Is the Pain Over for Chainlink? On-Chain Data Says… Maybe

- Chainlink has dropped 17.2% since July 28, but on-chain data (like declining MVRV and dormant circulation spikes) suggests the worst of the sell-off may be behind it.

- The $15.5 zone is a key level to watch, backed by the 50-day moving average and historical demand—any bullish reversal will likely start here.

- Market structure remains bearish for now, but a stabilization in Bitcoin’s price could trigger a rebound in LINK if broader sentiment improves.

Chainlink’s taken a bit of a hit lately—down 17.2% since July 28th. Not great, but hey, Bitcoin also dropped 4.9%, sliding from $119.8K to around $113.6K. So, it’s not like LINK’s bleeding alone. The question now is: are we done dropping, or is this just halftime?

Profit-Taking Wave Might Be Fading Out

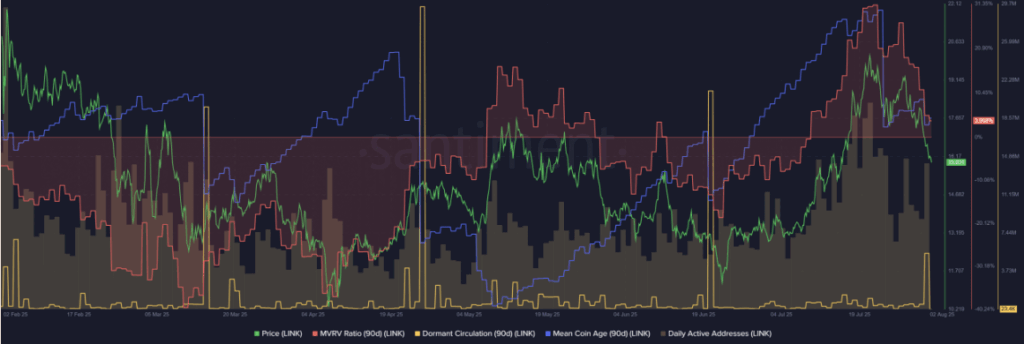

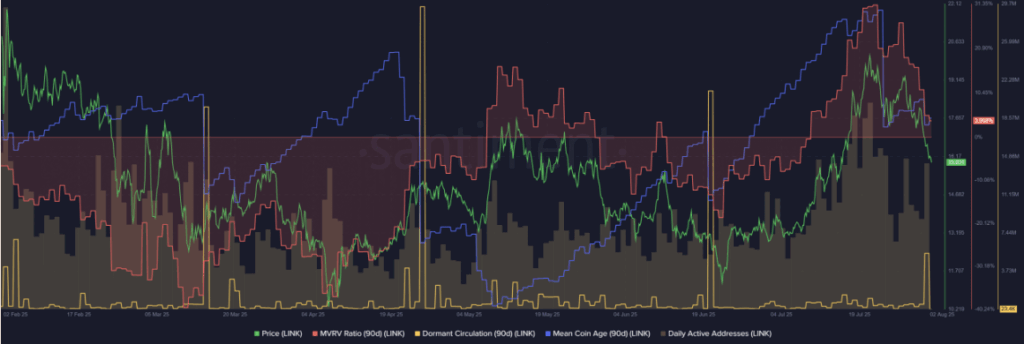

Let’s start with what the charts aren’t saying and look under the hood a bit. Santiment data popped up showing a surge in Dormant Circulation on August 1st. That spike usually screams “selling spree”—older tokens moving again, likely to exchanges. Makes sense, considering LINK dipped over 5% that same day.

What’s more, the 90-day Mean Coin Age has been slipping too. That’s not super bullish, by the way—it means coins are moving more, not sitting cozy in long-term wallets. In other words, it’s been a bit of a distribution phase lately. People cashing out.

Now, the MVRV ratio (basically a heat check for profits) has dropped right alongside price. As it nears zero, it suggests we’re running out of people in profit, which usually means the bulk of selling pressure might be behind us. Might.

$15.5 – The Make-Or-Break Zone?

