Peter Brandt Says XRP On His List of Short Candidates

Veteran trader Peter Brandt says he is keeping tabs on XRP for a possible short but shares a condition that would confirm his bearish stance.

Brandt has highlighted a bearish XRP formation for the second time this week. This time, he noted that the altcoin is in his list of candidates for a possible short position.

Brandt Waits on Bearish Confirmation

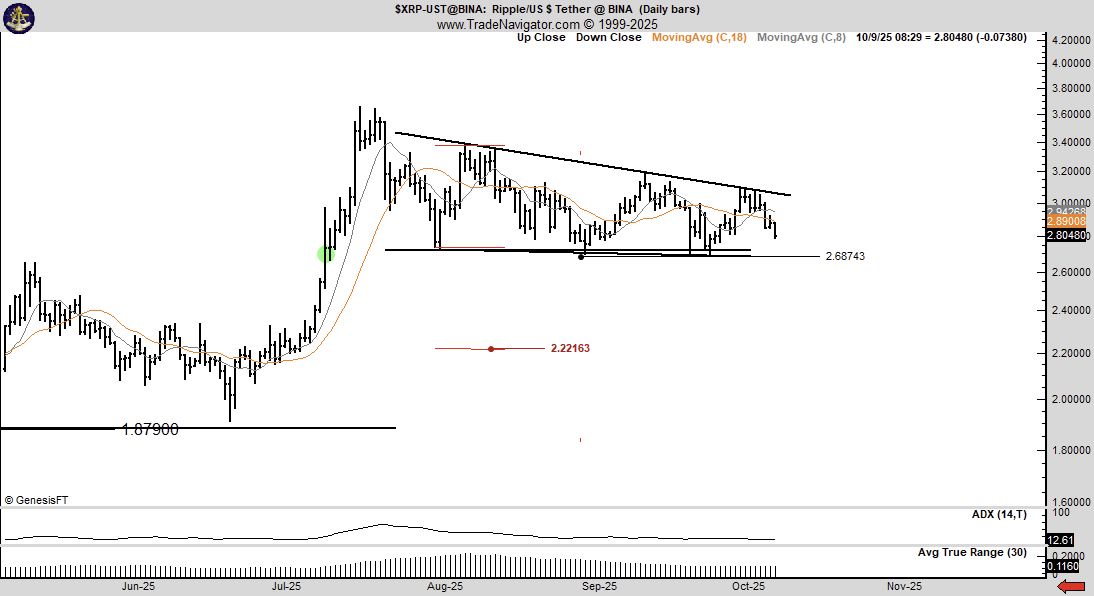

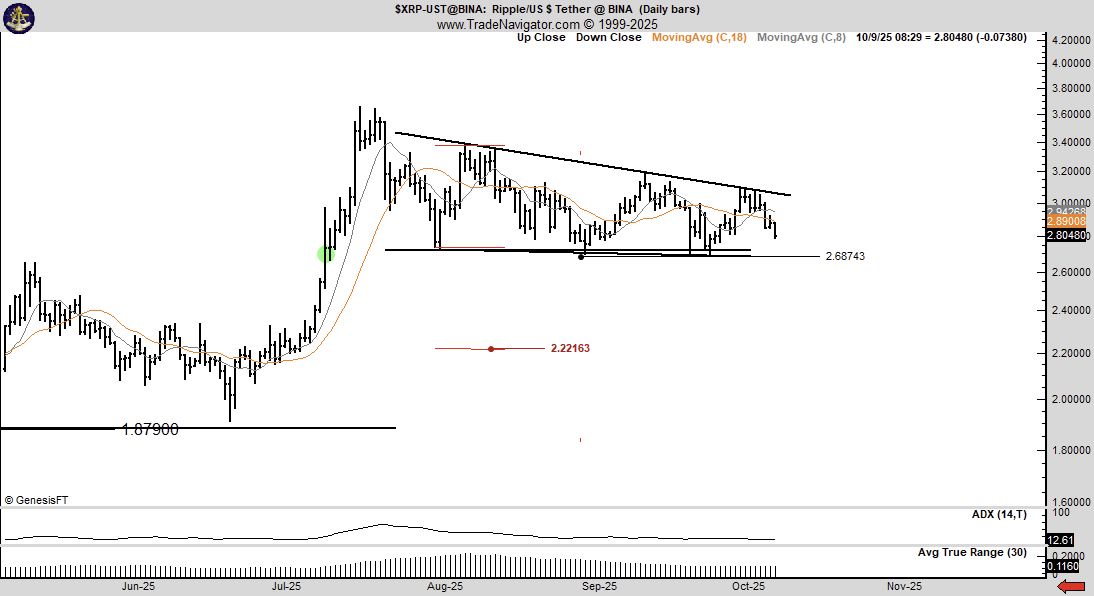

Notably, the market pundit confirmed that he would take the bearish stand upon the completion of a classic descending triangle formation on the daily chart.

