ATOM Trades in Tight Range as Institutional Flows Dominate, But Consolidation Signals Are Clear

- ATOM stayed trapped in a $0.18 range, with $4.60 capping gains and $4.47–$4.48 holding as key support.

- Institutional buying spiked Aug. 12, but a final-hour selloff wiped most of the day’s upside.

- Technicals point to accumulation within the range, with a possible 2025 target of $5.48 if adoption trends hold.

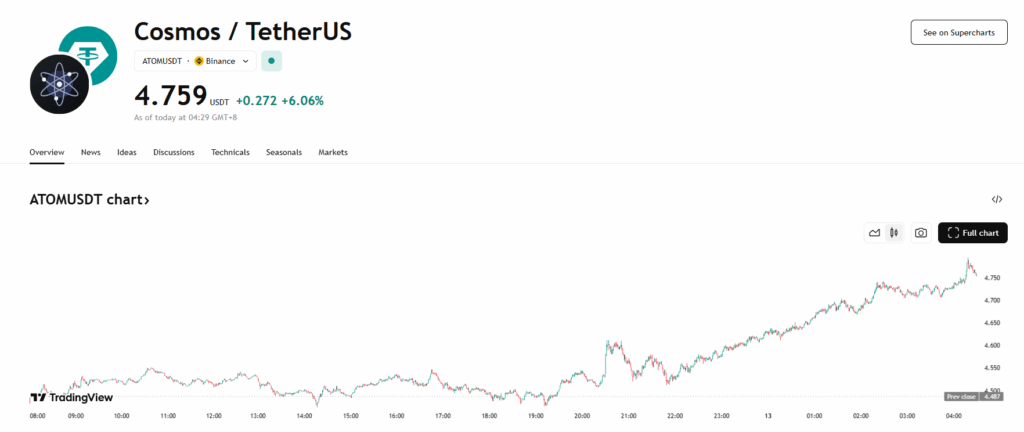

ATOM spent the past 24 hours moving within an unusually narrow band — just $0.18 wide — with $4.60 acting as a stubborn institutional ceiling and $4.47–$4.48 holding strong as a buyer’s floor. The real action started Aug. 12 when heavy institutional buying lit up the tape, sending volumes to nearly 1.93 million tokens during a brisk recovery push.

But that enthusiasm didn’t last to the closing bell. In the final hour, a wave of sell orders cracked through multiple supports, pulling ATOM down from $4.57 to $4.51 — about a 1% slide — in under 25 minutes. The selloff erased much of the morning’s grind higher, leaving traders debating whether this is pure consolidation… or a warning.

Range-Bound but Building Pressure

Price action between Aug. 11 and Aug. 12 told a story of two camps — determined sellers dumping from $4.65 down to $4.45 late on the 11th, and opportunistic buyers who stepped in hard the next morning. The $4.60 mark has now emerged as a clear profit-taking zone, while every dip toward $4.47–$4.48 has been aggressively defended. Analysts point to this behavior as textbook accumulation, hinting at a potential breakout toward $5.48 sometime in 2025, especially if institutional adoption keeps growing.

Adding fuel to the ecosystem’s sentiment, Coinbase’s listing of dYdX (COSMOSDYDX) sparked a quick move from $0.59 to $0.63, suggesting renewed interest in Cosmos-linked assets. That’s keeping ATOM traders cautiously optimistic, even as short-term charts show a market still wrestling for direction.

Technical Picture Still Mixed

The latest technical readout shows a defined $0.18 institutional range, heavy profit-taking right at $4.60, and repeated accumulation at the $4.47–$4.48 level. The spike in volume during the Aug. 12 recovery phase was notable — 1,927,633 tokens in just one hour — but the late-session reversal erased much of that momentum.

Sellers proved relentless at $4.57, using the final hour to push through supports at $4.55 and $4.53 before a modest recovery attempt steadied price in the $4.52–$4.53 zone. This leaves ATOM in a clear holding pattern, with neither side willing to make the big move… yet.

The post ATOM Trades in Tight Range as Institutional Flows Dominate, But Consolidation Signals Are Clear first appeared on BlockNews.

