Bitcoin Whales Flash Top Signal, BTC Price Needs to Hold This Support

Bitcoin BTC $96 611 24h volatility: 2.1% Market cap: $1.92 T Vol. 24h: $29.09 B price has been struggling to break past $110K and clock new all-time highs amid the absence of a fresh catalyst. As a result, the BTC whale entities have resolved to distribution instead of accumulation, highlighting a shift in the sentiment.

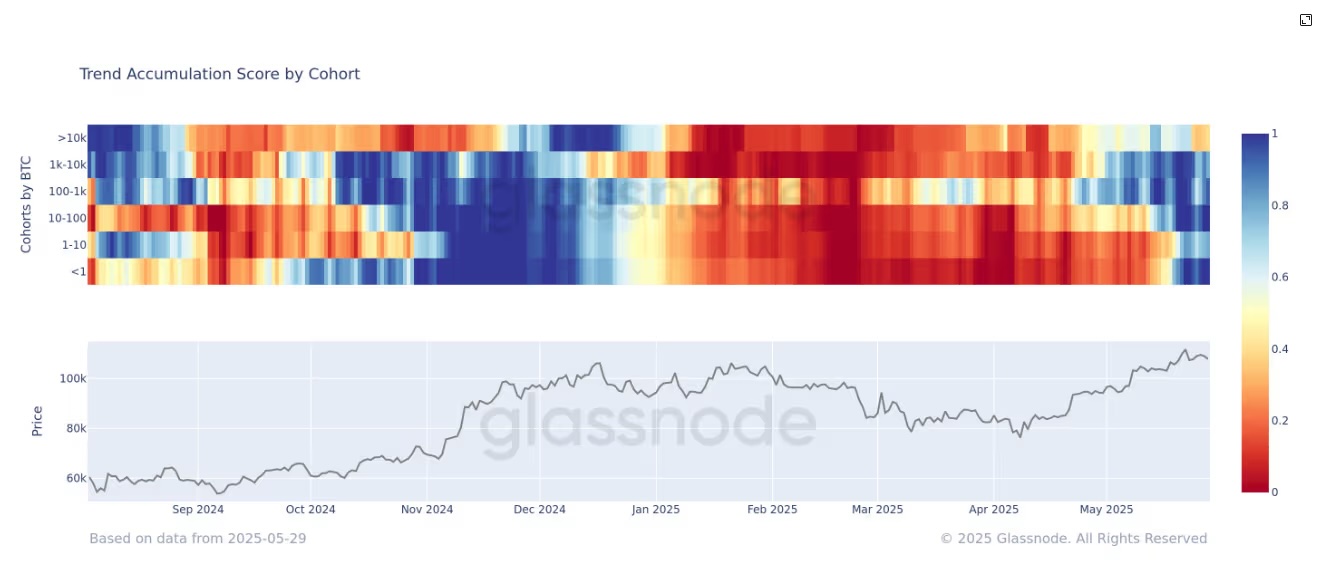

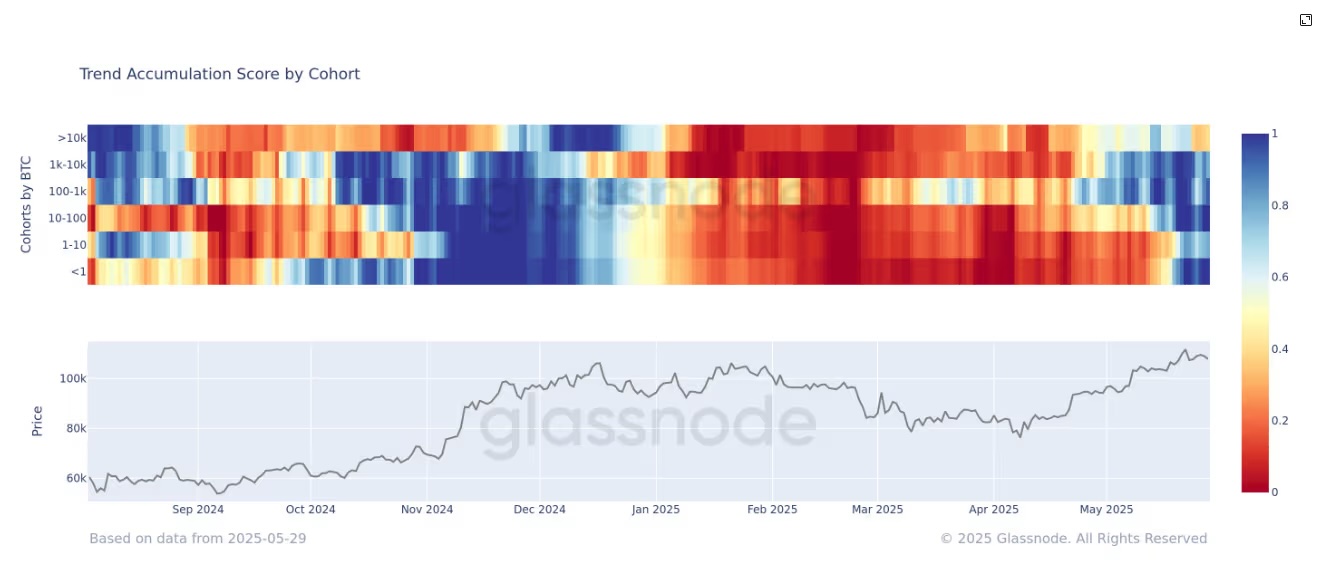

Glassnode’s Accumulation Trend Score shows that Bitcoin whales aren’t quite confident of making fresh purchases at this point, looking at the volume of BTC purchased in the last 15 days.

For Bitcoin whales, this Accumulation Trend Score dropped to 0.4, which shows that the selling by large whale entities has increased. A reading closer to 1 signals strong buying activity, while a level near 0 indicates selling pressure.

Keep in mind that wallets linked to exchanges and miners are excluded from this analysis to present a more accurate view of investor behavior. However, this on-chain metric considers entities holding over 10,000 Bitcoin, often classified as whales.

This Bitcoin whale cohort started accumulating during April when BTC was trading at $75,000. However, after staying in a month-long accumulation phase, the same cohort has started to offload its holdings now. This highlights profit booking by big players and a cautious short-term outlook at the current level.

