Bitcoin Treasury Metaplanet Draws Fresh $130M Debt Amid 20% Unrealized Loss

Поделиться:

Key Insights:

- Metaplanet drew $130 million from its Bitcoin-backed credit facility to expand BTC holdings and support income-generation strategies.

- The company employs a dual funding approach, combining collateralized debt and preferred equity to scale its Bitcoin treasury.

- Despite sitting on an almost 20% unrealized loss, Metaplanet continues accumulating Bitcoin and maintaining its HODL strategy.

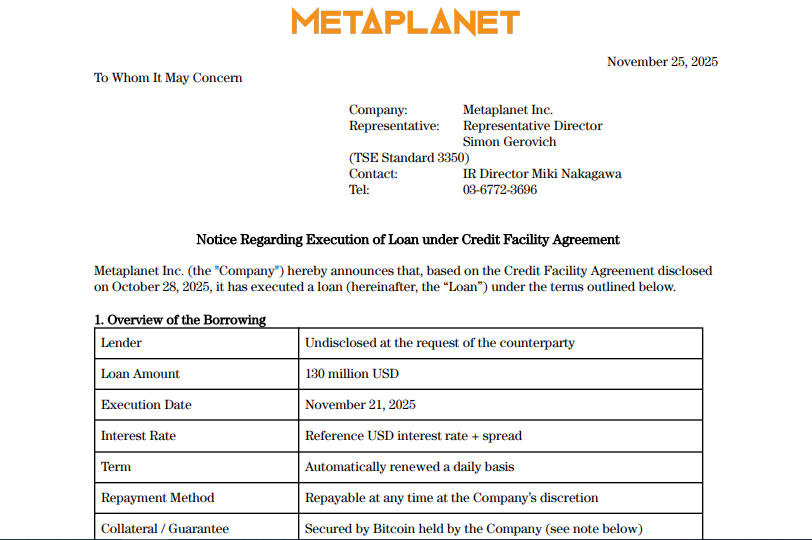

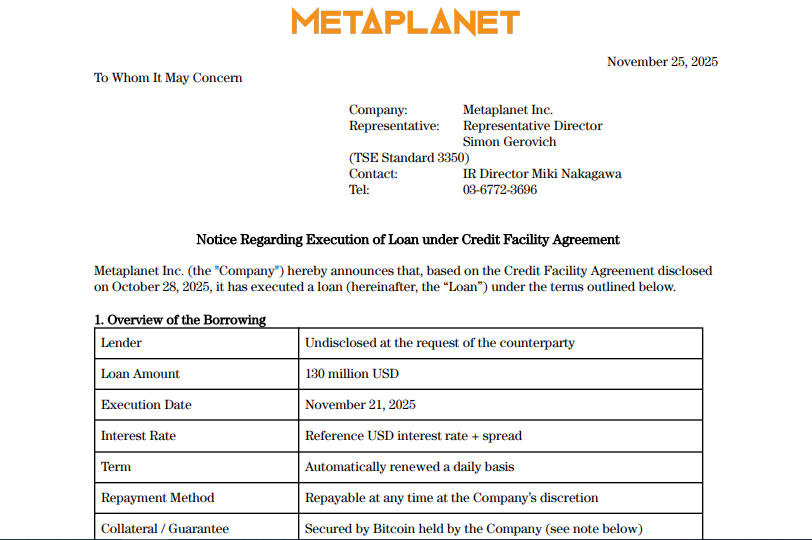

Metaplanet Inc., the Tokyo-listed firm pioneering Bitcoin treasuries in Asia, executed a $130 million loan on November 25, 2025, against its BTC collateral, pushing total borrowings to $230 million under a $500 million facility.

This move, disclosed in a PDF filing on the company’s investor site, underscores Metaplanet’s aggressive accumulation strategy even as Bitcoin trades at $87,580—19.5% below the firm’s average acquisition cost of $108,036, per BitcoinTreasuries.net data.

Meanwhile, Metaplanet stock (3350.T) closed at $2.28, down 7.75% from $2.48 the prior day and 81.5% off the 52-week high of $12.35, according to Yahoo Finance.

The debt draw signals confidence in BTC’s long-term value but exposes the firm to collateral risks in a volatile market, where recent dips to $82,000 tested treasury models worldwide.

