5 Reasons You Keep Missing Big Crypto Trades, And How to Fix It

- Most traders miss trades due to slow apps, manual setups, and clunky mobile execution—not because they can’t spot alpha.

- Archer Bot fixes this by moving trading into Telegram with instant execution, automation, and risk management baked in.

- The result: faster trades, fewer mistakes, and the ability to actually catch those explosive 100x moves instead of just watching them.

You spot the perfect setup. The chart looks flawless, the momentum is building, and you know this could be the trade that changes your week. But by the time you navigate through your trading app, find the token, adjust your settings, and finally hit buy, the opportunity is gone. You’re left watching the price pump 300% while you’re still trying to figure out why your transaction failed.

The vast majority of traders miss the best opportunities not because they can’t spot them, but because they can’t execute them fast enough. The fastest traders have already solved this problem using tools like Archer Bot that execute trades instantly through Telegram. Stop missing trades with Archer Bot →.

Reason #1: Your Trading App is Too Slow

Traditional trading apps were built for a different era—when traders held positions for days, not minutes. The typical workflow is a nightmare: see alpha on social media, switch to your trading app, wait for it to load, navigate multiple screens, search for the token, set up parameters, and finally execute—often 5-10 minutes after the opportunity appears.

In Solana time, 10 minutes might as well be 10 hours. Prices can move 100%+ while you’re still trying to complete a single trade. Every second spent navigating interfaces is money left on the table.

Archer Bot eliminates this by bringing trading directly into Telegram. When alpha drops in your groups, execute trades without leaving the conversation. Trade where the alpha lives →.

Reason #2: Manual Processes Kill Speed

Every trade requiring manual configuration kills momentum. Setting slippage, calculating position sizes, adjusting gas fees, manually inputting contract addresses—these steps take time you don’t have during explosive moves.

How many trades have you missed because you copied the wrong contract address or made a typo? Manual processes are error-prone, especially under pressure. When you’re rushing to catch a pumping token, mistakes become inevitable.

Successful traders automate these decisions in advance. They’ve predetermined position sizes, slippage settings, and risk parameters so they can execute instantly without calculations or second-guessing.

Reason #3: Risk Management Slows You Down

Many traders avoid setting stop-losses because the process is complicated and time-consuming. Without automated risk management, you’re forced to babysit every position, preventing you from taking multiple opportunities simultaneously.

Profit-taking is even harder. Greed makes you hold winners too long; fear makes you sell too early. Manual profit-taking requires perfect emotional control that few traders possess during volatile moves.

The most successful traders use systematic rules: sell 25% at 2x, 25% at 5x, 25% at 10x, let the final 25% ride. But implementing this manually during fast markets is nearly impossible.

Reason #4: Mobile Trading Doesn’t Work

Most crypto opportunities appear when you’re away from your computer. Traditional trading apps provide terrible mobile experiences—small screens, complex menus, poor touch interfaces make fast execution nearly impossible.

Mobile trading relies on stable connections that aren’t always available. Slow loading times, failed transactions, and app crashes during high-volume periods are common. By the time price alerts reach your phone and you open your trading app, opportunities are often gone.

Trying to execute time-sensitive trades on mobile means struggling with tiny buttons and hoping your fingers hit the right areas. The stress leads to mistakes and missed opportunities.

Reason #5: The Social Trading Gap

The best alpha comes from social sources—Telegram groups, Twitter calls, Discord communities. But there’s a massive gap between receiving information and acting on it. Traditional workflows require leaving these platforms to execute trades, creating delays that kill opportunities.

Alpha has a half-life measured in minutes. By the time you process information, switch apps, and execute trades, the alpha has often completely decayed. The edge exists only for those who can act immediately within the same environment where they’re getting information.

Trading in isolation also means missing the collective intelligence of successful communities—you don’t see how experienced traders position themselves or manage risk during volatile periods.

The Simple Fix: Archer Bot’s Comprehensive Solution

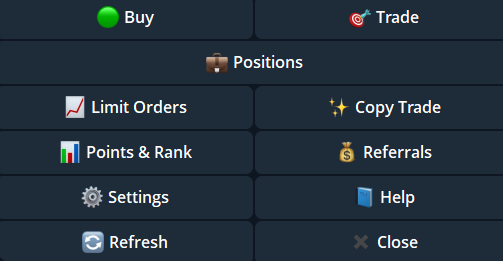

Archer Bot solves every execution problem by bringing professional-grade trading directly into Telegram. No app switching, no interface delays, no manual configurations. When opportunities appear, you’re positioned instantly while others are still opening their trading apps.

