Solana Faces $870 Million Token Unlock – What It Means for SOL Price

Поделиться:

Solana is facing an $870 million token unlock from staking, raising concerns about potential market impacts. If these tokens flood into the market, it could lead to significant sell pressure on centralized exchanges. Technical analysis shows a bearish trend with support levels at $120 and $79.50, which are critical to monitor for price stability.

Solana traders are on edge. Roughly $870 million worth of SOL is set to unlock from staking, and that kind of supply does not slip into the market price quietly in these condtions.

Bulls have been trying to build structure, but a sudden wave of tokens hitting circulation can shift momentum again.

Now the big question is simple. Does the market absorb it, or do key support levels start to crack under the pressure?

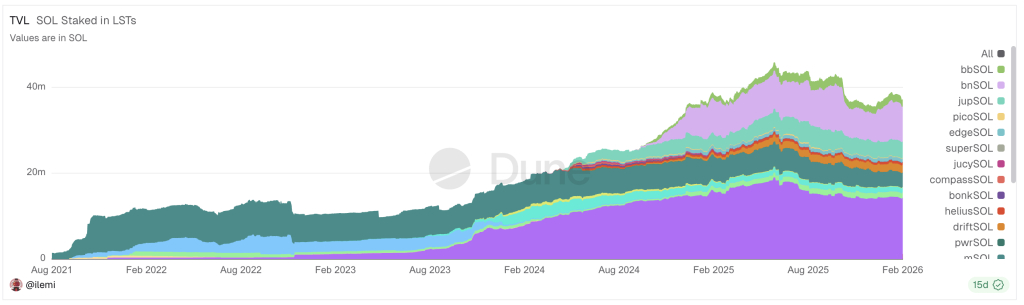

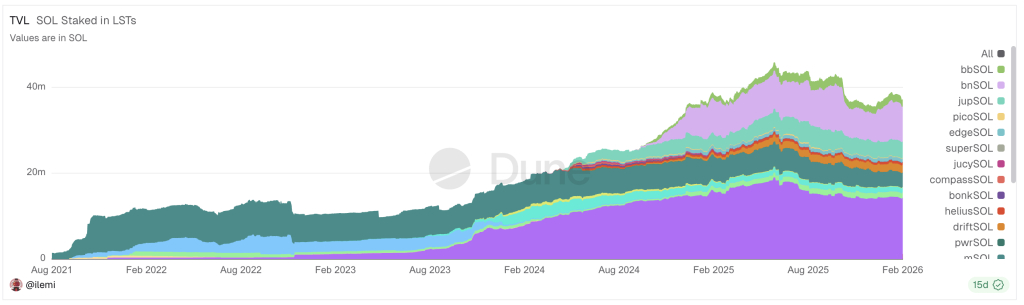

Breaking Down the Numbers

At current prices, $870 million is a big slice of daily trading volume. Solana usually expands gradually, but large unstaking waves can create sudden gaps in these market condtions.

if a chunk of these unlocked tokens moves straight to centralized exchanges, market makers will have to absorb serious sell pressure.

Traders are watching on chain flows closely. Transfers to major exchanges would signal likely selling. If the tokens stay put or get re staked, the panic narrative cools down. The next few days will reveal which path the market takes.

What Happens Next for Solana Price?

Technicals are not exactly comforting right now. A bearish structure flagged in recent analysis points to a possible 50% correction if near term support gives way.

Still, it is not one sided. Longer term projections remain mixed, with volatility expected through 2026 rather than a straight collapse. In the short term, $120 is the key support level, while $144 acts as the first recovery barrier.

If the $870 million unlock gets absorbed cleanly, that failed breakdown could flip into a bullish trap for shorts. The reaction around those levels will define the next leg.

Discover: Here are the crypto likely to explode!

The post Solana Faces $870 Million Token Unlock – What It Means for SOL Price appeared first on Cryptonews.

Читать больше

Solana Faces $870 Million Token Unlock – What It Means for SOL Price

Поделиться:

Solana is facing an $870 million token unlock from staking, raising concerns about potential market impacts. If these tokens flood into the market, it could lead to significant sell pressure on centralized exchanges. Technical analysis shows a bearish trend with support levels at $120 and $79.50, which are critical to monitor for price stability.

Solana traders are on edge. Roughly $870 million worth of SOL is set to unlock from staking, and that kind of supply does not slip into the market price quietly in these condtions.

Bulls have been trying to build structure, but a sudden wave of tokens hitting circulation can shift momentum again.

Now the big question is simple. Does the market absorb it, or do key support levels start to crack under the pressure?

Breaking Down the Numbers

At current prices, $870 million is a big slice of daily trading volume. Solana usually expands gradually, but large unstaking waves can create sudden gaps in these market condtions.

if a chunk of these unlocked tokens moves straight to centralized exchanges, market makers will have to absorb serious sell pressure.

Traders are watching on chain flows closely. Transfers to major exchanges would signal likely selling. If the tokens stay put or get re staked, the panic narrative cools down. The next few days will reveal which path the market takes.

What Happens Next for Solana Price?

Technicals are not exactly comforting right now. A bearish structure flagged in recent analysis points to a possible 50% correction if near term support gives way.

Still, it is not one sided. Longer term projections remain mixed, with volatility expected through 2026 rather than a straight collapse. In the short term, $120 is the key support level, while $144 acts as the first recovery barrier.

If the $870 million unlock gets absorbed cleanly, that failed breakdown could flip into a bullish trap for shorts. The reaction around those levels will define the next leg.

Discover: Here are the crypto likely to explode!

The post Solana Faces $870 Million Token Unlock – What It Means for SOL Price appeared first on Cryptonews.

Читать больше