Chainlink Partners with Saudi Awwal Bank, Price Struggles to React

- Chainlink sealed a deal with Saudi Awwal Bank, using CCIP and CRE to drive on-chain finance adoption.

- Saudi’s Vision 2030 goals align with tokenization and blockchain experiments, adding long-term bullish potential.

- LINK price still hangs near $23 support, with risk of dipping to $20.5 if bulls don’t defend.

Chainlink (LINK) just scored a pretty big win on the institutional front, inking an agreement with Saudi Awwal Bank (SAB) — one of Saudi Arabia’s biggest banks with more than $100 billion in assets. The deal is aimed at ramping up on-chain finance across the region. Sounds bullish on paper, right? Yet, oddly enough, LINK’s price didn’t really budge. In fact, it’s been mostly flat, even down about 2% for the week.

Saudi Arabia’s First Bank Taps Chainlink Tech

SAB confirmed Monday that it had signed an Innovation Cooperation Agreement with Chainlink, making it the first Saudi bank to dip seriously into blockchain tech. As part of the plan, SAB’s devs will start experimenting with Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and Chainlink Runtime Environment (CRE).

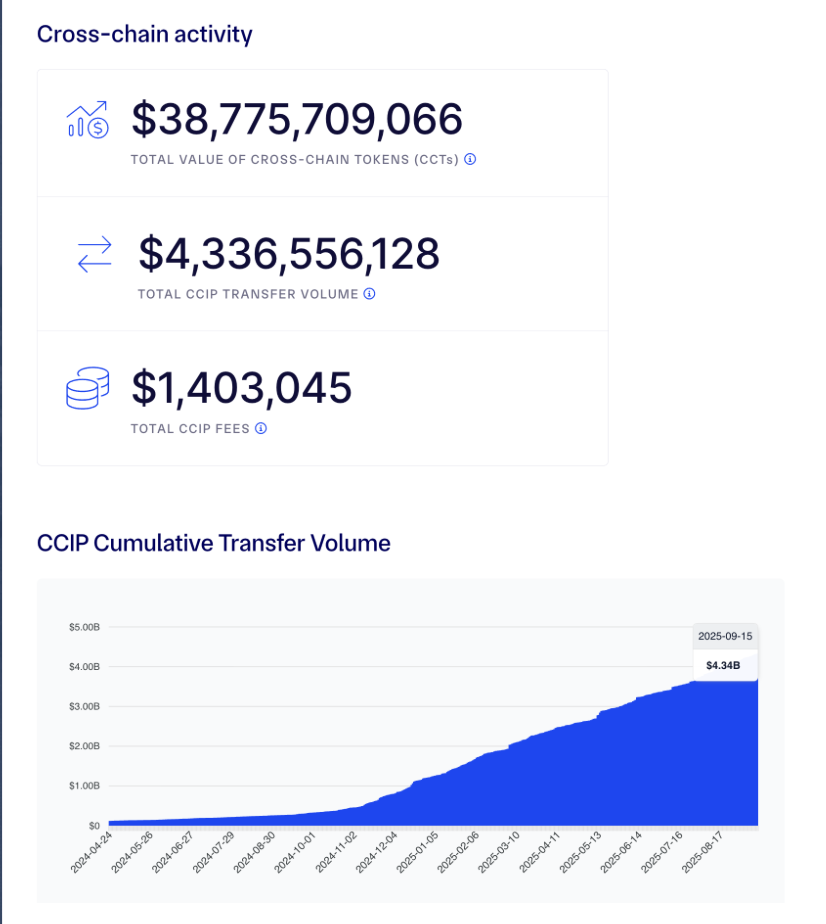

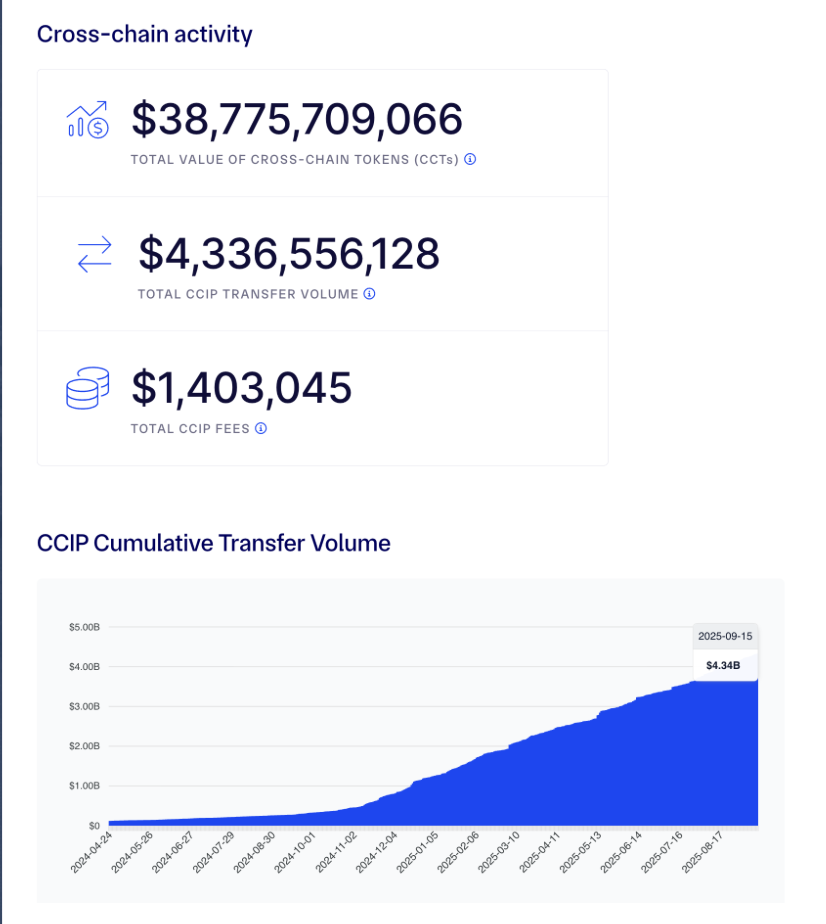

For context, CRE acts as a modular base for building apps while tapping into different APIs, while CCIP is the heavy lifter for cross-chain transfers. And this isn’t just theory — Chainlink says its CCIP is already live across 60 blockchains, processing $4.34B worth of transfers, with total cross-chain token value sitting above $38.7B.

Expanding Beyond Oil: Vision 2030 and Tokenization

Interestingly, SAB also inked a deal with Wamid, a subsidiary of Saudi Tadawul Group. The partnership? Testing tokenization in capital markets that carry a massive valuation of roughly $2.32 trillion. That lines up neatly with Crown Prince Mohammed bin Salman’s Vision 2030 plan to diversify Saudi’s economy away from oil dependency.

In other words — this isn’t just a PR stunt. If these tokenization and cross-chain projects gain traction, Saudi could become a heavyweight in digital finance infrastructure.

LINK Price Hangs at Support

Despite the flashy headlines, LINK hasn’t exploded. The token trades just above $23 as of mid-week, clinging to the 61.8% Fibonacci retracement at $22.98 (measured from the Dec 13 high of $30.94 to the Apr 7 low of $10.10). That level is the line in the sand right now.

Tuesday’s candle left a Doji pattern, hinting at indecision, but some traders see the potential for a V-shaped reversal if bulls step back in. If momentum returns, LINK could retest the 78.6% Fib level at $26.48.

For now, though, indicators are muted. The RSI sits around 51, showing neither strong buying nor selling pressure, while the MACD has slipped below its signal line — a sign that bullish energy has cooled off.

If LINK can’t hold $22.98, bears may drag it down toward the next major support at $20.52.

The post Chainlink Partners with Saudi Awwal Bank, Price Struggles to React first appeared on BlockNews.

Читать больше