Instant Telegram Execution

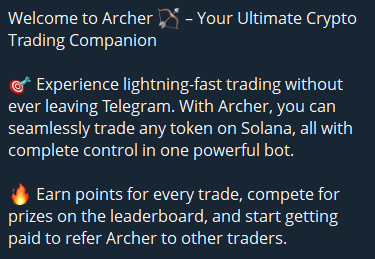

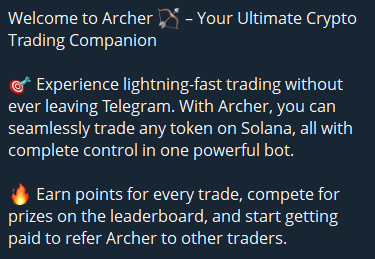

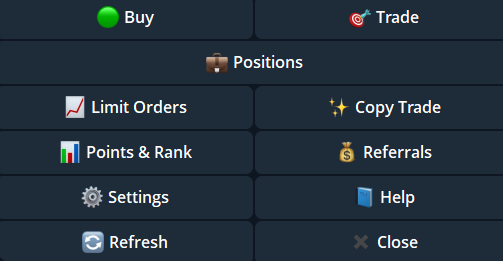

Execute trades directly in the communities where alpha gets shared. Archer Bot transforms Telegram from just an information source into a complete trading platform, eliminating the gap between discovery and execution.

Automated Everything

Set your position sizing and profit-taking rules once. Archer Bot executes every trade with perfect discipline, removing emotion from critical decisions. This automation lets you take multiple opportunities simultaneously without babysitting positions.

Mobile-First Design

Built specifically for mobile trading through Telegram, Archer Bot provides the same execution speed whether you’re at your desk or on the go. Simple text commands replace complex interfaces.

Solana Optimization

Archer Bot is built for Solana’s speed and characteristics. Automatic token detection, optimal routing, MEV protection, and slippage optimization—all handled automatically while you focus on opportunities.

Zero Learning Curve

Paste a contract address and confirm—that’s it. No manual calculations, no configuration delays, no room for error. The speed to catch opportunities plus the automation to manage them properly.

Ready to stop missing the best trades? Archer Bot eliminates every friction point that kills opportunities while providing the automation needed for consistent profits. Transform your trading today →

The Bottom Line

Missing good trades isn’t about lacking skill or information—it’s about execution infrastructure. The five problems above affect nearly every trader, but they’re completely solvable with the right tools.

The gap between seeing opportunities and profiting from them will only widen as markets become more competitive. Traders who solve the execution problem now will maintain sustainable advantages over those using outdated methods.

Stop watching opportunities slip away and start capturing them. Archer Bot provides instant execution, automated risk management, and seamless social integration. Get Archer Bot now →

The post 5 Reasons You Keep Missing Big Crypto Trades, And How to Fix It first appeared on BlockNews.

5 Reasons You Keep Missing Big Crypto Trades, And How to Fix It

- Most traders miss trades due to slow apps, manual setups, and clunky mobile execution—not because they can’t spot alpha.

- Archer Bot fixes this by moving trading into Telegram with instant execution, automation, and risk management baked in.

- The result: faster trades, fewer mistakes, and the ability to actually catch those explosive 100x moves instead of just watching them.

You spot the perfect setup. The chart looks flawless, the momentum is building, and you know this could be the trade that changes your week. But by the time you navigate through your trading app, find the token, adjust your settings, and finally hit buy, the opportunity is gone. You’re left watching the price pump 300% while you’re still trying to figure out why your transaction failed.

The vast majority of traders miss the best opportunities not because they can’t spot them, but because they can’t execute them fast enough. The fastest traders have already solved this problem using tools like Archer Bot that execute trades instantly through Telegram. Stop missing trades with Archer Bot →.

Reason #1: Your Trading App is Too Slow

Traditional trading apps were built for a different era—when traders held positions for days, not minutes. The typical workflow is a nightmare: see alpha on social media, switch to your trading app, wait for it to load, navigate multiple screens, search for the token, set up parameters, and finally execute—often 5-10 minutes after the opportunity appears.

In Solana time, 10 minutes might as well be 10 hours. Prices can move 100%+ while you’re still trying to complete a single trade. Every second spent navigating interfaces is money left on the table.

