Strategy Buys Another $27M in Bitcoin — Here Is How Saylor Keeps Winning the Dip

- Strategy bought 220 BTC worth $27.2 million, bringing its total holdings to 640,250 BTC.

- The firm now owns 3% of Bitcoin’s total supply, worth roughly $73 billion.

- Saylor’s “42/42” plan ensures continued BTC accumulation through 2027.

Michael Saylor’s firm adds 220 BTC after the market crash, now sitting on over 3% of Bitcoin’s total supply worth $73 billion.

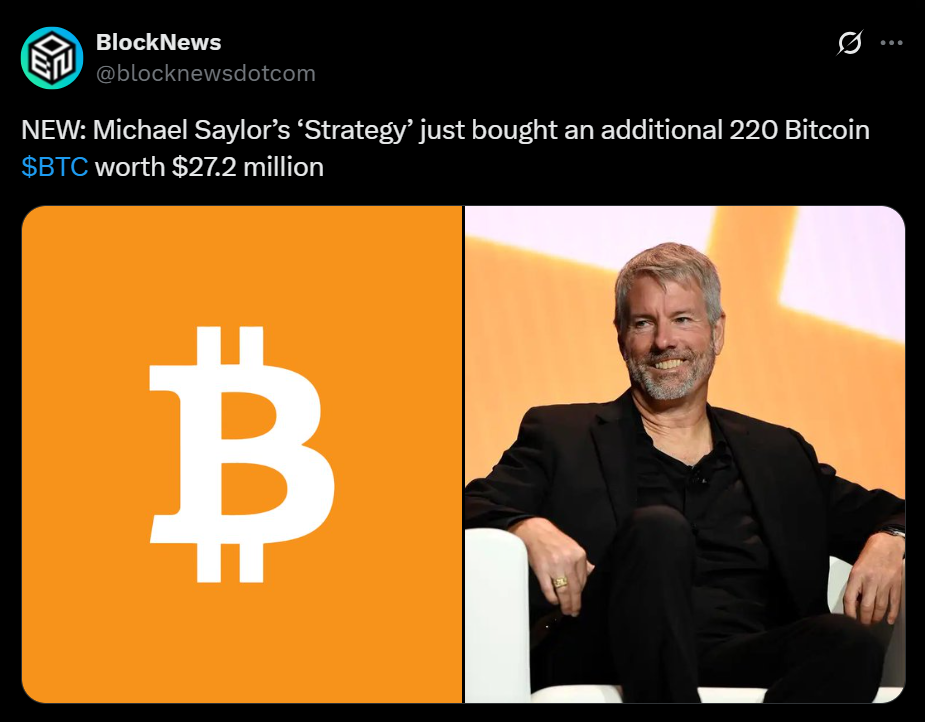

When the market panics, Michael Saylor doesn’t. His company, Strategy (formerly MicroStrategy), has once again doubled down on Bitcoin — this time adding 220 BTC worth about $27.2 million between October 6 and 12 at an average price of $123,561 per coin. The new purchase pushes Strategy’s total stash to a staggering 640,250 BTC, valued at roughly $73 billion as of today.

That haul now represents over 3% of Bitcoin’s entire supply, placing Strategy far ahead of any other public company in crypto holdings. The average cost per coin stands at around $74,000, meaning the firm is sitting on roughly $25.6 billion in paper gains.

How Strategy Funded Its Latest Buy

The firm used proceeds from the issuance of its perpetual preferred stocks — part of its massive “42/42” capital plan, which targets a total of $84 billion in equity offerings and convertible notes for BTC acquisitions through 2027. Originally, this program aimed for $42 billion, but Saylor expanded it earlier this year after exhausting the first phase.

The different stock types in play include STRK, STRF, STRC, and STRD, each offering varying degrees of risk, yield, and convertibility. Together, these instruments have given Strategy an effective and sustainable way to keep buying Bitcoin — no matter the market cycle.

Saylor’s Philosophy: Buy Fear, Sell Never

The latest buy came after one of the most chaotic weekends the crypto market has seen. A historic $20 billion liquidation cascade sent Bitcoin below $108,000 and wiped out several over-leveraged traders. Yet Saylor’s response was simple — he posted, “Don’t Stop ₿elievin’” on X, hinting at another accumulation move before officially confirming the purchase on Monday.

