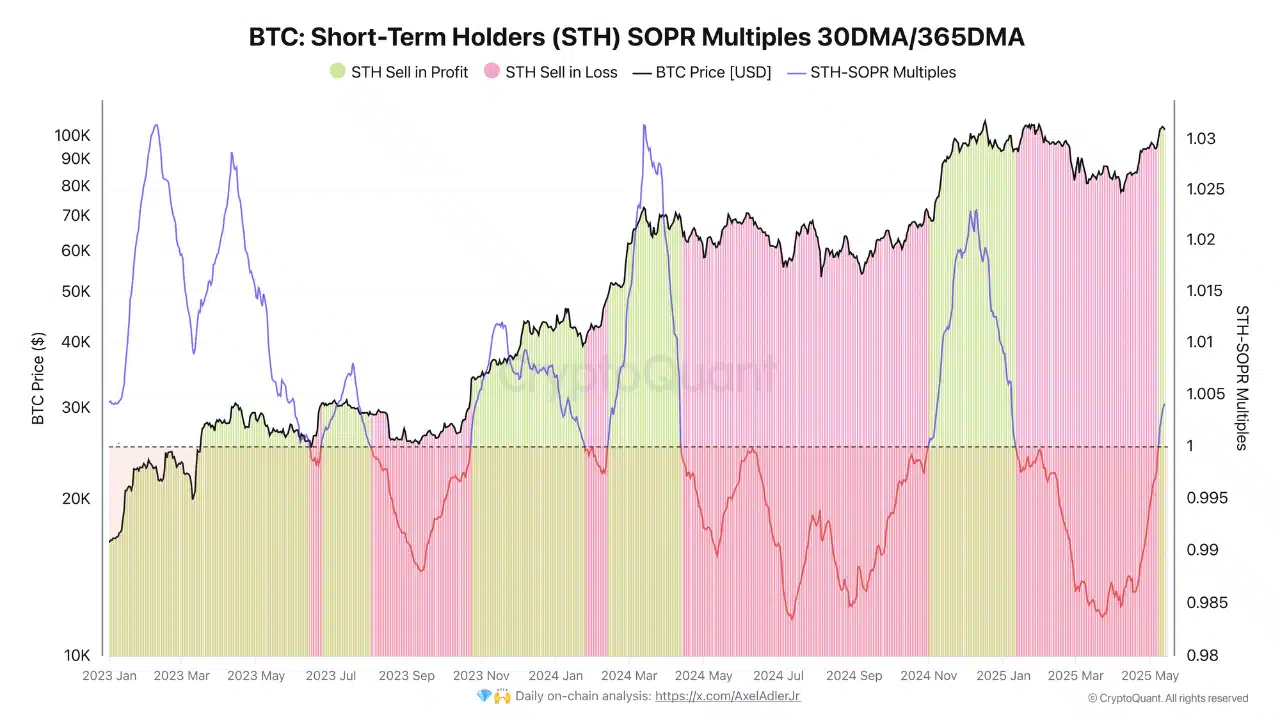

Since the 8th of May, STHs have re-entered profit territory as Bitcoin surged past $99K. Their SOPR has consistently held above 1, signaling that recent sellers are locking in gains.

This is a key indicator of bullish momentum: when STHs are in profit, they’re less likely to panic sell and more inclined to ride the trend.

As SOPR climbs toward 1.03, potential sell pressure builds – but so far, there’s little sign of aggressive distribution. Instead, sentiment suggests a market still gaining traction.

Price action cools, but momentum holds

Bitcoin traded at $102,706 at press time, down 0.83% on the day – a slight cooldown after its recent run above $103K. The RSI was at 66.47, bordering on overbought territory but not yet flashing warning signs of a reversal.

Meanwhile, the OBV flattened following a strong April uptrend – hinting at waning conviction among buyers, but not outright weakness.

While the daily candles show consolidation, the broader structure remains bullish.

As long as BTC holds above the $100K psychological support, the path of least resistance remains upward – though further gains may require fresh buying volume.