SOL spot flows revealed that sell pressure has been declining as price pushed lower. However, it also showed that the bulls were not as eager to capitalize, likely due to prevailing uncertainty and fear in the market.

Solana Network Health Snapshot

The bearish conditions had a significant impact on the market and the Solana network in the last few weeks. For example, its TVL tanked by almost $2 billion from its peak in September.

The network’s stablecoin count also suffered a blow, with roughly $3 billion worth of outflows since its October peak.

Despite this, the cryptocurrency still recorded noteworthy liquidity flows. SOL price demonstrated a significant inflows spike since mid-November.

While net rising net flows were positive in the first half of this week, a few key data sets revealed that activity was still lagging. For example, weekly address activity was still down to a 12-month high.

Weak address activity mirrored the bearish market conditions. Solana network activity tends to improve during bullish phases.

This means recent market conditions have also been holding back SOL’s price potential.

The post Will Solana Price Get Much Needed Boost With These Uniquely Timed ETF Filings? appeared first on The Coin Republic.

Will Solana Price Get Much Needed Boost With These Uniquely Timed ETF Filings?

Compartir:

In recent Solana news, Fidelity and Canary Capital SOL ETF just made their debut. And their timing could not have been better.

SOL price may be on the verge of recovering from bearish tantrums which briefly pushed the cryptocurrency into oversold territory earlier this week.

Bitwise and Grayscale Solana ETF made headlines in the first half of November for maintaining positive flows despite the bearish market headwinds.

However, their demand was relatively weak, and barely had much of an impact on SOL price.

Well, this week, Fidelity, VanEck, and Canary Capital Solana ETFs were launched this week, adding to the list of companies interested in the cryptocurrency.

VanEck and Fidelity contributed to $3.9 million worth of SOL demand on Tuesday. The total inflows for the day amounted to just over $26 million, marking the 4th largest Solana ETFs inflows on Tuesday.

Why a SOL Price Bullish Relief Could Be on the Cards

Solana ETFs have so far maintained a streak of positive flows since their launch, with no days in the red. This indicates that the ETF companies continued to buy the dip even as prices pushed lower.

The sustained demand may aid in building up confidence especially after the recently discounted levels. Beyond the ETF scope, SOL price demonstrated a bit of liquidity injection after the latest dip.

SOL price kicked off the week in oversold territory on Monday, after dropping as far as $128. Its MFI indicator also registered a slight uptick, confirming a noteworthy demand spike near its recent lows.

SOL on-chain data revealed relatively weak demand from the whales. However, it did align with the recent accumulation demonstrated by the MFI.

Meanwhile, liquidation data revealed a bias in favor of a bullish pivot. Roughly $25 million worth of SOL longs will be liquidated if the price pushes as low as $130.

On the flip side, more than $127 million in short positions will be liquidated if SOL pushes back above $145.

The SOL liquidation map suggests that there are more shorts at liquidation risk compared to longs, hence upside incentive.

However, the market is not driven by incentive alone, hence the need to check on demand and supply characteristics.

SOL spot flows revealed that sell pressure has been declining as price pushed lower. However, it also showed that the bulls were not as eager to capitalize, likely due to prevailing uncertainty and fear in the market.

Solana Network Health Snapshot

The bearish conditions had a significant impact on the market and the Solana network in the last few weeks. For example, its TVL tanked by almost $2 billion from its peak in September.

The network’s stablecoin count also suffered a blow, with roughly $3 billion worth of outflows since its October peak.

Despite this, the cryptocurrency still recorded noteworthy liquidity flows. SOL price demonstrated a significant inflows spike since mid-November.

While net rising net flows were positive in the first half of this week, a few key data sets revealed that activity was still lagging. For example, weekly address activity was still down to a 12-month high.

Weak address activity mirrored the bearish market conditions. Solana network activity tends to improve during bullish phases.

This means recent market conditions have also been holding back SOL’s price potential.

The post Will Solana Price Get Much Needed Boost With These Uniquely Timed ETF Filings? appeared first on The Coin Republic.

1654073624197.png)