Why Is Crypto Down Today? – February 6, 2026

Поделиться:

The crypto market is down today, posting another significant decrease. It fell 8% over the past 24 hours to $2.3 trillion. Moreover, 90 of the top 100 coins saw their prices drop. At the same time, the total crypto trading volume stands at $356 billion, the highest it’s been in months.

Crypto Winners & Losers

On Friday morning (UTC), 9 of the top 10 coins per market capitalisation have seen their prices fall. Whopping 5 of these have recorded double-digit drops.

Bitcoin (BTC) dropped by 9.1%, now trading at $64,744.

Ethereum (ETH) is down 11%, now changing hands at $1,878.

The highest decrease in the category is 14% by Solana (SOL), now standing at $79.

It’s followed by Dogecoin (DOGE)’s fall of 11.3% to the price of $0.09056.

The smallest decrease is Tron (TRX)’s 4% to $0.2687.

The only green coin is Figure Heloc (FIGR_HELOC). It’s up 2.9% to the price of $1.03.

Furthermore, of the top 100 coins per market cap, 90 have posted price drops today. 41 of these saw double-digit pullbacks.

The biggest fall today is 21.3% by Official Trump (TRUMP). It now trades at $3.23.

The next one on the list is LEO Token (LEO), having dropped 17.2% to $6.69.

Of the green coins, the best performer is MYX Finance (MYX). It appreciated 6.1%, now changing hands at $6.48.

MemeCore (M) follows with a 5% rise to $1.58.

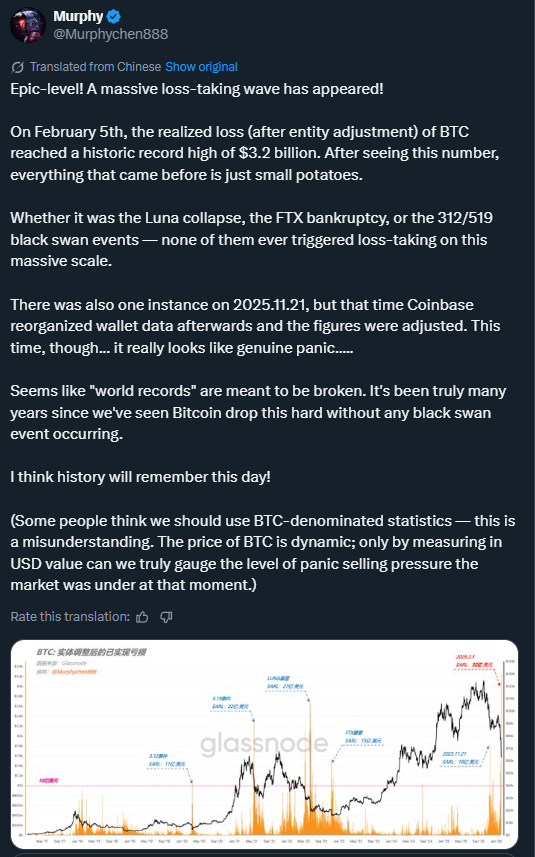

Bitcoin’s entity-adjusted realised loss hit a record $3.2 billion on 5 February, a sign that traders rushed to exit as the market plunged.

On-chain analyst Murphy defined this as capitulation, arguing that the scale of loss-taking surpassed what the market absorbed during some of its strongest shocks.

Meanwhile, Bitcoin miner Marathon Digital (MARA) transferred 1,318 BTC, worth $86.9 million, in ten hours to three crypto wallets.

The plunge in prices has taken a significant toll on Bitcoin miners.

‘Consolidating a Clearly Corrective Phase’

Matt Howells Barby, VP at Kraken, “Bitcoin breaching the 2021 all-time high of $69,000 is significant, but it doesn’t rule out further short-term downside.”

He argues that the coin’s price is now entering a well-defined support zone between $54,000 and $69,000.

Moreover, the weekly RSI has dipped below 30 for the first time since mid-2022. This signal “has historically preceded major bottoms forming within a three-to-six-month window.”