What Happened in Crypto Today? – September 19: Mass Adoption Incoming?

Chainlink Partners with Saudi Awwal Bank, Price Struggles to React

- Chainlink sealed a deal with Saudi Awwal Bank, using CCIP and CRE to drive on-chain finance adoption.

- Saudi’s Vision 2030 goals align with tokenization and blockchain experiments, adding long-term bullish potential.

- LINK price still hangs near $23 support, with risk of dipping to $20.5 if bulls don’t defend.

Chainlink (LINK) just scored a pretty big win on the institutional front, inking an agreement with Saudi Awwal Bank (SAB) — one of Saudi Arabia’s biggest banks with more than $100 billion in assets. The deal is aimed at ramping up on-chain finance across the region. Sounds bullish on paper, right? Yet, oddly enough, LINK’s price didn’t really budge. In fact, it’s been mostly flat, even down about 2% for the week.

Saudi Arabia’s First Bank Taps Chainlink Tech

SAB confirmed Monday that it had signed an Innovation Cooperation Agreement with Chainlink, making it the first Saudi bank to dip seriously into blockchain tech. As part of the plan, SAB’s devs will start experimenting with Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and Chainlink Runtime Environment (CRE).

For context, CRE acts as a modular base for building apps while tapping into different APIs, while CCIP is the heavy lifter for cross-chain transfers. And this isn’t just theory — Chainlink says its CCIP is already live across 60 blockchains, processing $4.34B worth of transfers, with total cross-chain token value sitting above $38.7B.

Expanding Beyond Oil: Vision 2030 and Tokenization

Interestingly, SAB also inked a deal with Wamid, a subsidiary of Saudi Tadawul Group. The partnership? Testing tokenization in capital markets that carry a massive valuation of roughly $2.32 trillion. That lines up neatly with Crown Prince Mohammed bin Salman’s Vision 2030 plan to diversify Saudi’s economy away from oil dependency.

In other words — this isn’t just a PR stunt. If these tokenization and cross-chain projects gain traction, Saudi could become a heavyweight in digital finance infrastructure.

LINK Price Hangs at Support

Despite the flashy headlines, LINK hasn’t exploded. The token trades just above $23 as of mid-week, clinging to the 61.8% Fibonacci retracement at $22.98 (measured from the Dec 13 high of $30.94 to the Apr 7 low of $10.10). That level is the line in the sand right now.

Tuesday’s candle left a Doji pattern, hinting at indecision, but some traders see the potential for a V-shaped reversal if bulls step back in. If momentum returns, LINK could retest the 78.6% Fib level at $26.48.

For now, though, indicators are muted. The RSI sits around 51, showing neither strong buying nor selling pressure, while the MACD has slipped below its signal line — a sign that bullish energy has cooled off.

If LINK can’t hold $22.98, bears may drag it down toward the next major support at $20.52.

The post Chainlink Partners with Saudi Awwal Bank, Price Struggles to React first appeared on BlockNews.

Читать больше