Expert Ray Dalio Explains Why Trump Is Deliberately Weakening The US Dollar

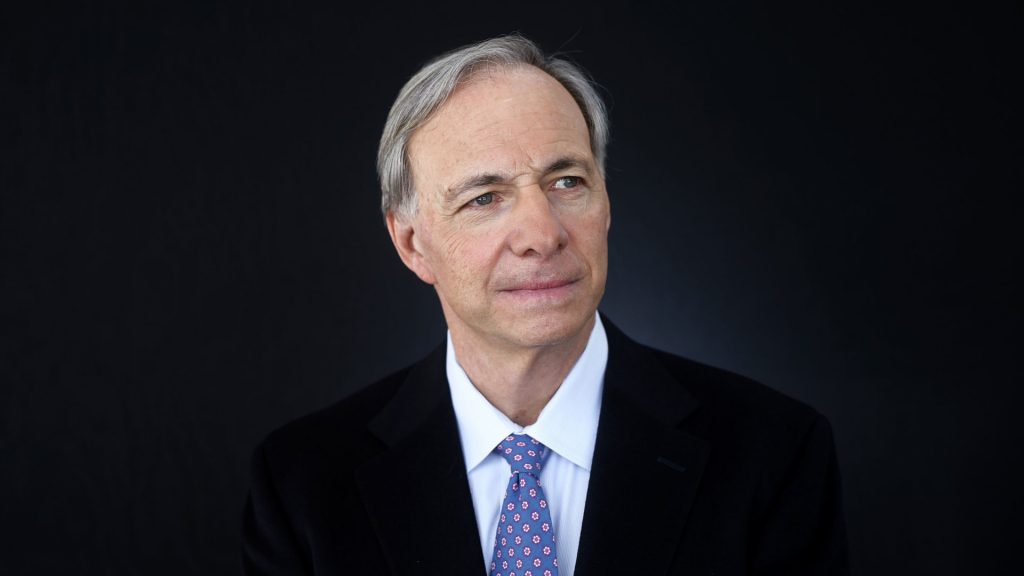

While the world seems shocked and disappointed at the flailing value of the US dollar, a leading finance expert believes that this predicament is nothing but a calculated strategy to counter the US debt crisis. Ray Dalio, founder of Bridgewater Associates, has come up with an intriguing analysis of Trump’s strategic regime, the one that promotes devaluing one’s own currency to combat the rising US debt crisis.

Also Read: De-dollarization: Devere CEO Warns Dollar Supremacy Cracking as Asia Dumps USD

Ray Dalio Floats A New Compelling Theory

Ray Dalio, in his recent post on X, presented a brief yet compelling analysis of currency dynamics and trends. His post outlined the idea of currency devaluation as one of the methods to reduce debt issues.

Dalio took to X to share how, sometimes, when nations are grappling with intense debt crises and the debt is denominated in their own currency, in such a case, these nations opt to devalue their currencies to stabilize rising debt issues.

He later shared how this is one of the primary reasons why the US dollar has been weak against the majority of other currencies, taking the investors by sweet surprise.

“When countries have big debt problems and the debt is denominated in their currency, they inevitably devalue the currency. As explained in my upcoming book How Countries Go Broke: The Big Debt Cycle, “debt is currency and currency is debt.” In other words, since a debt asset is the promise to receive a specified currency at a future date, and since when one holds a currency, one holds it in a debt instrument, debt and currency are essentially the same thing. If you don’t like one, you must not like the other. Watch out for the price and value of currency. That is why the dollar has been weak in relation to most other currencies, and all currencies have been weak in relation to gold.”

When countries have big debt problems and the debt is denominated in their currency, they inevitably devalue the currency. As explained in my upcoming book How Countries Go Broke: The Big Debt Cycle, "debt is currency and currency is debt." In other words, since a debt asset is…

— Ray Dalio (@RayDalio) May 6, 2025

Also Read: $280 Price Target Projected for Amazon Stock (AMZN)

Trump Wants a Weaker Dollar: Why?