“In our view, a base is most likely to form in the $54,000–$60,000 range, particularly as the low-$50,000s align with the 200-day moving average,” the VP concludes.

Moreover, Antonio Di Giacomo, Senior Market Analyst at XS.com, commented that Bitcoin posted a sharp decline amid a contraction in global liquidity and a broad sell-off in tech stocks.

“The cryptocurrency has recorded losses in seven of the last eight sessions, consolidating a clearly corrective phase that has significantly weakened market sentiment.”

Therefore, the number one coin saw a nearly 50% drop from its ATH, “confirming a structural shift in price dynamics.” Per the analyst, “the market has transitioned from an environment dominated by speculation and leverage to one focused on capital preservation, amid a broader adjustment across risk assets.”

The break of key technical levels increased the downward pressure and triggered a wave of forced liquidations in the derivatives market. Almost $770 million in leveraged positions got liquidated in just 24 hours. This, in turn, amplified volatility and accelerated the price decline in a low-liquidity environment.

“This deleveraging process reflects a market that has yet to complete its cleansing phase. Over recent months, elevated leverage left Bitcoin vulnerable to sharp moves, and the recent break of technical supports acted as a catalyst for a deeper, more disorderly adjustment.”

Moreover, BTC no longer act as an alternative safe-haven asset. It’s now aligned with the risk-asset cycle again.

Di Giacomo writes: “In the short term, price action will remain conditioned by liquidity stability and the evolution of the macroeconomic environment. As long as restrictive financial conditions and a defensive tone prevail in global markets, technical rebounds may be limited and vulnerable to renewed selling pressure.”

Levels & Events to Watch Next

At the time of writing on Friday morning, BTC was trading at $64,744. While it began the day at $71,702, it gradually, but swiftly, dropped below the psychologically critical support level of $70,000 and to the intraday low of $60,255.

It is now down nearly 22% in a single week, with the highest price in this period being $84,177. BTC is also down 48.5% from its all-time high of $126,080 recorded in October 2025.

Having dipped to the $60,250 level, Bitcoin now has high chances of dropping below $60,000 towards $58,500, followed by $56,300. The resistance area now stands at the $77,000 level.

At the same time, Ethereum was changing hands at $1,878. It decreased from the intraday high of $2,136 to the low of $1,756. It recovered slightly since.

Over the past week, the price dropped by 31.5%, while it pulled back 62% from the August ATH of $4,946.

Like BTC, ETH also shows a strong bearish trend. If the course does not reverse, having dropped below $2,000, the coin is now in danger of pulling back further towards $1,700 and $1,620, with the next stop being the $1,500 level.

Moreover, the crypto market sentiment has dropped to a level not seen since CoinMarketCap began tracking this metric in mid-2023.

The crypto fear and greed index now stands at just 5, having plunged from 11 seen a day ago. This is deep within the extreme fear zone.

The drop in sentiment is unsurprising given the plunge in the market prices. It will be interesting to see how low it can go during this massive pullback. The number reflects a high level of concern among market participants, and it may get worse still.

ETFs Continue Outflow Streak

The US BTC spot exchange-traded funds (ETFs) closed another session lower on Thursday, with $434.15 million in negative flows. The total net inflow fell to the current $54.32 billion.

Six of the twelve ETFs posted negative flows, and none saw inflows. BlackRock let go of $175.33 million on 5 February.

Fidelity recorded outflows of $109.48 million, followed by Grayscale’s $75.42 million.

Additionally, the US ETH ETFs saw outflows on Thursday as well, letting go of $80.79 million. The total net inflow decreased to $11.83 billion.

Of the nine funds, three posted negative flows, and two saw inflows. Fidelity let go of $55.78 million, followed by Grayscale’s $27.08 million and BlackRock’s $8.52 million.

At the same time, Grayscale Mini Trust and Invesco took in $7.05 million and $3.53 million, respectively.

Quick FAQ

- Did crypto move with stocks today?

