Bitcoin (BTC USD) Max Pain Level: Bitwise Exec Names 2 Price Levels to Watch

Поделиться:

Key Insights

- Bitcoin USD traders are watching max pain levels near $84,000 and $73,000 as pressure increased.

- CoinGlass data showed $11 million in Bitcoin liquidations amid ongoing market volatility.

- Whale traders faced rising losses as long positions were cleared across major exchanges.

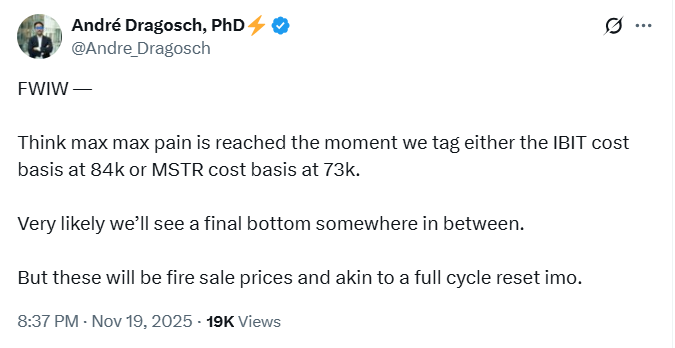

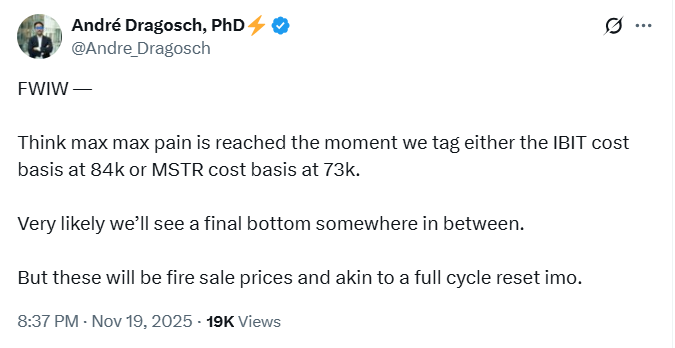

Bitcoin USD price max pain level projection is drawing attention after a Bitwise executive pointed to key cost bases at $84,000 and $73,000.

The price is currently hovering near $85,279 as traders face rising liquidations. Coinglass data showed $26.62 million in Bitcoin liquidations amid heavy losses across major exchanges.

Bitcoin USD Max Pain Levels to Watch

Bitcoin max pain levels became a topic of interest after André Dragosch from Bitwise highlighted two price areas that he viewed as important.

He said the market could feel the most pressure when the price reached the IBIT cost basis at $84,000 or the MSTR cost basis at $73,000.

His remarks came as Bitcoin slipped under $85,000 and earlier today traded near $84,863. The comments added context as traders looked for signs of where the market might settle next.

It is worth mentioning that Bitcoin moved through one of its roughest months of 2025, giving up all gains made earlier in the year.

The Bitcoin (BTC USD) price dropped about 28% from the early October high above $126,000 and reached levels not seen since April.

Several events shaped the recent change in sentiment. A large liquidation wave followed market reactions to Donald Trump’s tariff comments.

Uncertainty around the Federal Reserve’s upcoming policy choices added more pressure.

Looking at these developments together gives a clearer picture of why Bitcoin fell and what traders may watch next.

As of writing, Bitcoin was trading at $81,925.32, down by 10.72% in the past 24 hours.