By Monday morning, Bitcoin had recovered above $114,000, suggesting Saylor once again timed the market turbulence to his advantage. The purchase underscores his long-standing belief that Bitcoin dips are temporary — conviction, he says, is forever.

The Bigger Picture

According to Bitcoin Treasuries data, Strategy leads by a wide margin among corporate holders. The rest of the top ten — including Marathon (52,850 BTC), Tether’s Twenty One (43,514 BTC), and Metaplanet (30,823 BTC) — barely scratch the surface compared to Strategy’s immense position.

Despite market volatility, Strategy’s stock (MSTR) ticked up 1.1% in pre-market trading on Monday, rebounding slightly after dropping 13% last week amid fears of a renewed U.S.-China trade war. For context, Bitcoin remains up 22% year-to-date, while Strategy’s stock is up just 1.6%.

Bottom Line

Saylor’s message hasn’t changed — volatility creates opportunity. With a war chest now worth over $73 billion and an ongoing plan to keep buying through 2027, Strategy’s conviction play might end up being one of the boldest in modern financial history.

The post Strategy Buys Another $27M in Bitcoin — Here Is How Saylor Keeps Winning the Dip first appeared on BlockNews.

Strategy Buys Another $27M in Bitcoin — Here Is How Saylor Keeps Winning the Dip

- Strategy bought 220 BTC worth $27.2 million, bringing its total holdings to 640,250 BTC.

- The firm now owns 3% of Bitcoin’s total supply, worth roughly $73 billion.

- Saylor’s “42/42” plan ensures continued BTC accumulation through 2027.

Michael Saylor’s firm adds 220 BTC after the market crash, now sitting on over 3% of Bitcoin’s total supply worth $73 billion.

When the market panics, Michael Saylor doesn’t. His company, Strategy (formerly MicroStrategy), has once again doubled down on Bitcoin — this time adding 220 BTC worth about $27.2 million between October 6 and 12 at an average price of $123,561 per coin. The new purchase pushes Strategy’s total stash to a staggering 640,250 BTC, valued at roughly $73 billion as of today.

That haul now represents over 3% of Bitcoin’s entire supply, placing Strategy far ahead of any other public company in crypto holdings. The average cost per coin stands at around $74,000, meaning the firm is sitting on roughly $25.6 billion in paper gains.

How Strategy Funded Its Latest Buy

The firm used proceeds from the issuance of its perpetual preferred stocks — part of its massive “42/42” capital plan, which targets a total of $84 billion in equity offerings and convertible notes for BTC acquisitions through 2027. Originally, this program aimed for $42 billion, but Saylor expanded it earlier this year after exhausting the first phase.

The different stock types in play include STRK, STRF, STRC, and STRD, each offering varying degrees of risk, yield, and convertibility. Together, these instruments have given Strategy an effective and sustainable way to keep buying Bitcoin — no matter the market cycle.

Saylor’s Philosophy: Buy Fear, Sell Never

The latest buy came after one of the most chaotic weekends the crypto market has seen. A historic $20 billion liquidation cascade sent Bitcoin below $108,000 and wiped out several over-leveraged traders. Yet Saylor’s response was simple — he posted, “Don’t Stop ₿elievin’” on X, hinting at another accumulation move before officially confirming the purchase on Monday.

By Monday morning, Bitcoin had recovered above $114,000, suggesting Saylor once again timed the market turbulence to his advantage. The purchase underscores his long-standing belief that Bitcoin dips are temporary — conviction, he says, is forever.

The Bigger Picture

According to Bitcoin Treasuries data, Strategy leads by a wide margin among corporate holders. The rest of the top ten — including Marathon (52,850 BTC), Tether’s Twenty One (43,514 BTC), and Metaplanet (30,823 BTC) — barely scratch the surface compared to Strategy’s immense position.

Despite market volatility, Strategy’s stock (MSTR) ticked up 1.1% in pre-market trading on Monday, rebounding slightly after dropping 13% last week amid fears of a renewed U.S.-China trade war. For context, Bitcoin remains up 22% year-to-date, while Strategy’s stock is up just 1.6%.

Bottom Line

Saylor’s message hasn’t changed — volatility creates opportunity. With a war chest now worth over $73 billion and an ongoing plan to keep buying through 2027, Strategy’s conviction play might end up being one of the boldest in modern financial history.

The post Strategy Buys Another $27M in Bitcoin — Here Is How Saylor Keeps Winning the Dip first appeared on BlockNews.