The triangle has its roots in a rejection after the XRP swing high of $3.66 in July. Since then, prices have been losing momentum at the resistance neckline of the structure at every rally.

The experienced trader had earlier highlighted that a close below $2.66 would mark a breakdown for XRP, with lower prices following. His target for the breakdown is a retest of the July lows at $2.22, representing a 21% correction from the current market price of $2.82.

Market Technician Egrag Crypto Disagrees

Remarkably, Brandt’s bearish disposition did not bode well with some market participants. Specifically, market technician Egrag Crypto disagrees with the veteran trader, with an accompanying chart suggesting XRP may have bottomed.

For perspective, Egrag’s 1M chart shows that XRP trades close to the support of an inverted descending triangle, and prices could take a positive turn instead. The analyst further claimed that he remembers Brandt shorting XRP at $0.50, which ended up becoming XRP’s bottom price this cycle.

Meanwhile, another user pointed to a similar descending triangle formation, which Brandt highlighted was bullish after an upside breakout. The featured chart was an XRP monthly chart showing a breakout in July after years of price accumulation.

Nonetheless, Brandt explained that the chart in question was an explosive long-term XRP price prediction. Furthermore, while he intends to open a short on XRP if it breaks down, he also stated that he is willing to buy an upside breakout.

Analysts Insist XRP Is Bullish

Meanwhile, market analysts have continued to highlight the bullish possibilities in the XRP chart. Millionaire trader Gordon called it “beyond bullish,” challenging anyone to show him a chart with more juice than XRP.

Mr. Xoom also pinpointed that every structure remains intact for XRP, advising against FUD. According to him, he sees no reason for holders to be afraid. Zach Rector also shares this sentiment, noting that XRP is still leading the market in gains since November 2024.

The post Peter Brandt Says XRP On His List of Short Candidates first appeared on The Crypto Basic.

Читать больше

Expert Sees BNB at $2,000, Predicts XRP Price

Peter Brandt Says XRP On His List of Short Candidates

Veteran trader Peter Brandt says he is keeping tabs on XRP for a possible short but shares a condition that would confirm his bearish stance.

Brandt has highlighted a bearish XRP formation for the second time this week. This time, he noted that the altcoin is in his list of candidates for a possible short position.

Brandt Waits on Bearish Confirmation

Notably, the market pundit confirmed that he would take the bearish stand upon the completion of a classic descending triangle formation on the daily chart.

The triangle has its roots in a rejection after the XRP swing high of $3.66 in July. Since then, prices have been losing momentum at the resistance neckline of the structure at every rally.

The experienced trader had earlier highlighted that a close below $2.66 would mark a breakdown for XRP, with lower prices following. His target for the breakdown is a retest of the July lows at $2.22, representing a 21% correction from the current market price of $2.82.

Market Technician Egrag Crypto Disagrees

Remarkably, Brandt’s bearish disposition did not bode well with some market participants. Specifically, market technician Egrag Crypto disagrees with the veteran trader, with an accompanying chart suggesting XRP may have bottomed.

For perspective, Egrag’s 1M chart shows that XRP trades close to the support of an inverted descending triangle, and prices could take a positive turn instead. The analyst further claimed that he remembers Brandt shorting XRP at $0.50, which ended up becoming XRP’s bottom price this cycle.

Meanwhile, another user pointed to a similar descending triangle formation, which Brandt highlighted was bullish after an upside breakout. The featured chart was an XRP monthly chart showing a breakout in July after years of price accumulation.

Nonetheless, Brandt explained that the chart in question was an explosive long-term XRP price prediction. Furthermore, while he intends to open a short on XRP if it breaks down, he also stated that he is willing to buy an upside breakout.

Analysts Insist XRP Is Bullish

Meanwhile, market analysts have continued to highlight the bullish possibilities in the XRP chart. Millionaire trader Gordon called it “beyond bullish,” challenging anyone to show him a chart with more juice than XRP.

Mr. Xoom also pinpointed that every structure remains intact for XRP, advising against FUD. According to him, he sees no reason for holders to be afraid. Zach Rector also shares this sentiment, noting that XRP is still leading the market in gains since November 2024.

The post Peter Brandt Says XRP On His List of Short Candidates first appeared on The Crypto Basic.

Читать больше