The crypto market recorded another pullback in the last day. Also, the US stock market closed the Thursday session sharply lower. By the end of trading on 5 February, the S&P 500 was down 1.23%, the Nasdaq-100 decreased by 1.38%, and the Dow Jones Industrial Average fell by 1.2%. Investors weighed the latest labour data and Big Tech earnings reports.

- Is this drop sustainable?

The prices can still go lower. There is room for additional pullbacks, unless significant macroeconomic and/or geopolitical factors provide a strong enough tailwind for another leg up.

The post Why Is Crypto Down Today? – February 6, 2026 appeared first on Cryptonews.

Читать больше

Why Is Crypto Down Today? – February 6, 2026

Поделиться:

The crypto market is down today, posting another significant decrease. It fell 8% over the past 24 hours to $2.3 trillion. Moreover, 90 of the top 100 coins saw their prices drop. At the same time, the total crypto trading volume stands at $356 billion, the highest it’s been in months.

Crypto Winners & Losers

On Friday morning (UTC), 9 of the top 10 coins per market capitalisation have seen their prices fall. Whopping 5 of these have recorded double-digit drops.

Bitcoin (BTC) dropped by 9.1%, now trading at $64,744.

Ethereum (ETH) is down 11%, now changing hands at $1,878.

The highest decrease in the category is 14% by Solana (SOL), now standing at $79.

It’s followed by Dogecoin (DOGE)’s fall of 11.3% to the price of $0.09056.

The smallest decrease is Tron (TRX)’s 4% to $0.2687.

The only green coin is Figure Heloc (FIGR_HELOC). It’s up 2.9% to the price of $1.03.

Furthermore, of the top 100 coins per market cap, 90 have posted price drops today. 41 of these saw double-digit pullbacks.

The biggest fall today is 21.3% by Official Trump (TRUMP). It now trades at $3.23.

The next one on the list is LEO Token (LEO), having dropped 17.2% to $6.69.

Of the green coins, the best performer is MYX Finance (MYX). It appreciated 6.1%, now changing hands at $6.48.

MemeCore (M) follows with a 5% rise to $1.58.

Bitcoin’s entity-adjusted realised loss hit a record $3.2 billion on 5 February, a sign that traders rushed to exit as the market plunged.

On-chain analyst Murphy defined this as capitulation, arguing that the scale of loss-taking surpassed what the market absorbed during some of its strongest shocks.

Meanwhile, Bitcoin miner Marathon Digital (MARA) transferred 1,318 BTC, worth $86.9 million, in ten hours to three crypto wallets.

The plunge in prices has taken a significant toll on Bitcoin miners.

‘Consolidating a Clearly Corrective Phase’

Matt Howells Barby, VP at Kraken, “Bitcoin breaching the 2021 all-time high of $69,000 is significant, but it doesn’t rule out further short-term downside.”

He argues that the coin’s price is now entering a well-defined support zone between $54,000 and $69,000.

Moreover, the weekly RSI has dipped below 30 for the first time since mid-2022. This signal “has historically preceded major bottoms forming within a three-to-six-month window.”

“In our view, a base is most likely to form in the $54,000–$60,000 range, particularly as the low-$50,000s align with the 200-day moving average,” the VP concludes.

Moreover, Antonio Di Giacomo, Senior Market Analyst at XS.com, commented that Bitcoin posted a sharp decline amid a contraction in global liquidity and a broad sell-off in tech stocks.

“The cryptocurrency has recorded losses in seven of the last eight sessions, consolidating a clearly corrective phase that has significantly weakened market sentiment.”

Therefore, the number one coin saw a nearly 50% drop from its ATH, “confirming a structural shift in price dynamics.” Per the analyst, “the market has transitioned from an environment dominated by speculation and leverage to one focused on capital preservation, amid a broader adjustment across risk assets.”

The break of key technical levels increased the downward pressure and triggered a wave of forced liquidations in the derivatives market. Almost $770 million in leveraged positions got liquidated in just 24 hours. This, in turn, amplified volatility and accelerated the price decline in a low-liquidity environment.