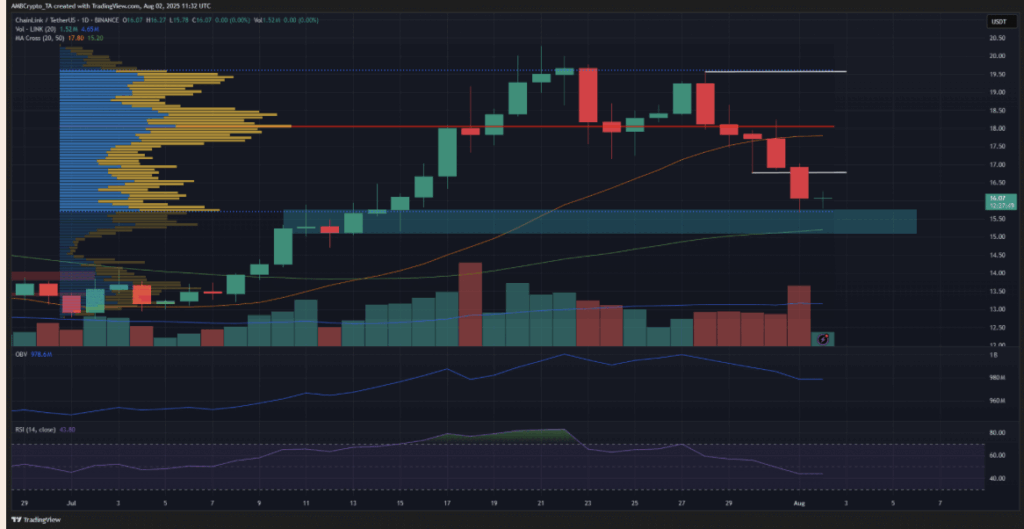

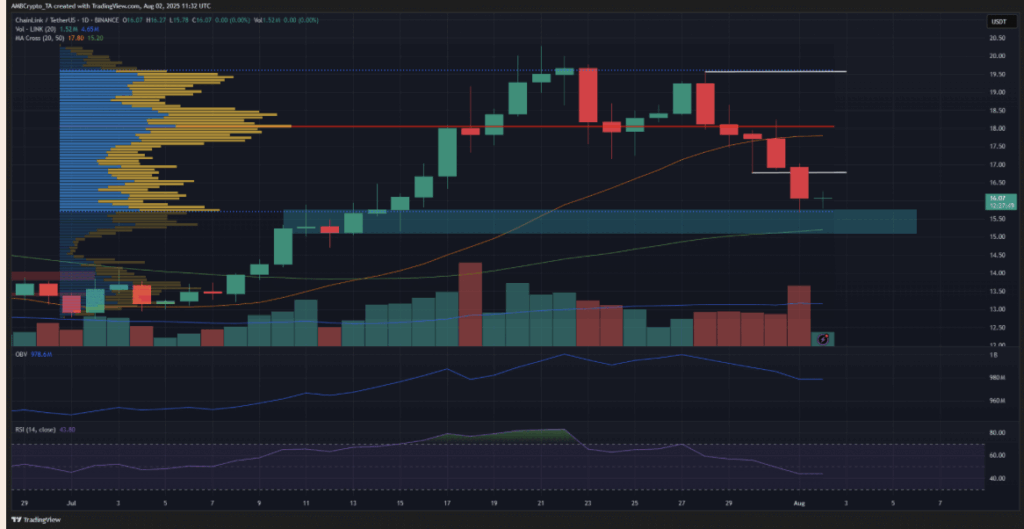

Technically speaking, things don’t look amazing… yet. The RSI? Below neutral 50. OBV? Sliding. Market structure? Still pointing down. But—there’s a little glimmer of hope around $15.5.

That zone has history. Back in mid-July, LINK hung out there before rocketing up. It’s not just a random number either—it’s backed by the 50-day moving average and lines up with the Value Area Low (about $15.7) from the Fixed Range Volume Profile. Basically, a lotta stuff happened there.

If bulls are going to make a stand, that’s where it’ll likely be.

Don’t Forget to Watch Bitcoin

Here’s the thing though—Chainlink doesn’t move in a vacuum. Bitcoin sneezes and LINK catches a cold. If BTC finds some footing soon, it might give LINK the green light to bounce.

So yeah, there’s a chance we’ve bottomed out short-term. But it’s not a done deal. Keep an eye on $15.5 and hope Bitcoin chills for a bit.

The post Is the Pain Over for Chainlink? On-Chain Data Says… Maybe first appeared on BlockNews.

Is the Pain Over for Chainlink? On-Chain Data Says… Maybe

- Chainlink has dropped 17.2% since July 28, but on-chain data (like declining MVRV and dormant circulation spikes) suggests the worst of the sell-off may be behind it.

- The $15.5 zone is a key level to watch, backed by the 50-day moving average and historical demand—any bullish reversal will likely start here.

- Market structure remains bearish for now, but a stabilization in Bitcoin’s price could trigger a rebound in LINK if broader sentiment improves.

Chainlink’s taken a bit of a hit lately—down 17.2% since July 28th. Not great, but hey, Bitcoin also dropped 4.9%, sliding from $119.8K to around $113.6K. So, it’s not like LINK’s bleeding alone. The question now is: are we done dropping, or is this just halftime?

Profit-Taking Wave Might Be Fading Out

Let’s start with what the charts aren’t saying and look under the hood a bit. Santiment data popped up showing a surge in Dormant Circulation on August 1st. That spike usually screams “selling spree”—older tokens moving again, likely to exchanges. Makes sense, considering LINK dipped over 5% that same day.

What’s more, the 90-day Mean Coin Age has been slipping too. That’s not super bullish, by the way—it means coins are moving more, not sitting cozy in long-term wallets. In other words, it’s been a bit of a distribution phase lately. People cashing out.

Now, the MVRV ratio (basically a heat check for profits) has dropped right alongside price. As it nears zero, it suggests we’re running out of people in profit, which usually means the bulk of selling pressure might be behind us. Might.

$15.5 – The Make-Or-Break Zone?

Technically speaking, things don’t look amazing… yet. The RSI? Below neutral 50. OBV? Sliding. Market structure? Still pointing down. But—there’s a little glimmer of hope around $15.5.

That zone has history. Back in mid-July, LINK hung out there before rocketing up. It’s not just a random number either—it’s backed by the 50-day moving average and lines up with the Value Area Low (about $15.7) from the Fixed Range Volume Profile. Basically, a lotta stuff happened there.

If bulls are going to make a stand, that’s where it’ll likely be.

Don’t Forget to Watch Bitcoin

Here’s the thing though—Chainlink doesn’t move in a vacuum. Bitcoin sneezes and LINK catches a cold. If BTC finds some footing soon, it might give LINK the green light to bounce.

So yeah, there’s a chance we’ve bottomed out short-term. But it’s not a done deal. Keep an eye on $15.5 and hope Bitcoin chills for a bit.

The post Is the Pain Over for Chainlink? On-Chain Data Says… Maybe first appeared on BlockNews.