Why Is Crypto Up Today? – July 18, 2025

The cryptocurrency market capitalization has surpassed $4 trillion, now standing at $4.01 trillion. This follows significant increases in individual crypto prices. The market is up today, with 96 of the top 100 coins per market cap appreciating over the past 24 hours. At the same time, the total crypto trading volume is at $284 billion, the highest it’s been in a while.

TLDR:

Crypto Winners & Losers

At the time of writing, all the top 10 coins per market cap are still green.

Bitcoin (BTC) has appreciated by 1.6% to the price of $120,352. This is the smallest increase in this category.

Also, Ethereum (ETH) rose by 6.5%, currently trading at $3,652. The price is gradually approaching the long-awaited $4,000 mark.

The highest gainer is Dogecoin (DOGE). It’s up 14.9% to $0.2434.

XRP (XRP) and Cardano (ADA) also saw double-digit increases of 12.9% and 12.3% to $3.56 and $0.868, respectively. Notably, XRP hit a new ATH of $3.65 today.

In the top 100 coins category, 96 coins are green and 4 are red. Of the green ones, 14 have double-digit rises in the past days.

At the top is Uniswap (UNI) with a 19% rise to $10.53. It’s followed by Hedera (HBAR), which saw a 16.1%, now trading at $0.281.

On the other side, Bonk (BONK) is down 7.4%, changing hands at $0.00003636.

Pump.fun (PUMP) follows with a drop of 5% to $0.005102.

The other two red coins are down below 0.2%, meaning they’re practically unchanged.

Meanwhile, the crypto market surge has been fueled by positive regulatory developments. Specifically, the US House of Representatives passed three key crypto-related bills.

However, Congresswoman Maxine Waters argued that the CLARITY Act, one of the above-mentioned three bills, would cause “investor harm.”

“The bill presents several serious risks: it exposes consumers to exploitation by bad actors in the crypto industry, undermines national security, and ignores Donald Trump’s escalating conflicts of interest tied to his personal involvement in cryptocurrency,” Waters wrote on Thursday.

‘This Isn’t Just a Spike, It’s a Regime Change’

Sean Dawson, Head of Research at onchain options platform Derive.xyz, commented on Ethereum’s surge over the past week, surpassing $3,500.

“BTC is participating,” he says, “but this rally belongs to ETH.” Several factors point to a structural shift in positioning, including the technical setup, option flows, and liquidations.

Thanks to macro tailwinds, falling rates, and ETF momentum, the second half of 2025 may be Ethereum’s strongest in years, he explains.

“Ethereum’s moment in the sun has finally arrived,” Dawson writes in an email. “Traders are aggressively positioned for a rapid move to $4K by July 25.”

Dawson argues that the sharp rally marks a potential breakout moment for ETH “fueled by bullish macro conditions, rising institutional inflows, and an overwhelming shift in sentiment.”

“This isn’t just a spike, it’s a regime change. We’re seeing explosive upside bets and a wave of short liquidations. The market may finally be waking up to ETH’s asymmetric upside.”

Currently, there is a 14% chance that ETH ends July above $4,000. There is also a 27% chance it surpasses $5,000 by the end of 2025.

Also, there is an 18% chance that BTC moves above $125,000 by the end of July, and a 12% chance it ends the year above $170,000.