Whale Traders Face Losses as Leverage Built Up

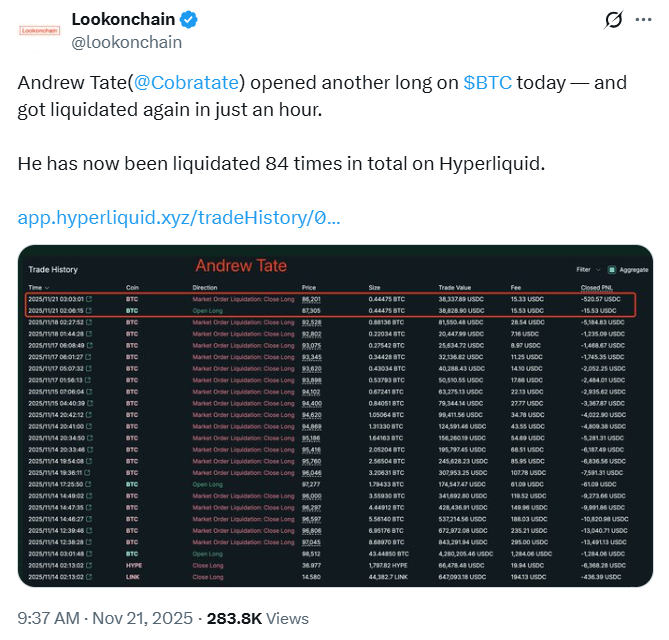

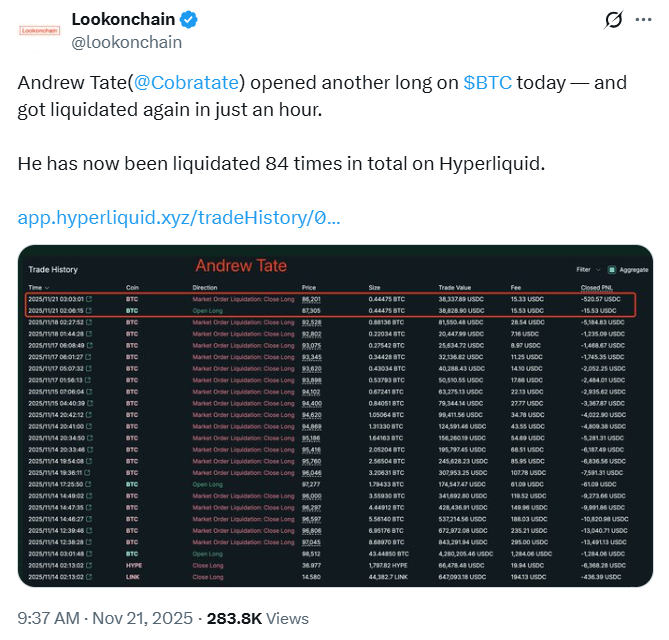

More whale-level traders faced losses as price swings grew sharper. Lookonchain reported that Andrew Tate opened another long position on Bitcoin (BTC USD) on Hyperliquid and was liquidated again within an hour.

The report stated that this was his 84th liquidation on the platform. The event drew attention because it showed how even large traders struggle with rapid price changes when using high leverage.

Rising liquidations across exchanges suggested that many traders were positioned for a rise in price.

The BTC decline created a chain reaction as long trades across the market hit forced closure levels.

These events often occur when markets move quickly and leave highly leveraged positions with little room to adjust.

The pattern became clear as liquidation totals climbed toward the billion-dollar range.

Liquidation Outlook Reflects Bitcoin (BTC USD) Price Outlook

It is worth mentioning that the outlook for liquidations remained uncertain as the broader environment shifted.

Coinglass data showed $11.46 million in Bitcoin USD liquidations on the heatmap during the recent move.

Ethereum liquidations reached about $2.73 million, while other assets, such as TNSR, ZEC, XRP, and SOL, also saw activity.

The broader liquidation picture reached far higher levels. Coinglass listed total liquidations near $2.02 billion over 24 hours.

Long positions made up about $1.79 billion of that amount, while short positions accounted for about $137.22 million.

A total of 409,955 traders were liquidated during this period. The largest single order appeared on Hyperliquid and was valued at $36.78 million in BTC.

Different exchanges showed varying levels of stress. Bybit posted about $389.56 million in liquidations, while Hyperliquid recorded about $371.27 million.

Binance followed at about $86.52 million. Most of the losses came from long trades. Hyperliquid showed about 99.4% long liquidations, while Bybit showed about 98.07%.