ATOM Trades in Tight Range as Institutional Flows Dominate, But Consolidation Signals Are Clear

- ATOM stayed trapped in a $0.18 range, with $4.60 capping gains and $4.47–$4.48 holding as key support.

- Institutional buying spiked Aug. 12, but a final-hour selloff wiped most of the day’s upside.

- Technicals point to accumulation within the range, with a possible 2025 target of $5.48 if adoption trends hold.

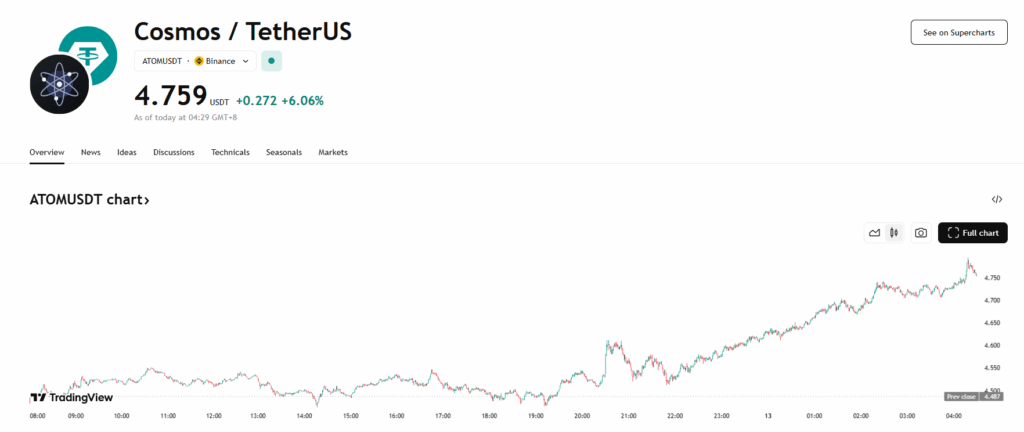

ATOM spent the past 24 hours moving within an unusually narrow band — just $0.18 wide — with $4.60 acting as a stubborn institutional ceiling and $4.47–$4.48 holding strong as a buyer’s floor. The real action started Aug. 12 when heavy institutional buying lit up the tape, sending volumes to nearly 1.93 million tokens during a brisk recovery push.

But that enthusiasm didn’t last to the closing bell. In the final hour, a wave of sell orders cracked through multiple supports, pulling ATOM down from $4.57 to $4.51 — about a 1% slide — in under 25 minutes. The selloff erased much of the morning’s grind higher, leaving traders debating whether this is pure consolidation… or a warning.

Range-Bound but Building Pressure

Price action between Aug. 11 and Aug. 12 told a story of two camps — determined sellers dumping from $4.65 down to $4.45 late on the 11th, and opportunistic buyers who stepped in hard the next morning. The $4.60 mark has now emerged as a clear profit-taking zone, while every dip toward $4.47–$4.48 has been aggressively defended. Analysts point to this behavior as textbook accumulation, hinting at a potential breakout toward $5.48 sometime in 2025, especially if institutional adoption keeps growing.

Adding fuel to the ecosystem’s sentiment, Coinbase’s listing of dYdX (COSMOSDYDX) sparked a quick move from $0.59 to $0.63, suggesting renewed interest in Cosmos-linked assets. That’s keeping ATOM traders cautiously optimistic, even as short-term charts show a market still wrestling for direction.

Technical Picture Still Mixed

The latest technical readout shows a defined $0.18 institutional range, heavy profit-taking right at $4.60, and repeated accumulation at the $4.47–$4.48 level. The spike in volume during the Aug. 12 recovery phase was notable — 1,927,633 tokens in just one hour — but the late-session reversal erased much of that momentum.

Sellers proved relentless at $4.57, using the final hour to push through supports at $4.55 and $4.53 before a modest recovery attempt steadied price in the $4.52–$4.53 zone. This leaves ATOM in a clear holding pattern, with neither side willing to make the big move… yet.

The post ATOM Trades in Tight Range as Institutional Flows Dominate, But Consolidation Signals Are Clear first appeared on BlockNews.