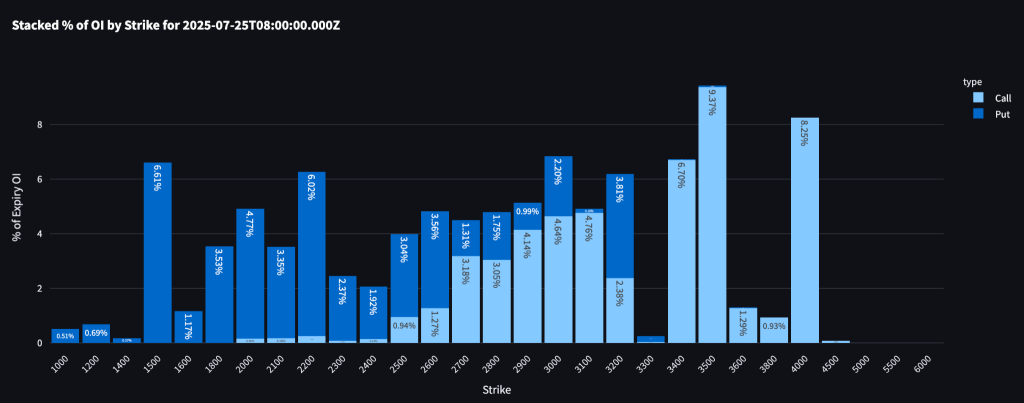

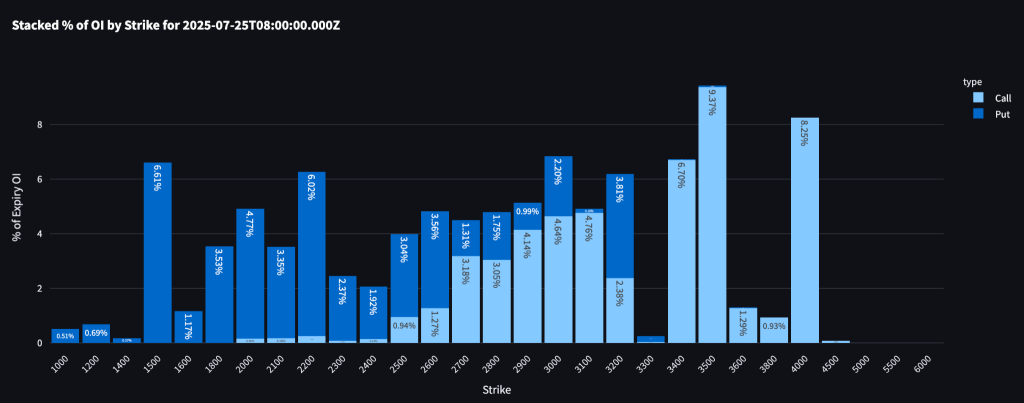

Meanwhile, in the past 24 hours, 25% of Derive’s ETH trading volume has been concentrated on call options between $3,000 and $4,000 for the 25 July expiry. This is “a strong signal that traders are aligned on a fast, continued breakout,” says Dawson.

Also, 8% of all open interest for that expiry is sitting on the $4,000 ETH strike. This reflects “a growing appetite for leveraged long exposure as bullish conviction builds”.

Percentage of open interest by strike for the 25 July expiry on Derive (light blue – call, dark blue – put)