These numbers indicated that many traders had expected higher Bitcoin (BTC USD) price surge and were caught when the market moved in the opposite direction.

The post Bitcoin (BTC USD) Max Pain Level: Bitwise Exec Names 2 Price Levels to Watch appeared first on The Coin Republic.

Bitcoin (BTC USD) Max Pain Level: Bitwise Exec Names 2 Price Levels to Watch

Поделиться:

Key Insights

- Bitcoin USD traders are watching max pain levels near $84,000 and $73,000 as pressure increased.

- CoinGlass data showed $11 million in Bitcoin liquidations amid ongoing market volatility.

- Whale traders faced rising losses as long positions were cleared across major exchanges.

Bitcoin USD price max pain level projection is drawing attention after a Bitwise executive pointed to key cost bases at $84,000 and $73,000.

The price is currently hovering near $85,279 as traders face rising liquidations. Coinglass data showed $26.62 million in Bitcoin liquidations amid heavy losses across major exchanges.

Bitcoin USD Max Pain Levels to Watch

Bitcoin max pain levels became a topic of interest after André Dragosch from Bitwise highlighted two price areas that he viewed as important.

He said the market could feel the most pressure when the price reached the IBIT cost basis at $84,000 or the MSTR cost basis at $73,000.

His remarks came as Bitcoin slipped under $85,000 and earlier today traded near $84,863. The comments added context as traders looked for signs of where the market might settle next.

It is worth mentioning that Bitcoin moved through one of its roughest months of 2025, giving up all gains made earlier in the year.

The Bitcoin (BTC USD) price dropped about 28% from the early October high above $126,000 and reached levels not seen since April.

Several events shaped the recent change in sentiment. A large liquidation wave followed market reactions to Donald Trump’s tariff comments.

Uncertainty around the Federal Reserve’s upcoming policy choices added more pressure.

Looking at these developments together gives a clearer picture of why Bitcoin fell and what traders may watch next.

As of writing, Bitcoin was trading at $81,925.32, down by 10.72% in the past 24 hours.

Whale Traders Face Losses as Leverage Built Up

More whale-level traders faced losses as price swings grew sharper. Lookonchain reported that Andrew Tate opened another long position on Bitcoin (BTC USD) on Hyperliquid and was liquidated again within an hour.

The report stated that this was his 84th liquidation on the platform. The event drew attention because it showed how even large traders struggle with rapid price changes when using high leverage.

Rising liquidations across exchanges suggested that many traders were positioned for a rise in price.

The BTC decline created a chain reaction as long trades across the market hit forced closure levels.

These events often occur when markets move quickly and leave highly leveraged positions with little room to adjust.

The pattern became clear as liquidation totals climbed toward the billion-dollar range.

Liquidation Outlook Reflects Bitcoin (BTC USD) Price Outlook

It is worth mentioning that the outlook for liquidations remained uncertain as the broader environment shifted.

Coinglass data showed $11.46 million in Bitcoin USD liquidations on the heatmap during the recent move.

Ethereum liquidations reached about $2.73 million, while other assets, such as TNSR, ZEC, XRP, and SOL, also saw activity.

The broader liquidation picture reached far higher levels. Coinglass listed total liquidations near $2.02 billion over 24 hours.

Long positions made up about $1.79 billion of that amount, while short positions accounted for about $137.22 million.

A total of 409,955 traders were liquidated during this period. The largest single order appeared on Hyperliquid and was valued at $36.78 million in BTC.

Different exchanges showed varying levels of stress. Bybit posted about $389.56 million in liquidations, while Hyperliquid recorded about $371.27 million.

Binance followed at about $86.52 million. Most of the losses came from long trades. Hyperliquid showed about 99.4% long liquidations, while Bybit showed about 98.07%.

These numbers indicated that many traders had expected higher Bitcoin (BTC USD) price surge and were caught when the market moved in the opposite direction.

The post Bitcoin (BTC USD) Max Pain Level: Bitwise Exec Names 2 Price Levels to Watch appeared first on The Coin Republic.