Trump’s intent to push the US dollar further down has now become a reality. According to several experts, a weaker dollar is good for exports, helping the US boost its manufacturing, which in turn will help reduce US deficits.

“When the dollar is strong, US imports rise because foreign goods become cheap relative to domestically produced goods. At the same time, US exports fall as they become more expensive.” Lubin shared

At the same time, Trump seems to have succeeded in devaluing the dollar, as giants like Goldman Sachs have predicted how the USD is on a path for further decay and erosion.

“We have previously argued that the US’s exceptional return prospects are responsible for the dollar’s strong valuation,” Cahill writes. “But, if tariffs weigh on US firms’ profit margins and US consumers’ real incomes, they can erode that exceptionalism and, in turn, crack the central pillar of the strong dollar.”

Also Read: Nvidia Chip Export Restrictions: CEO Warns Legislation Could Impact NVDA Stock

Expert Ray Dalio Explains Why Trump Is Deliberately Weakening The US Dollar

While the world seems shocked and disappointed at the flailing value of the US dollar, a leading finance expert believes that this predicament is nothing but a calculated strategy to counter the US debt crisis. Ray Dalio, founder of Bridgewater Associates, has come up with an intriguing analysis of Trump’s strategic regime, the one that promotes devaluing one’s own currency to combat the rising US debt crisis.

Also Read: De-dollarization: Devere CEO Warns Dollar Supremacy Cracking as Asia Dumps USD

Ray Dalio Floats A New Compelling Theory

Ray Dalio, in his recent post on X, presented a brief yet compelling analysis of currency dynamics and trends. His post outlined the idea of currency devaluation as one of the methods to reduce debt issues.

Dalio took to X to share how, sometimes, when nations are grappling with intense debt crises and the debt is denominated in their own currency, in such a case, these nations opt to devalue their currencies to stabilize rising debt issues.

He later shared how this is one of the primary reasons why the US dollar has been weak against the majority of other currencies, taking the investors by sweet surprise.

“When countries have big debt problems and the debt is denominated in their currency, they inevitably devalue the currency. As explained in my upcoming book How Countries Go Broke: The Big Debt Cycle, “debt is currency and currency is debt.” In other words, since a debt asset is the promise to receive a specified currency at a future date, and since when one holds a currency, one holds it in a debt instrument, debt and currency are essentially the same thing. If you don’t like one, you must not like the other. Watch out for the price and value of currency. That is why the dollar has been weak in relation to most other currencies, and all currencies have been weak in relation to gold.”

When countries have big debt problems and the debt is denominated in their currency, they inevitably devalue the currency. As explained in my upcoming book How Countries Go Broke: The Big Debt Cycle, "debt is currency and currency is debt." In other words, since a debt asset is…

— Ray Dalio (@RayDalio) May 6, 2025

Also Read: $280 Price Target Projected for Amazon Stock (AMZN)

Trump Wants a Weaker Dollar: Why?

Trump’s intent to push the US dollar further down has now become a reality. According to several experts, a weaker dollar is good for exports, helping the US boost its manufacturing, which in turn will help reduce US deficits.

“When the dollar is strong, US imports rise because foreign goods become cheap relative to domestically produced goods. At the same time, US exports fall as they become more expensive.” Lubin shared

At the same time, Trump seems to have succeeded in devaluing the dollar, as giants like Goldman Sachs have predicted how the USD is on a path for further decay and erosion.

“We have previously argued that the US’s exceptional return prospects are responsible for the dollar’s strong valuation,” Cahill writes. “But, if tariffs weigh on US firms’ profit margins and US consumers’ real incomes, they can erode that exceptionalism and, in turn, crack the central pillar of the strong dollar.”

Also Read: Nvidia Chip Export Restrictions: CEO Warns Legislation Could Impact NVDA Stock