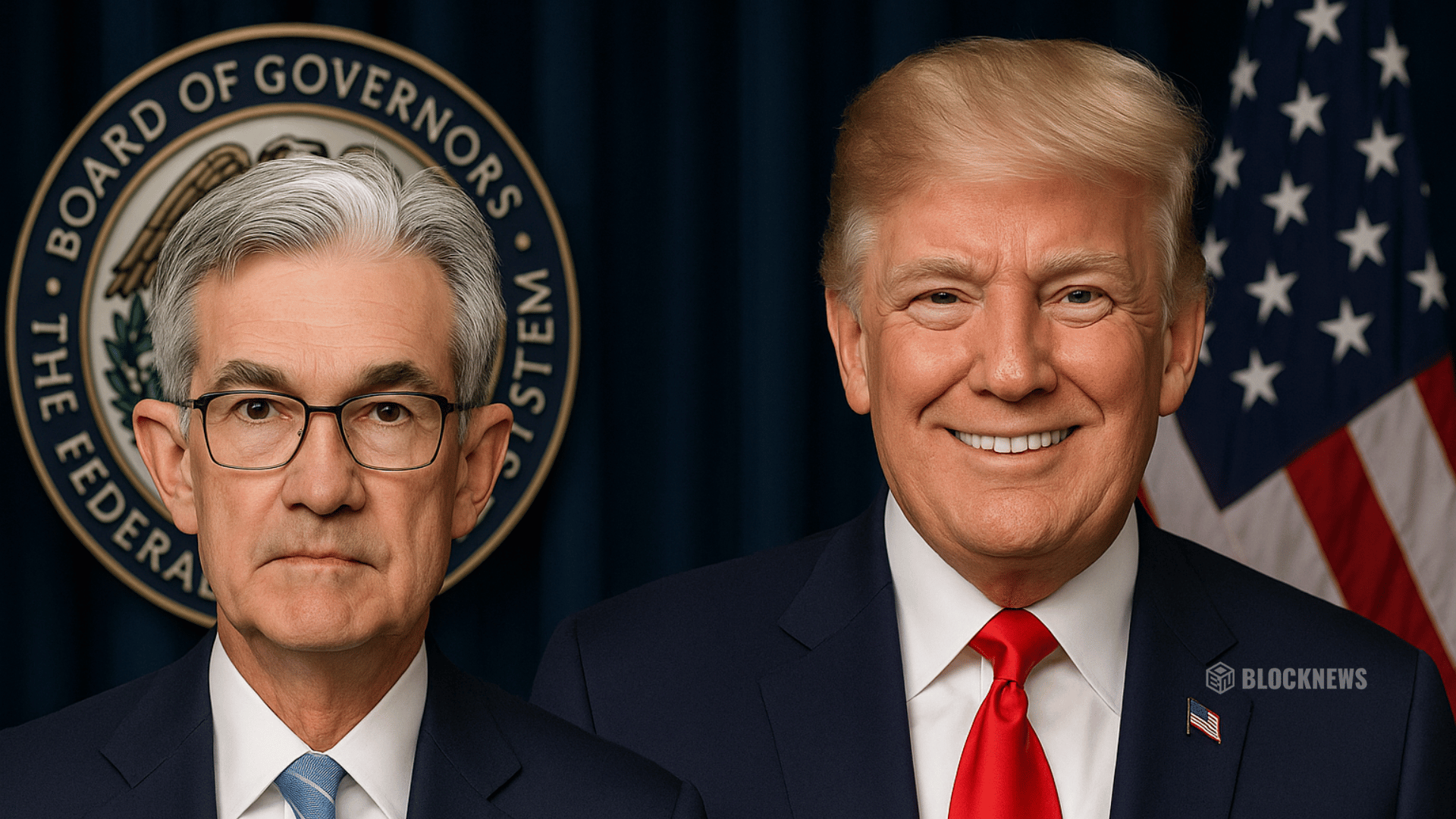

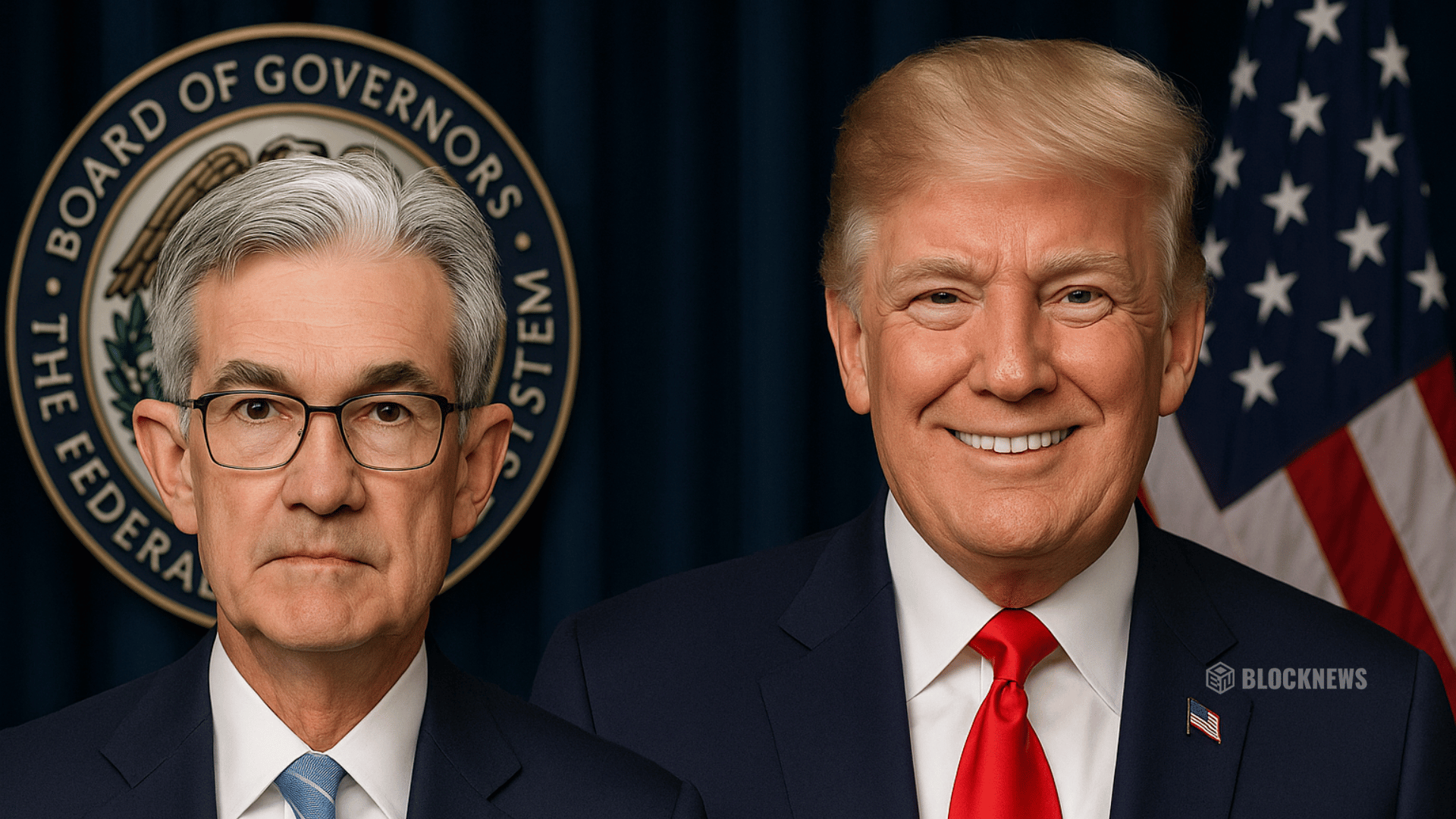

Fed Jerome Powell Cuts Interest Rates by 25 BPS: How Did Bitcoin and Crypto React?

- The Fed cut rates by 0.25% for the first time since December, citing weak job data.

- Bitcoin stayed flat near $116K, suggesting the move was already priced in.

- Traders await Powell’s comments for signals on future cuts and easing cycles.

The U.S. Federal Reserve has lowered interest rates for the first time since December, cutting the federal funds rate by 0.25% to a range of 4%–4.25%. The move followed a downward revision showing 911,000 fewer jobs created in the past year than initially reported, signaling economic weakness. Inflation, at 2.9%, remains above the Fed’s 2% target, but policymakers chose to prioritize growth. The cut also came after mounting pressure from President Donald Trump, who has repeatedly criticized the Fed for being too slow to ease.