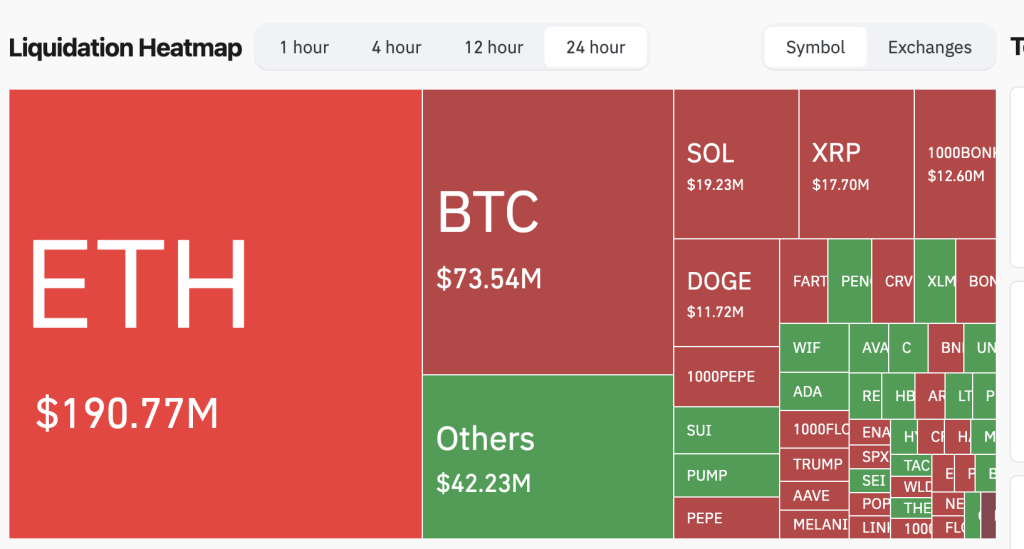

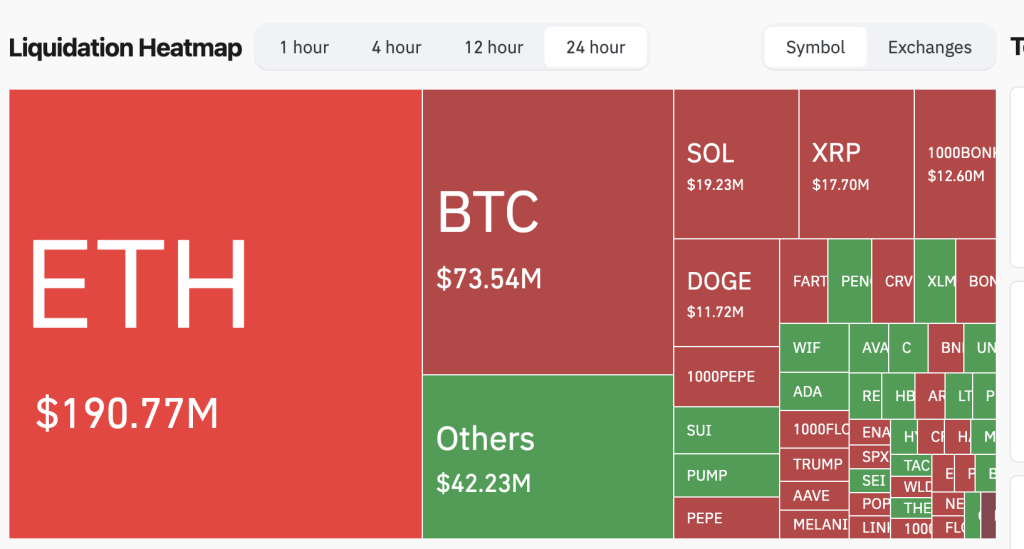

Moreover, over $190 million in ETH shorts and $73.5 million in BTC shorts were liquidated during this move. This is “fueling an aggressive short squeeze that pushed prices even higher,” Dawson says.

Levels & Events to Watch Next

At the time of writing, BTC trades at $120,352. It started the day at the daily low of $117,785, climbing to the intraday high of $120,689 before slightly correcting to the current price.

The coin is approaching the $122,838, which it recorded four days ago. Investors are watching for BTC to retake and keep the $121,000 level first.

Moreover, Ethereum is currently trading at $3,652. It rose from the intraday low of $3,382 to $3,669 in a matter of hours. All eyes are now on the $3,700 level.

Meanwhile, the crypto market sentiment continues climbing within greed territory. The Fear and Greed Index increased from 70 yesterday to 71 today.

The level suggests a positive outlook on the market. However, it may also indicate overconfidence, with the market becoming overbought, which would lead to a correction.

Moreover, on 17 July, the US BTC spot exchange-traded funds (ETFs) saw more positive flows, marking eleven days in a row. They recorded $522.6 million in inflows. The total has now reached $54.39 billion.

BlackRock recorded $497.3 million in inflows on Thursday, while Fidelity, Grayscale, VanEck, and Invesco saw inflows between $5 million and $7 million.

At the same time, US ETH ETFs saw positive flows for the tenth day in a row. It recorded another significant amount: $602.02 million on Thursday, which is the second-highest level ever, following Wednesday’s record of $726.74 million.

Of this amount, BlackRock recorded $546.7 million. It’s followed by Grayscale’s $29.9 million. Fidelity, Bitwise, and 21Shares account for the rest.