Bitcoin whale distribution pattern – Source: Glassnode

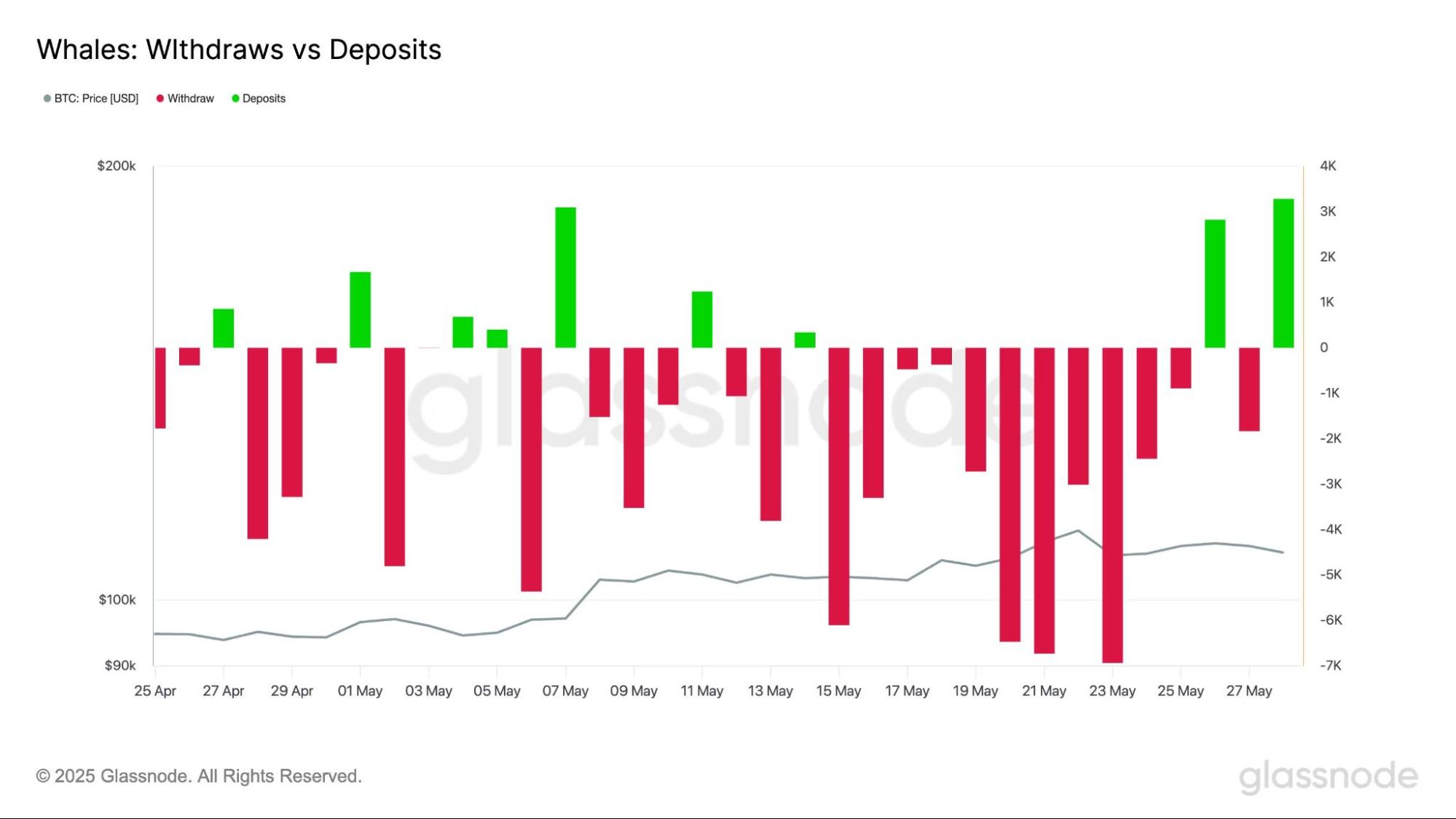

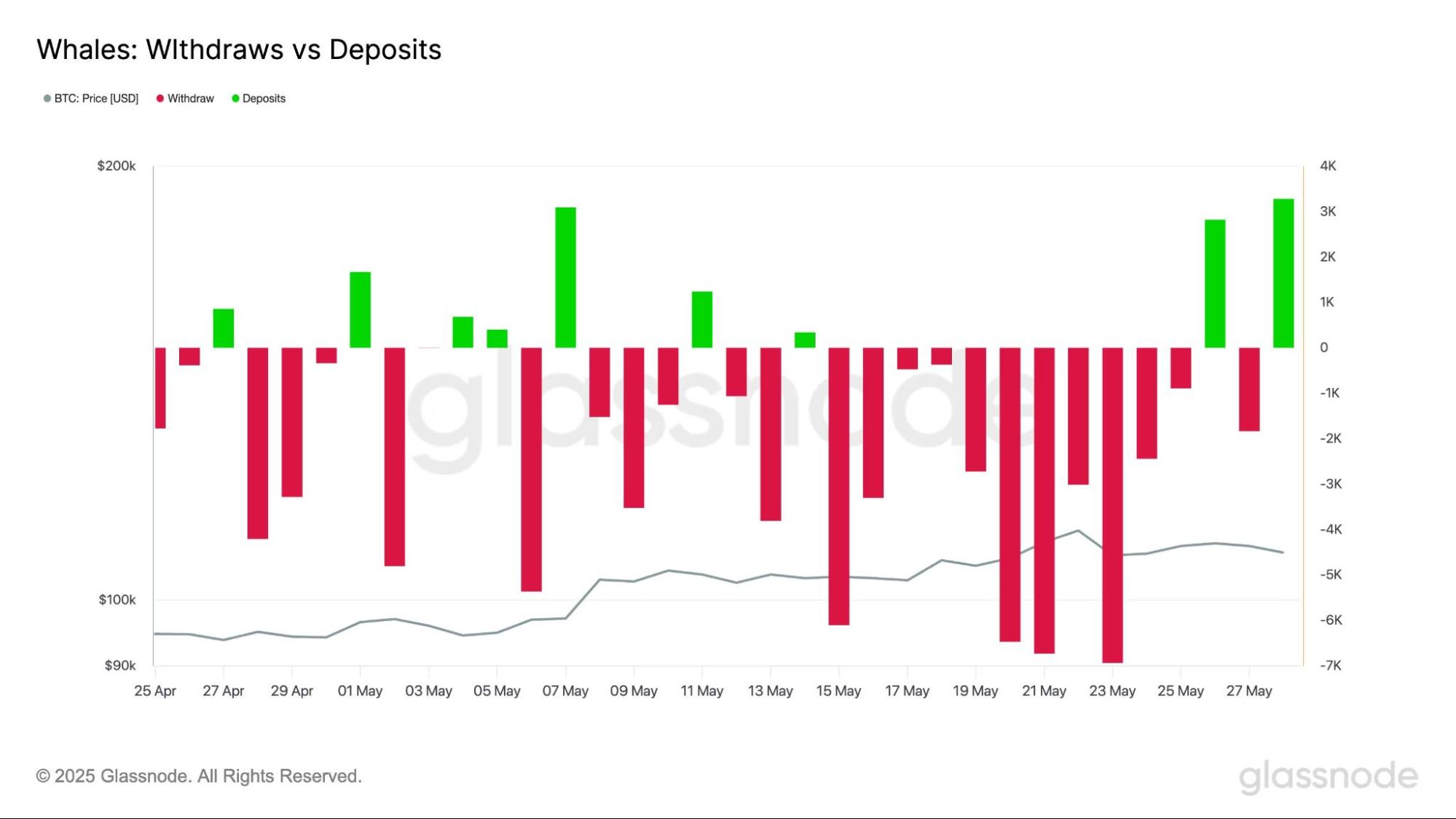

The exchange-flow data provides further evidence to this. Over the past month, whale wallets have consistently withdrawn Bitcoin from exchanges, a bullish sign that suggests no near-term plans to sell.

However, this trend appears to be reversing. In two of the past three days, whales have begun depositing BTC back onto exchanges, a move often associated with upcoming selling activity.

Bitcoin exchange deposits and withdrawals – Source: Glassnode

Where’s btc price heading next?

Following the rejection at $110K, BTC price seems to be heading south once again, and is currently trading at $108,433. By citing the same BTC Accumulation Trend Score, popular market analyst Kyledoops stated that Bitcoin tends to attract significant buying activity when it hits new all-time highs, a pattern observed this year at $70,000 and $107,000.

However, he pointed out a similar gain in buying enthusiasm at $69,000 in 2021, which preceded a sharp market downturn. “Strong buying isn’t always bullish,” Doops remarked.

When $BTC hits a new all-time high, people tend to pile in – happened at $70K and $107K this year.

But the same thing happened at $69K back in 2021… right before the market turned.

Strong buying isn’t always bullish. If everyone’s buying, it could be a warning sign. pic.twitter.com/mejVOftPdz

— Kyledoops (@kyledoops) May 29, 2025

Market strategist Justin Bennett reiterated his bearish outlook on Bitcoin, emphasizing a potential downside scenario. Bennett revealed he remains short on Bitcoin from just above the $111,000 mark, maintaining his cautious stance despite recent market movements.

“$106,000 holds the key to the $96,000–$97,000 imbalance,” Bennett stated, identifying the level as critical support for now.