Debt Play of Metaplanet: A Calculated Bet on BTC Resilience

Metaplanet first tapped its credit facility on October 31, 2025, drawing $100 million to fund Bitcoin buys. The latest tranche, secured by the company’s 30,823 BTC holdings valued at $3.5 billion as of October 31, follows Bitcoin’s 30% drop from October peaks.

“Given the substantial scale of Bitcoin holdings relative to the loan amount, the Company expects to maintain sufficient collateral headroom,” the filing states, emphasizing a conservative draw policy to buffer volatility.

Meanwhile, interest accrues at a reference USD rate plus spread, with daily renewals and repayment at Metaplanet’s discretion. The lender remains undisclosed, a common practice in such arrangements.

Funds target three areas: more BTC acquisitions, expansion of a Bitcoin income program via options premiums, and potential share repurchases.

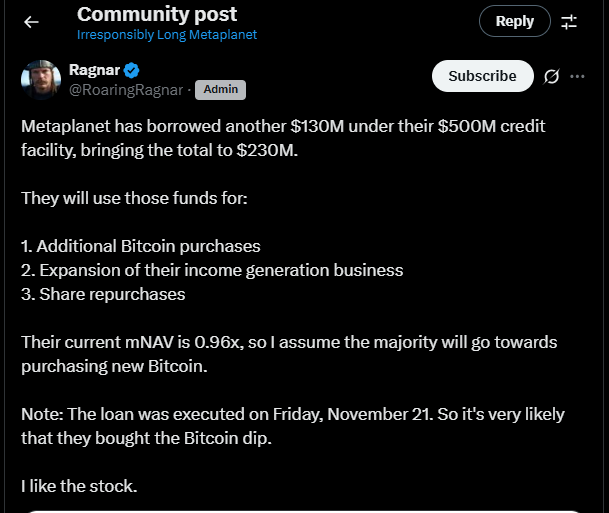

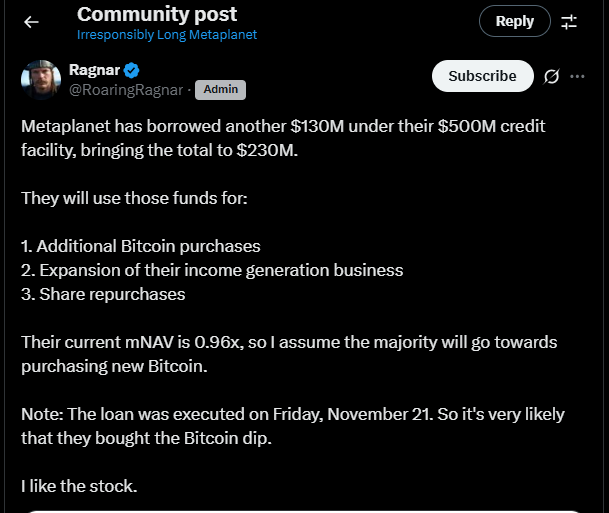

Ragnar, a prominent X commentator, noted on November 25: “The loan was executed on Friday, November 21. So it’s very likely that they bought the Bitcoin dip. I like the stock.”

A Closer Look

This approach mirrors global peers but adapts to Japan’s regulatory landscape. Unlike U.S.-based Strategy Inc., Metaplanet faces Tokyo Stock Exchange scrutiny on crypto exposures, as flagged in a November 20 exchange operator memo.

However, the firm adheres to a “conservative financial policy of only drawing funds within the range where sufficient collateral buffer can be maintained—even during periods of significant Bitcoin price volatility,” per the disclosure.

Metaplanet pairs its $500 million BTC-backed credit line with a $135 million preferred shares issuance, blending short-term liquidity and long-term capital.

The perpetual Class B shares offer fixed yields, conversion rights, and repurchase options, providing stable funding without diluting common equity.

This hybrid model, detailed in a November 15, 2025, investor update on Metaplanet.jp, supports the firm’s goal of 10,000 BTC by year-end and 21,000 by 2026, as outlined in BitcoinTreasuries.net’s profile.

Dylan LeClair, Metaplanet’s Bitcoin strategy director, reinforced resolve amid the rout. On November 21, he posted on X: “We are HODLing.”