Archer Bot eliminates this by bringing trading directly into Telegram. When alpha drops in your groups, execute trades without leaving the conversation. Trade where the alpha lives →.

Reason #2: Manual Processes Kill Speed

Every trade requiring manual configuration kills momentum. Setting slippage, calculating position sizes, adjusting gas fees, manually inputting contract addresses—these steps take time you don’t have during explosive moves.

How many trades have you missed because you copied the wrong contract address or made a typo? Manual processes are error-prone, especially under pressure. When you’re rushing to catch a pumping token, mistakes become inevitable.

Successful traders automate these decisions in advance. They’ve predetermined position sizes, slippage settings, and risk parameters so they can execute instantly without calculations or second-guessing.

Reason #3: Risk Management Slows You Down

Many traders avoid setting stop-losses because the process is complicated and time-consuming. Without automated risk management, you’re forced to babysit every position, preventing you from taking multiple opportunities simultaneously.

Profit-taking is even harder. Greed makes you hold winners too long; fear makes you sell too early. Manual profit-taking requires perfect emotional control that few traders possess during volatile moves.

The most successful traders use systematic rules: sell 25% at 2x, 25% at 5x, 25% at 10x, let the final 25% ride. But implementing this manually during fast markets is nearly impossible.

Reason #4: Mobile Trading Doesn’t Work

Most crypto opportunities appear when you’re away from your computer. Traditional trading apps provide terrible mobile experiences—small screens, complex menus, poor touch interfaces make fast execution nearly impossible.

Mobile trading relies on stable connections that aren’t always available. Slow loading times, failed transactions, and app crashes during high-volume periods are common. By the time price alerts reach your phone and you open your trading app, opportunities are often gone.

Trying to execute time-sensitive trades on mobile means struggling with tiny buttons and hoping your fingers hit the right areas. The stress leads to mistakes and missed opportunities.

Reason #5: The Social Trading Gap

The best alpha comes from social sources—Telegram groups, Twitter calls, Discord communities. But there’s a massive gap between receiving information and acting on it. Traditional workflows require leaving these platforms to execute trades, creating delays that kill opportunities.

Alpha has a half-life measured in minutes. By the time you process information, switch apps, and execute trades, the alpha has often completely decayed. The edge exists only for those who can act immediately within the same environment where they’re getting information.

Trading in isolation also means missing the collective intelligence of successful communities—you don’t see how experienced traders position themselves or manage risk during volatile periods.

The Simple Fix: Archer Bot’s Comprehensive Solution

Archer Bot solves every execution problem by bringing professional-grade trading directly into Telegram. No app switching, no interface delays, no manual configurations. When opportunities appear, you’re positioned instantly while others are still opening their trading apps.

Instant Telegram Execution

Execute trades directly in the communities where alpha gets shared. Archer Bot transforms Telegram from just an information source into a complete trading platform, eliminating the gap between discovery and execution.

Automated Everything

Set your position sizing and profit-taking rules once. Archer Bot executes every trade with perfect discipline, removing emotion from critical decisions. This automation lets you take multiple opportunities simultaneously without babysitting positions.

Mobile-First Design

Built specifically for mobile trading through Telegram, Archer Bot provides the same execution speed whether you’re at your desk or on the go. Simple text commands replace complex interfaces.

Solana Optimization

Archer Bot is built for Solana’s speed and characteristics. Automatic token detection, optimal routing, MEV protection, and slippage optimization—all handled automatically while you focus on opportunities.

Zero Learning Curve

Paste a contract address and confirm—that’s it. No manual calculations, no configuration delays, no room for error. The speed to catch opportunities plus the automation to manage them properly.

Ready to stop missing the best trades? Archer Bot eliminates every friction point that kills opportunities while providing the automation needed for consistent profits. Transform your trading today →

The Bottom Line

Missing good trades isn’t about lacking skill or information—it’s about execution infrastructure. The five problems above affect nearly every trader, but they’re completely solvable with the right tools.

The gap between seeing opportunities and profiting from them will only widen as markets become more competitive. Traders who solve the execution problem now will maintain sustainable advantages over those using outdated methods.

Stop watching opportunities slip away and start capturing them. Archer Bot provides instant execution, automated risk management, and seamless social integration. Get Archer Bot now →

The post 5 Reasons You Keep Missing Big Crypto Trades, And How to Fix It first appeared on BlockNews.