I still think this is the most likely scenario for $BTC. I'm also still short from just above $111k. #Bitcoin

$106k holds the key to the $96/97k imbalance—support for now.

Trade with me on BloFin (no KYC)

▶️ https://t.co/TV0qdsNje8 (affiliate link) pic.twitter.com/zssB9xJyRa— Justin Bennett (@JustinBennettFX) May 28, 2025

The post Bitcoin Whales Flash Top Signal, BTC Price Needs to Hold This Support appeared first on Coinspeaker.

Читать больше

Bitcoin ETFs See $9 Billion Inflows Amid Escalating Shift Away From Gold

Bitcoin Whales Flash Top Signal, BTC Price Needs to Hold This Support

Bitcoin BTC $96 611 24h volatility: 2.1% Market cap: $1.92 T Vol. 24h: $29.09 B price has been struggling to break past $110K and clock new all-time highs amid the absence of a fresh catalyst. As a result, the BTC whale entities have resolved to distribution instead of accumulation, highlighting a shift in the sentiment.

Glassnode’s Accumulation Trend Score shows that Bitcoin whales aren’t quite confident of making fresh purchases at this point, looking at the volume of BTC purchased in the last 15 days.

For Bitcoin whales, this Accumulation Trend Score dropped to 0.4, which shows that the selling by large whale entities has increased. A reading closer to 1 signals strong buying activity, while a level near 0 indicates selling pressure.

Keep in mind that wallets linked to exchanges and miners are excluded from this analysis to present a more accurate view of investor behavior. However, this on-chain metric considers entities holding over 10,000 Bitcoin, often classified as whales.

This Bitcoin whale cohort started accumulating during April when BTC was trading at $75,000. However, after staying in a month-long accumulation phase, the same cohort has started to offload its holdings now. This highlights profit booking by big players and a cautious short-term outlook at the current level.

Bitcoin whale distribution pattern – Source: Glassnode

The exchange-flow data provides further evidence to this. Over the past month, whale wallets have consistently withdrawn Bitcoin from exchanges, a bullish sign that suggests no near-term plans to sell.

However, this trend appears to be reversing. In two of the past three days, whales have begun depositing BTC back onto exchanges, a move often associated with upcoming selling activity.

Bitcoin exchange deposits and withdrawals – Source: Glassnode

Where’s btc price heading next?

Following the rejection at $110K, BTC price seems to be heading south once again, and is currently trading at $108,433. By citing the same BTC Accumulation Trend Score, popular market analyst Kyledoops stated that Bitcoin tends to attract significant buying activity when it hits new all-time highs, a pattern observed this year at $70,000 and $107,000.

However, he pointed out a similar gain in buying enthusiasm at $69,000 in 2021, which preceded a sharp market downturn. “Strong buying isn’t always bullish,” Doops remarked.

When $BTC hits a new all-time high, people tend to pile in – happened at $70K and $107K this year.

But the same thing happened at $69K back in 2021… right before the market turned.

Strong buying isn’t always bullish. If everyone’s buying, it could be a warning sign. pic.twitter.com/mejVOftPdz

— Kyledoops (@kyledoops) May 29, 2025

Market strategist Justin Bennett reiterated his bearish outlook on Bitcoin, emphasizing a potential downside scenario. Bennett revealed he remains short on Bitcoin from just above the $111,000 mark, maintaining his cautious stance despite recent market movements.

“$106,000 holds the key to the $96,000–$97,000 imbalance,” Bennett stated, identifying the level as critical support for now.

I still think this is the most likely scenario for $BTC. I'm also still short from just above $111k. #Bitcoin

$106k holds the key to the $96/97k imbalance—support for now.

Trade with me on BloFin (no KYC)

▶️ https://t.co/TV0qdsNje8 (affiliate link) pic.twitter.com/zssB9xJyRa— Justin Bennett (@JustinBennettFX) May 28, 2025

The post Bitcoin Whales Flash Top Signal, BTC Price Needs to Hold This Support appeared first on Coinspeaker.

Читать больше