How to Buy Crypto Like Smart Money: The Dollar-Cost Averaging Strategy Explained

- DCA reduces timing risk by spreading crypto buys over fixed intervals.

- Works best with Bitcoin, Ethereum, and select altcoins for stability and growth.

- Consistency is key—don’t stop DCA during bear markets.

Trying to time the crypto market perfectly is like trying to catch a falling knife while riding a rollercoaster—exciting, but you’ll probably get hurt. While amateur investors stress about finding the “perfect entry point,” experienced crypto investors have been quietly using a strategy that eliminates timing anxiety and builds wealth systematically: Dollar-Cost Averaging (DCA).

DCA isn’t just another investment buzzword. It’s the strategy that helped countless investors navigate crypto’s wild volatility while building substantial positions in Bitcoin, Ethereum, and other major cryptocurrencies. Instead of gambling on market timing, DCA turns market volatility into your advantage.

This is exactly the type of proven strategy we teach in our Crypto 101 course—moving beyond gambling and speculation to systematic wealth building. Learn the complete framework HERE

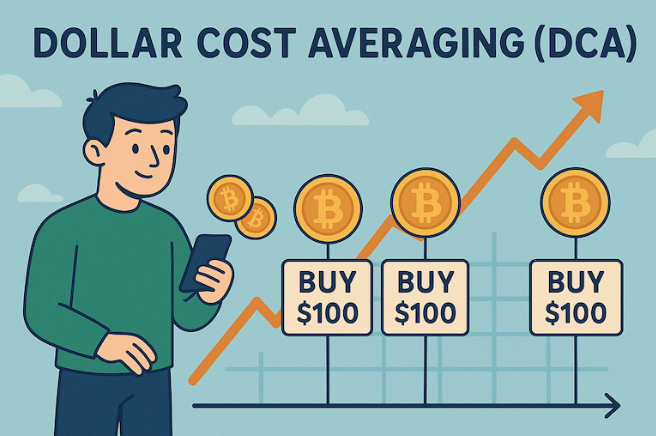

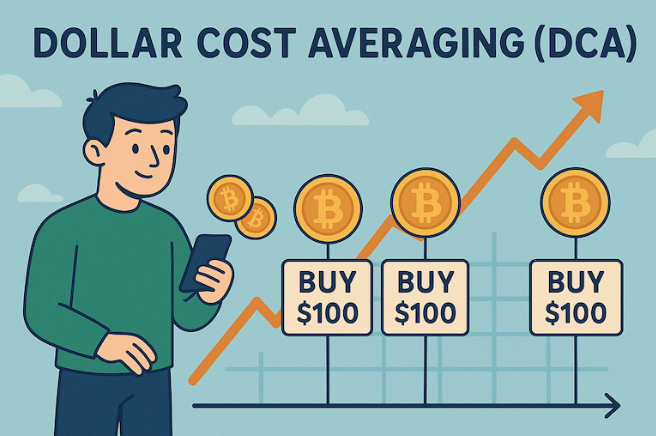

What is Dollar-Cost Averaging (DCA)?

Dollar-Cost Averaging is an investment strategy where you invest a fixed dollar amount into a particular asset at regular intervals, regardless of the asset’s price. Instead of investing $1,200 all at once, you might invest $100 every month for 12 months.

Why DCA Works So Well in Crypto

When you DCA into a volatile asset, you automatically buy more units when prices are low and fewer units when prices are high. This mathematical advantage compounds over time.

Example: DCA vs. Lump Sum Bitcoin Purchase

Let’s say you wanted to invest $1,200 in Bitcoin over 6 months, ending today:

Lump Sum: Buy $1,200 worth at $95,000 (March) = 0.0126 BTC

DCA: Buy $200 monthly:

- March: $200 at $95,000 = 0.0021 BTC

- April: $200 at $88,000 = 0.0023 BTC

- May: $200 at $92,000 = 0.0022 BTC

- June: $200 at $85,000 = 0.0024 BTC

- July: $200 at $98,000 = 0.0020 BTC

- August: $200 at $102,000 = 0.0020 BTC

- Total: 0.0130 BTC at an average cost of $92,308

With Bitcoin now trading above $110,000, the DCA approach resulted in more Bitcoin at a lower average cost than the lump sum purchase.

Psychological Benefits

DCA eliminates the most dangerous emotions in crypto investing:

- FOMO: No need to rush into positions during rallies

- Analysis Paralysis: No perfect timing required

- Regret: Can’t regret “buying at the top” when you buy at all levels

- Panic Selling: Regular purchases create conviction

Photo credit: Zoomex

Setting Up Your DCA Strategy

Choose Your Assets Wisely

Best for DCA:

- Bitcoin (BTC) – Digital store of value with longest track record

- Ethereum (ETH) – Leading smart contract platform

- Major altcoins (Solana, etc.) for higher risk/reward

Avoid for DCA: Meme coins, new projects without track records

Determine Your Schedule and Amount

Frequency: Weekly (better averaging) or monthly (simpler) Amount: 5-10% of investable income you won’t need for 2+ years

Choose Your Platform

Look for exchanges with:

- Automatic recurring purchase options

- Low fees for small, frequent buys

- Strong security track record

- Your chosen cryptocurrencies available

Popular options: Coinbase, Kraken, Gemini, Cash App (Bitcoin only)

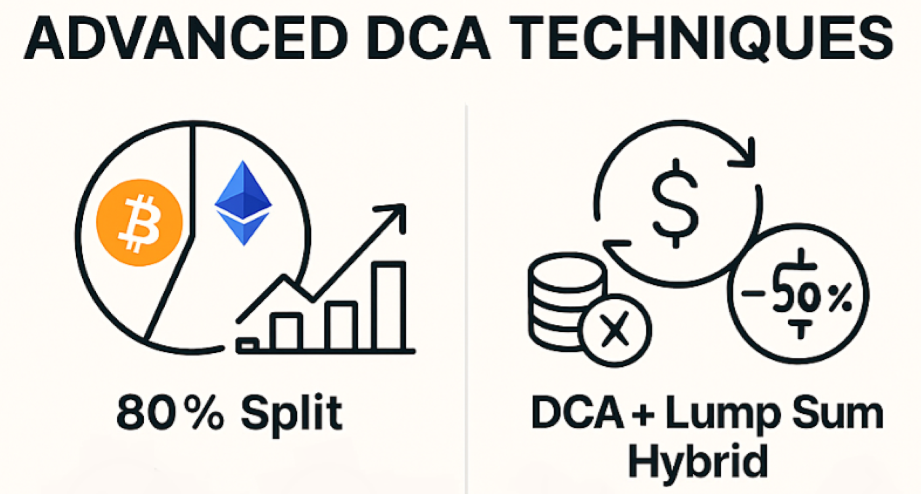

Advanced DCA Techniques

The 80/20 Split

- 80% into Bitcoin and Ethereum (stability)

- 20% into higher-risk altcoins

DCA + Lump Sum Hybrid

Combine regular DCA with opportunistic purchases during major crashes (20%-50%+ drops)

Common DCA Mistakes to Avoid

- Stopping during bear markets – This is when DCA provides the most value

- Trying to “optimize” constantly – Consistency is key

- Spreading across too many assets – Focus on 2-4 high-conviction picks

- Neglecting security – Set up proper storage as holdings grow

- Ignoring taxes – Keep detailed records of each purchase

When DCA Underperforms

- Strong bull markets (lump sum at start wins)

- Consistent downtrends (still loses money)

- High-fee environments (costs erode small purchases)

How to Make Your Own DCA Action Plan

- Calculate your DCA budget

- Choose 1-2 assets (Bitcoin/Ethereum for beginners)

- Select exchange and set up security

- Make your first manual purchase

- Once you are comfortable, set up automatic recurring purchases

- Create tracking system

- Plan long-term storage solution

- Stick to schedule regardless of market conditions

- Review quarterly, not daily

- Continue learning about crypto fundamentals

Building a successful DCA strategy is just the beginning. The crypto space moves fast, and staying ahead requires continuous education about market cycles, emerging opportunities, and advanced strategies. Master everything you need in Crypto 101 →

Building Your Complete Crypto Knowledge

DCA is powerful, but it’s most effective as part of a comprehensive crypto investment strategy. Understanding how DCA fits with security practices, research methods, and market analysis is crucial for long-term success.

Ready to master not just DCA, but all aspects of crypto investing? Our comprehensive Crypto 101 course covers everything from blockchain fundamentals to advanced investment strategies and research methods. Master crypto fundamentals HERE

Want to connect with experienced investors who’ve successfully implemented DCA strategies? Join the Trade Hero community where members share real-world results, discuss optimal allocation strategies, and help each other navigate market volatility with discipline. Join Trade Hero community →

The Bottom Line

The best DCA strategy is the one you’ll actually follow consistently. Start simple with Bitcoin and Ethereum, automate your purchases, and let time and volatility work in your favor. The crypto market will continue its wild swings, but with a solid DCA strategy and ongoing education, you’ll be positioned to build wealth regardless of short-term chaos.

Ready to implement DCA with confidence and connect with investors who’ve mastered crypto strategies? Discover what successful crypto investors know in Trade Hero →

The post How to Buy Crypto Like Smart Money: The Dollar-Cost Averaging Strategy Explained first appeared on BlockNews.

How to Buy Crypto Like Smart Money: The Dollar-Cost Averaging Strategy Explained

- DCA reduces timing risk by spreading crypto buys over fixed intervals.

- Works best with Bitcoin, Ethereum, and select altcoins for stability and growth.

- Consistency is key—don’t stop DCA during bear markets.

Trying to time the crypto market perfectly is like trying to catch a falling knife while riding a rollercoaster—exciting, but you’ll probably get hurt. While amateur investors stress about finding the “perfect entry point,” experienced crypto investors have been quietly using a strategy that eliminates timing anxiety and builds wealth systematically: Dollar-Cost Averaging (DCA).

DCA isn’t just another investment buzzword. It’s the strategy that helped countless investors navigate crypto’s wild volatility while building substantial positions in Bitcoin, Ethereum, and other major cryptocurrencies. Instead of gambling on market timing, DCA turns market volatility into your advantage.