“This deleveraging process reflects a market that has yet to complete its cleansing phase. Over recent months, elevated leverage left Bitcoin vulnerable to sharp moves, and the recent break of technical supports acted as a catalyst for a deeper, more disorderly adjustment.”

Moreover, BTC no longer act as an alternative safe-haven asset. It’s now aligned with the risk-asset cycle again.

Di Giacomo writes: “In the short term, price action will remain conditioned by liquidity stability and the evolution of the macroeconomic environment. As long as restrictive financial conditions and a defensive tone prevail in global markets, technical rebounds may be limited and vulnerable to renewed selling pressure.”

Levels & Events to Watch Next

At the time of writing on Friday morning, BTC was trading at $64,744. While it began the day at $71,702, it gradually, but swiftly, dropped below the psychologically critical support level of $70,000 and to the intraday low of $60,255.

It is now down nearly 22% in a single week, with the highest price in this period being $84,177. BTC is also down 48.5% from its all-time high of $126,080 recorded in October 2025.

Having dipped to the $60,250 level, Bitcoin now has high chances of dropping below $60,000 towards $58,500, followed by $56,300. The resistance area now stands at the $77,000 level.

At the same time, Ethereum was changing hands at $1,878. It decreased from the intraday high of $2,136 to the low of $1,756. It recovered slightly since.

Over the past week, the price dropped by 31.5%, while it pulled back 62% from the August ATH of $4,946.

Like BTC, ETH also shows a strong bearish trend. If the course does not reverse, having dropped below $2,000, the coin is now in danger of pulling back further towards $1,700 and $1,620, with the next stop being the $1,500 level.

Moreover, the crypto market sentiment has dropped to a level not seen since CoinMarketCap began tracking this metric in mid-2023.

The crypto fear and greed index now stands at just 5, having plunged from 11 seen a day ago. This is deep within the extreme fear zone.

The drop in sentiment is unsurprising given the plunge in the market prices. It will be interesting to see how low it can go during this massive pullback. The number reflects a high level of concern among market participants, and it may get worse still.

ETFs Continue Outflow Streak

The US BTC spot exchange-traded funds (ETFs) closed another session lower on Thursday, with $434.15 million in negative flows. The total net inflow fell to the current $54.32 billion.

Six of the twelve ETFs posted negative flows, and none saw inflows. BlackRock let go of $175.33 million on 5 February.

Fidelity recorded outflows of $109.48 million, followed by Grayscale’s $75.42 million.

Additionally, the US ETH ETFs saw outflows on Thursday as well, letting go of $80.79 million. The total net inflow decreased to $11.83 billion.

Of the nine funds, three posted negative flows, and two saw inflows. Fidelity let go of $55.78 million, followed by Grayscale’s $27.08 million and BlackRock’s $8.52 million.

At the same time, Grayscale Mini Trust and Invesco took in $7.05 million and $3.53 million, respectively.

Quick FAQ

- Did crypto move with stocks today?

The crypto market recorded another pullback in the last day. Also, the US stock market closed the Thursday session sharply lower. By the end of trading on 5 February, the S&P 500 was down 1.23%, the Nasdaq-100 decreased by 1.38%, and the Dow Jones Industrial Average fell by 1.2%. Investors weighed the latest labour data and Big Tech earnings reports.

- Is this drop sustainable?

The prices can still go lower. There is room for additional pullbacks, unless significant macroeconomic and/or geopolitical factors provide a strong enough tailwind for another leg up.

The post Why Is Crypto Down Today? – February 6, 2026 appeared first on Cryptonews.

Читать больше

![[LIVE] Crypto News Today: Latest Updates for Feb. 06, 2026 – Bitcoin Briefly Drops Below $60K as Market Rout Deepens, $2.7B Liquidated in 24 Hours](https://cimg.co/wp-content/uploads/2026/02/06035635/1770350194-feb-06-crypto-news.jpg)