Meanwhile, SharpLink Gaming bought an additional 32,892 ETH worth $115 million, bringing the company’s total to 144,501 ETH. The company has allocated 99.7% of its ETH holdings to staking protocols, generating some 415 ETH in rewards since June.

In South Korea, the commercial banking giant Shinhan Bank has launched a range of crypto services on its SOL smartphone app. The services will include real-time price monitoring tools for a range of cryptoassets and introductory guides for first-time investors.

In the US, the Securities and Exchange Commission (SEC) is considering a potential “innovation exemption” as part of a broader effort to support the tokenization ecosystem, Chairman Paul Atkins said. “Staff is considering what other changes may be appropriate to incentivize tokenization within our regulatory framework,” he said.

Quick FAQ

- Why did crypto move with stocks today?

Both the crypto market and the stock market saw increases. The S&P 500 is up by 0.54%, the Nasdaq-100 increased by 0.76%, and the Dow Jones Industrial Average rose by 0.52%. Investors largely reacted to a number of quarterly earnings reports from major companies, in addition to retail sales data.

- Is this rally sustainable?

Analysts expect the rally to continue, and there is still room for BTC to hit new ATHs and ETH to at least approach its previous one. That said, pullbacks are also highly likely.

The post Why Is Crypto Up Today? – July 18, 2025 appeared first on Cryptonews.

Why Is Crypto Up Today? – July 18, 2025

The cryptocurrency market capitalization has surpassed $4 trillion, now standing at $4.01 trillion. This follows significant increases in individual crypto prices. The market is up today, with 96 of the top 100 coins per market cap appreciating over the past 24 hours. At the same time, the total crypto trading volume is at $284 billion, the highest it’s been in a while.

TLDR:

Crypto Winners & Losers

At the time of writing, all the top 10 coins per market cap are still green.

Bitcoin (BTC) has appreciated by 1.6% to the price of $120,352. This is the smallest increase in this category.

Also, Ethereum (ETH) rose by 6.5%, currently trading at $3,652. The price is gradually approaching the long-awaited $4,000 mark.

The highest gainer is Dogecoin (DOGE). It’s up 14.9% to $0.2434.

XRP (XRP) and Cardano (ADA) also saw double-digit increases of 12.9% and 12.3% to $3.56 and $0.868, respectively. Notably, XRP hit a new ATH of $3.65 today.

In the top 100 coins category, 96 coins are green and 4 are red. Of the green ones, 14 have double-digit rises in the past days.

At the top is Uniswap (UNI) with a 19% rise to $10.53. It’s followed by Hedera (HBAR), which saw a 16.1%, now trading at $0.281.

On the other side, Bonk (BONK) is down 7.4%, changing hands at $0.00003636.

Pump.fun (PUMP) follows with a drop of 5% to $0.005102.

The other two red coins are down below 0.2%, meaning they’re practically unchanged.

Meanwhile, the crypto market surge has been fueled by positive regulatory developments. Specifically, the US House of Representatives passed three key crypto-related bills.

However, Congresswoman Maxine Waters argued that the CLARITY Act, one of the above-mentioned three bills, would cause “investor harm.”

“The bill presents several serious risks: it exposes consumers to exploitation by bad actors in the crypto industry, undermines national security, and ignores Donald Trump’s escalating conflicts of interest tied to his personal involvement in cryptocurrency,” Waters wrote on Thursday.

‘This Isn’t Just a Spike, It’s a Regime Change’

Sean Dawson, Head of Research at onchain options platform Derive.xyz, commented on Ethereum’s surge over the past week, surpassing $3,500.

“BTC is participating,” he says, “but this rally belongs to ETH.” Several factors point to a structural shift in positioning, including the technical setup, option flows, and liquidations.

Thanks to macro tailwinds, falling rates, and ETF momentum, the second half of 2025 may be Ethereum’s strongest in years, he explains.

“Ethereum’s moment in the sun has finally arrived,” Dawson writes in an email. “Traders are aggressively positioned for a rapid move to $4K by July 25.”