The message, garnering 2,233 likes and 87,334 views, echoes the firm’s no-sell stance despite unrealized losses nearing $700 million on current holdings. LeClair’s updates often precede buys; a similar post in September 2025 preceded a 500 BTC acquisition, per company filings.

Meanwhile, Metaplanet’s multiple to net asset value (mNAV) stands at 0.96x, per Ragnar’s analysis, trading below book value for the first time since its April pivot to BTC.

Navigating Losses: HODL in a Down Market

Metaplanet’s average BTC cost reflects aggressive buying during Q3 2025 highs above $100,000. At $87,580, the 19.5% discount translates to substantial paper losses, yet the firm presses on.

BitcoinTreasuries.net reports total holdings steady at 30,823 BTC through November 25, with no sales disclosed. This contrasts with smaller treasuries like Japan’s Green Minerals, which trimmed 10% of its stack last week amid margin calls, as noted in a November 23 Nikkei Asia report.

The income generation arm adds a yield layer. Funds will collateralize Bitcoin options sales for premiums, potentially yielding 5-8% annualized in low-vol environments, based on Deribit data for similar structures.

Meanwhile, LeClair highlighted this in a November 10 X thread: “Options premiums turn volatility into income—key for treasury sustainability.” Such strategies buffered Strategy Inc.’s Q3 earnings, reporting $15 million in BTC-derived yields despite a 21% asset drop.

Japan’s yen weakness amplifies the play. With the currency down 12% year-to-date against the dollar, per Bloomberg’s November 25 data, BTC serves as a hedge.

Notably, Metaplanet’s 2025 YTD stock return of 2.59% lags the Nikkei 225’s 15% gain but outperforms the TSE’s crypto peers, down an average 45% on similar exposures.

Metaplanet Stock Under Pressure

Metaplanet stock has shed 81.5% from its peak in July, closing at a $2.61 billion market cap on November 21, Yahoo Finance shows. The November 24 close at $2.28 reflects a 10.75% weekly slide, driven by Bitcoin’s correlation, 95% over 30 days, per TradingView metrics.

Yet mNAV below 1x draws value hunters; institutional ownership rose 8% in Q3 to 22%, via Japan Exchange Group filings on November 20.

X sentiment tilts positive. Ragnar’s thread sparked 167 likes, with replies debating put-selling tactics: “Maybe they sell puts aggressively… Would be the best of both worlds.” LeClair’s HODL post drew supportive echoes, including from @UncleDividends: “Yes, sir,” underscoring retail loyalty.

The post Bitcoin Treasury Metaplanet Draws Fresh $130M Debt Amid 20% Unrealized Loss appeared first on The Coin Republic.

Bitcoin Treasury Metaplanet Draws Fresh $130M Debt Amid 20% Unrealized Loss

Поделиться:

Key Insights:

- Metaplanet drew $130 million from its Bitcoin-backed credit facility to expand BTC holdings and support income-generation strategies.

- The company employs a dual funding approach, combining collateralized debt and preferred equity to scale its Bitcoin treasury.

- Despite sitting on an almost 20% unrealized loss, Metaplanet continues accumulating Bitcoin and maintaining its HODL strategy.

Metaplanet Inc., the Tokyo-listed firm pioneering Bitcoin treasuries in Asia, executed a $130 million loan on November 25, 2025, against its BTC collateral, pushing total borrowings to $230 million under a $500 million facility.

This move, disclosed in a PDF filing on the company’s investor site, underscores Metaplanet’s aggressive accumulation strategy even as Bitcoin trades at $87,580—19.5% below the firm’s average acquisition cost of $108,036, per BitcoinTreasuries.net data.

Meanwhile, Metaplanet stock (3350.T) closed at $2.28, down 7.75% from $2.48 the prior day and 81.5% off the 52-week high of $12.35, according to Yahoo Finance.

The debt draw signals confidence in BTC’s long-term value but exposes the firm to collateral risks in a volatile market, where recent dips to $82,000 tested treasury models worldwide.

Debt Play of Metaplanet: A Calculated Bet on BTC Resilience

Metaplanet first tapped its credit facility on October 31, 2025, drawing $100 million to fund Bitcoin buys. The latest tranche, secured by the company’s 30,823 BTC holdings valued at $3.5 billion as of October 31, follows Bitcoin’s 30% drop from October peaks.