Bitcoin’s Reaction: Flat Despite Expectations

Bitcoin (BTC) traded largely unchanged after the announcement, holding just above $116,000 and up 0.2% in the past 24 hours, according to CoinGecko. Analysts say the flat reaction shows the rate cut was already priced in, with BTC rallying earlier in anticipation. Ethereum also traded steady at $4,501. Traders are now looking to Fed Chair Jerome Powell’s comments for direction — whether he signals the start of a full easing cycle or takes a more cautious “wait for more data” stance.

Market Sentiment and Macro Ripples

The CME’s FedWatch tool showed a 96% probability of a rate cut ahead of the decision, meaning few were surprised. Gold, meanwhile, surged to a record above $3,730, up 10% in a month as investors leaned on safe havens. Broader uncertainty stems from Trump’s feud with the Fed and his ongoing trade war, which continue to weigh on investor confidence. Prediction markets like Myriad still see strong support for Bitcoin, with nearly 90% of users expecting BTC to stay above $105,000 throughout September.

What Traders Are Watching Next

The real focus now is Powell’s press conference and any hints at future cuts. Analysts say even silence could send signals: either that the Fed is cautiously beginning an easing cycle or that it needs more data before acting again. For crypto investors, continued liquidity injections could provide long-term bullish fuel, but in the short term, Bitcoin may remain steady until clarity emerges from Powell’s tone and future economic data.

The post Fed Jerome Powell Cuts Interest Rates by 25 BPS: How Did Bitcoin and Crypto React? first appeared on BlockNews.

Fed Jerome Powell Cuts Interest Rates by 25 BPS: How Did Bitcoin and Crypto React?

- The Fed cut rates by 0.25% for the first time since December, citing weak job data.

- Bitcoin stayed flat near $116K, suggesting the move was already priced in.

- Traders await Powell’s comments for signals on future cuts and easing cycles.

The U.S. Federal Reserve has lowered interest rates for the first time since December, cutting the federal funds rate by 0.25% to a range of 4%–4.25%. The move followed a downward revision showing 911,000 fewer jobs created in the past year than initially reported, signaling economic weakness. Inflation, at 2.9%, remains above the Fed’s 2% target, but policymakers chose to prioritize growth. The cut also came after mounting pressure from President Donald Trump, who has repeatedly criticized the Fed for being too slow to ease.

Bitcoin’s Reaction: Flat Despite Expectations

Bitcoin (BTC) traded largely unchanged after the announcement, holding just above $116,000 and up 0.2% in the past 24 hours, according to CoinGecko. Analysts say the flat reaction shows the rate cut was already priced in, with BTC rallying earlier in anticipation. Ethereum also traded steady at $4,501. Traders are now looking to Fed Chair Jerome Powell’s comments for direction — whether he signals the start of a full easing cycle or takes a more cautious “wait for more data” stance.

Market Sentiment and Macro Ripples

The CME’s FedWatch tool showed a 96% probability of a rate cut ahead of the decision, meaning few were surprised. Gold, meanwhile, surged to a record above $3,730, up 10% in a month as investors leaned on safe havens. Broader uncertainty stems from Trump’s feud with the Fed and his ongoing trade war, which continue to weigh on investor confidence. Prediction markets like Myriad still see strong support for Bitcoin, with nearly 90% of users expecting BTC to stay above $105,000 throughout September.

What Traders Are Watching Next

The real focus now is Powell’s press conference and any hints at future cuts. Analysts say even silence could send signals: either that the Fed is cautiously beginning an easing cycle or that it needs more data before acting again. For crypto investors, continued liquidity injections could provide long-term bullish fuel, but in the short term, Bitcoin may remain steady until clarity emerges from Powell’s tone and future economic data.

The post Fed Jerome Powell Cuts Interest Rates by 25 BPS: How Did Bitcoin and Crypto React? first appeared on BlockNews.

BREAKING: FED POWELL CUTS INTEREST RATES BY 25 BPS

BREAKING: FED POWELL CUTS INTEREST RATES BY 25 BPS  BREAKING: FED CHAIR JEROME POWELL CUTS INTEREST RATES BY 25 BPS

BREAKING: FED CHAIR JEROME POWELL CUTS INTEREST RATES BY 25 BPS