Dawson argues that the sharp rally marks a potential breakout moment for ETH “fueled by bullish macro conditions, rising institutional inflows, and an overwhelming shift in sentiment.”

“This isn’t just a spike, it’s a regime change. We’re seeing explosive upside bets and a wave of short liquidations. The market may finally be waking up to ETH’s asymmetric upside.”

Currently, there is a 14% chance that ETH ends July above $4,000. There is also a 27% chance it surpasses $5,000 by the end of 2025.

Also, there is an 18% chance that BTC moves above $125,000 by the end of July, and a 12% chance it ends the year above $170,000.

Meanwhile, in the past 24 hours, 25% of Derive’s ETH trading volume has been concentrated on call options between $3,000 and $4,000 for the 25 July expiry. This is “a strong signal that traders are aligned on a fast, continued breakout,” says Dawson.

Also, 8% of all open interest for that expiry is sitting on the $4,000 ETH strike. This reflects “a growing appetite for leveraged long exposure as bullish conviction builds”.

Percentage of open interest by strike for the 25 July expiry on Derive (light blue – call, dark blue – put)

Moreover, over $190 million in ETH shorts and $73.5 million in BTC shorts were liquidated during this move. This is “fueling an aggressive short squeeze that pushed prices even higher,” Dawson says.

Levels & Events to Watch Next

At the time of writing, BTC trades at $120,352. It started the day at the daily low of $117,785, climbing to the intraday high of $120,689 before slightly correcting to the current price.

The coin is approaching the $122,838, which it recorded four days ago. Investors are watching for BTC to retake and keep the $121,000 level first.

Moreover, Ethereum is currently trading at $3,652. It rose from the intraday low of $3,382 to $3,669 in a matter of hours. All eyes are now on the $3,700 level.

Meanwhile, the crypto market sentiment continues climbing within greed territory. The Fear and Greed Index increased from 70 yesterday to 71 today.

The level suggests a positive outlook on the market. However, it may also indicate overconfidence, with the market becoming overbought, which would lead to a correction.

Moreover, on 17 July, the US BTC spot exchange-traded funds (ETFs) saw more positive flows, marking eleven days in a row. They recorded $522.6 million in inflows. The total has now reached $54.39 billion.

BlackRock recorded $497.3 million in inflows on Thursday, while Fidelity, Grayscale, VanEck, and Invesco saw inflows between $5 million and $7 million.

At the same time, US ETH ETFs saw positive flows for the tenth day in a row. It recorded another significant amount: $602.02 million on Thursday, which is the second-highest level ever, following Wednesday’s record of $726.74 million.

Of this amount, BlackRock recorded $546.7 million. It’s followed by Grayscale’s $29.9 million. Fidelity, Bitwise, and 21Shares account for the rest.

Meanwhile, SharpLink Gaming bought an additional 32,892 ETH worth $115 million, bringing the company’s total to 144,501 ETH. The company has allocated 99.7% of its ETH holdings to staking protocols, generating some 415 ETH in rewards since June.

In South Korea, the commercial banking giant Shinhan Bank has launched a range of crypto services on its SOL smartphone app. The services will include real-time price monitoring tools for a range of cryptoassets and introductory guides for first-time investors.

In the US, the Securities and Exchange Commission (SEC) is considering a potential “innovation exemption” as part of a broader effort to support the tokenization ecosystem, Chairman Paul Atkins said. “Staff is considering what other changes may be appropriate to incentivize tokenization within our regulatory framework,” he said.

Quick FAQ

- Why did crypto move with stocks today?

Both the crypto market and the stock market saw increases. The S&P 500 is up by 0.54%, the Nasdaq-100 increased by 0.76%, and the Dow Jones Industrial Average rose by 0.52%. Investors largely reacted to a number of quarterly earnings reports from major companies, in addition to retail sales data.

- Is this rally sustainable?

Analysts expect the rally to continue, and there is still room for BTC to hit new ATHs and ETH to at least approach its previous one. That said, pullbacks are also highly likely.

The post Why Is Crypto Up Today? – July 18, 2025 appeared first on Cryptonews.