“Given the substantial scale of Bitcoin holdings relative to the loan amount, the Company expects to maintain sufficient collateral headroom,” the filing states, emphasizing a conservative draw policy to buffer volatility.

Meanwhile, interest accrues at a reference USD rate plus spread, with daily renewals and repayment at Metaplanet’s discretion. The lender remains undisclosed, a common practice in such arrangements.

Funds target three areas: more BTC acquisitions, expansion of a Bitcoin income program via options premiums, and potential share repurchases.

Ragnar, a prominent X commentator, noted on November 25: “The loan was executed on Friday, November 21. So it’s very likely that they bought the Bitcoin dip. I like the stock.”

A Closer Look

This approach mirrors global peers but adapts to Japan’s regulatory landscape. Unlike U.S.-based Strategy Inc., Metaplanet faces Tokyo Stock Exchange scrutiny on crypto exposures, as flagged in a November 20 exchange operator memo.

However, the firm adheres to a “conservative financial policy of only drawing funds within the range where sufficient collateral buffer can be maintained—even during periods of significant Bitcoin price volatility,” per the disclosure.

Metaplanet pairs its $500 million BTC-backed credit line with a $135 million preferred shares issuance, blending short-term liquidity and long-term capital.

The perpetual Class B shares offer fixed yields, conversion rights, and repurchase options, providing stable funding without diluting common equity.

This hybrid model, detailed in a November 15, 2025, investor update on Metaplanet.jp, supports the firm’s goal of 10,000 BTC by year-end and 21,000 by 2026, as outlined in BitcoinTreasuries.net’s profile.

Dylan LeClair, Metaplanet’s Bitcoin strategy director, reinforced resolve amid the rout. On November 21, he posted on X: “We are HODLing.”

The message, garnering 2,233 likes and 87,334 views, echoes the firm’s no-sell stance despite unrealized losses nearing $700 million on current holdings. LeClair’s updates often precede buys; a similar post in September 2025 preceded a 500 BTC acquisition, per company filings.

Meanwhile, Metaplanet’s multiple to net asset value (mNAV) stands at 0.96x, per Ragnar’s analysis, trading below book value for the first time since its April pivot to BTC.

Navigating Losses: HODL in a Down Market

Metaplanet’s average BTC cost reflects aggressive buying during Q3 2025 highs above $100,000. At $87,580, the 19.5% discount translates to substantial paper losses, yet the firm presses on.

BitcoinTreasuries.net reports total holdings steady at 30,823 BTC through November 25, with no sales disclosed. This contrasts with smaller treasuries like Japan’s Green Minerals, which trimmed 10% of its stack last week amid margin calls, as noted in a November 23 Nikkei Asia report.

The income generation arm adds a yield layer. Funds will collateralize Bitcoin options sales for premiums, potentially yielding 5-8% annualized in low-vol environments, based on Deribit data for similar structures.

Meanwhile, LeClair highlighted this in a November 10 X thread: “Options premiums turn volatility into income—key for treasury sustainability.” Such strategies buffered Strategy Inc.’s Q3 earnings, reporting $15 million in BTC-derived yields despite a 21% asset drop.

Japan’s yen weakness amplifies the play. With the currency down 12% year-to-date against the dollar, per Bloomberg’s November 25 data, BTC serves as a hedge.

Notably, Metaplanet’s 2025 YTD stock return of 2.59% lags the Nikkei 225’s 15% gain but outperforms the TSE’s crypto peers, down an average 45% on similar exposures.

Metaplanet Stock Under Pressure

Metaplanet stock has shed 81.5% from its peak in July, closing at a $2.61 billion market cap on November 21, Yahoo Finance shows. The November 24 close at $2.28 reflects a 10.75% weekly slide, driven by Bitcoin’s correlation, 95% over 30 days, per TradingView metrics.

Yet mNAV below 1x draws value hunters; institutional ownership rose 8% in Q3 to 22%, via Japan Exchange Group filings on November 20.

X sentiment tilts positive. Ragnar’s thread sparked 167 likes, with replies debating put-selling tactics: “Maybe they sell puts aggressively… Would be the best of both worlds.” LeClair’s HODL post drew supportive echoes, including from @UncleDividends: “Yes, sir,” underscoring retail loyalty.

The post Bitcoin Treasury Metaplanet Draws Fresh $130M Debt Amid 20% Unrealized Loss appeared first on The Coin Republic.