This is exactly the type of proven strategy we teach in our Crypto 101 course—moving beyond gambling and speculation to systematic wealth building. Learn the complete framework HERE

What is Dollar-Cost Averaging (DCA)?

Dollar-Cost Averaging is an investment strategy where you invest a fixed dollar amount into a particular asset at regular intervals, regardless of the asset’s price. Instead of investing $1,200 all at once, you might invest $100 every month for 12 months.

Why DCA Works So Well in Crypto

When you DCA into a volatile asset, you automatically buy more units when prices are low and fewer units when prices are high. This mathematical advantage compounds over time.

Example: DCA vs. Lump Sum Bitcoin Purchase

Let’s say you wanted to invest $1,200 in Bitcoin over 6 months, ending today:

Lump Sum: Buy $1,200 worth at $95,000 (March) = 0.0126 BTC

DCA: Buy $200 monthly:

- March: $200 at $95,000 = 0.0021 BTC

- April: $200 at $88,000 = 0.0023 BTC

- May: $200 at $92,000 = 0.0022 BTC

- June: $200 at $85,000 = 0.0024 BTC

- July: $200 at $98,000 = 0.0020 BTC

- August: $200 at $102,000 = 0.0020 BTC

- Total: 0.0130 BTC at an average cost of $92,308

With Bitcoin now trading above $110,000, the DCA approach resulted in more Bitcoin at a lower average cost than the lump sum purchase.

Psychological Benefits

DCA eliminates the most dangerous emotions in crypto investing:

- FOMO: No need to rush into positions during rallies

- Analysis Paralysis: No perfect timing required

- Regret: Can’t regret “buying at the top” when you buy at all levels

- Panic Selling: Regular purchases create conviction

Photo credit: Zoomex

Setting Up Your DCA Strategy

Choose Your Assets Wisely

Best for DCA:

- Bitcoin (BTC) – Digital store of value with longest track record

- Ethereum (ETH) – Leading smart contract platform

- Major altcoins (Solana, etc.) for higher risk/reward

Avoid for DCA: Meme coins, new projects without track records

Determine Your Schedule and Amount

Frequency: Weekly (better averaging) or monthly (simpler) Amount: 5-10% of investable income you won’t need for 2+ years

Choose Your Platform

Look for exchanges with:

- Automatic recurring purchase options

- Low fees for small, frequent buys

- Strong security track record

- Your chosen cryptocurrencies available

Popular options: Coinbase, Kraken, Gemini, Cash App (Bitcoin only)

Advanced DCA Techniques

The 80/20 Split

- 80% into Bitcoin and Ethereum (stability)

- 20% into higher-risk altcoins

DCA + Lump Sum Hybrid

Combine regular DCA with opportunistic purchases during major crashes (20%-50%+ drops)

Common DCA Mistakes to Avoid

- Stopping during bear markets – This is when DCA provides the most value

- Trying to “optimize” constantly – Consistency is key

- Spreading across too many assets – Focus on 2-4 high-conviction picks

- Neglecting security – Set up proper storage as holdings grow

- Ignoring taxes – Keep detailed records of each purchase

When DCA Underperforms

- Strong bull markets (lump sum at start wins)

- Consistent downtrends (still loses money)

- High-fee environments (costs erode small purchases)

How to Make Your Own DCA Action Plan

- Calculate your DCA budget

- Choose 1-2 assets (Bitcoin/Ethereum for beginners)

- Select exchange and set up security

- Make your first manual purchase

- Once you are comfortable, set up automatic recurring purchases

- Create tracking system

- Plan long-term storage solution

- Stick to schedule regardless of market conditions

- Review quarterly, not daily

- Continue learning about crypto fundamentals

Building a successful DCA strategy is just the beginning. The crypto space moves fast, and staying ahead requires continuous education about market cycles, emerging opportunities, and advanced strategies. Master everything you need in Crypto 101 →

Building Your Complete Crypto Knowledge

DCA is powerful, but it’s most effective as part of a comprehensive crypto investment strategy. Understanding how DCA fits with security practices, research methods, and market analysis is crucial for long-term success.

Ready to master not just DCA, but all aspects of crypto investing? Our comprehensive Crypto 101 course covers everything from blockchain fundamentals to advanced investment strategies and research methods. Master crypto fundamentals HERE

Want to connect with experienced investors who’ve successfully implemented DCA strategies? Join the Trade Hero community where members share real-world results, discuss optimal allocation strategies, and help each other navigate market volatility with discipline. Join Trade Hero community →

The Bottom Line

The best DCA strategy is the one you’ll actually follow consistently. Start simple with Bitcoin and Ethereum, automate your purchases, and let time and volatility work in your favor. The crypto market will continue its wild swings, but with a solid DCA strategy and ongoing education, you’ll be positioned to build wealth regardless of short-term chaos.

Ready to implement DCA with confidence and connect with investors who’ve mastered crypto strategies? Discover what successful crypto investors know in Trade Hero →

The post How to Buy Crypto Like Smart Money: The Dollar-Cost Averaging Strategy Explained first appeared on BlockNews.