Avalanche (AVAX) Stages a Wild Rebound After Sharp Sell-Off

- AVAX plunged 70% before rebounding from its 2023 support zone.

- Buy orders dominate 60/40, signaling accumulation at $22.

- Reclaiming $25 could ignite a rally toward $30–$32 in the near term.

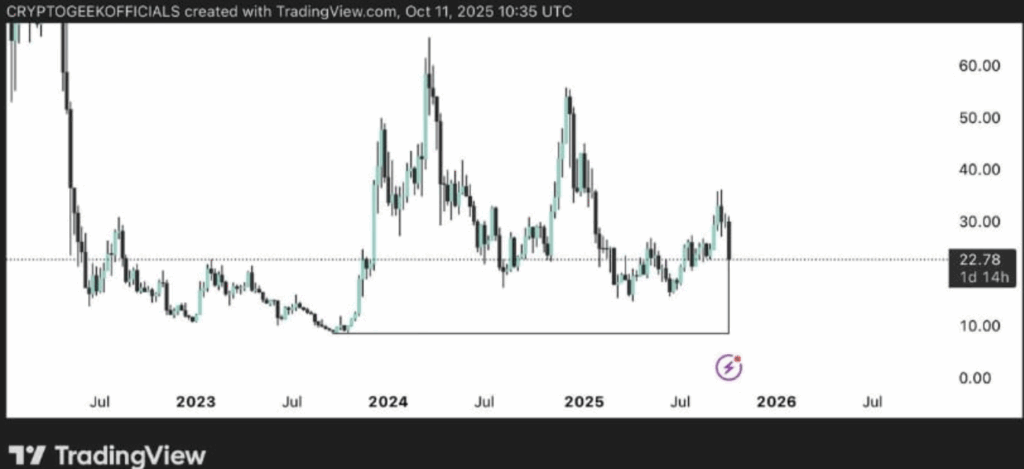

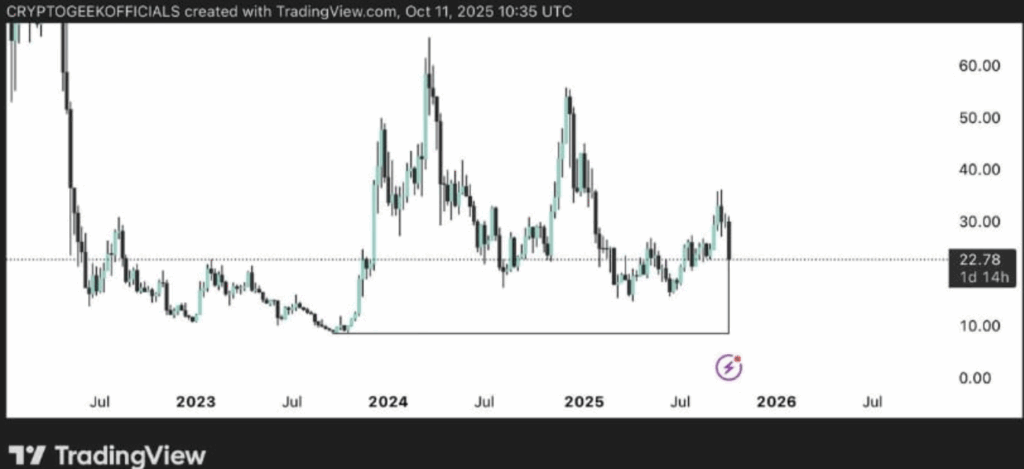

Avalanche had one of its wildest trading days in recent memory. The price of AVAX plunged nearly 70% in a single day before bouncing right back from its 2023 bear market lows — almost like it hit a springboard. The move was chaotic, but it also showed how quickly buyers stepped in once price tagged a critical support zone that’s held strong in past cycles.

At the time of writing, AVAX was hovering near $22.6, down about 19.8% on the day. But beneath all the noise, the setup looks a lot more interesting than it seems on the surface.

Revisiting 2023’s Support Zone

During the crash, Avalanche revisited the $12–$10 zone — the same demand area that marked the bottom of the last bear market. It’s a level that’s proven itself multiple times, and once price touched it again, the reaction was immediate. Buyers flooded in, driving AVAX back up with force.

Technically, this area is critical. It aligns with long-term horizontal support and sits right along the lower edge of the macro range. The bounce was sharp enough to shift short-term sentiment, but for bulls to truly gain traction, AVAX needs to build a higher low above $22 and keep that level intact.

Bulls Eyeing a Quick Recovery Toward $25

Despite the massive drop, traders don’t seem too shaken. Analyst Pound noted that Avalanche could bounce back toward $25 within 48 hours, pointing out that historically, AVAX tends to rebound fast once major liquidation zones are flushed out.

From a technical point of view, it’s not far-fetched. Early absorption signs are forming near the $22 region, and momentum oscillators show selling pressure is losing steam. If the price pushes above $23.80, it would confirm that a short-term bottom is already forming.

The next key resistances line up at $25.3, $27.5, and $30, which will likely act as checkpoints for the next leg up.

Buy Orders Tip the Scales Toward the Bulls

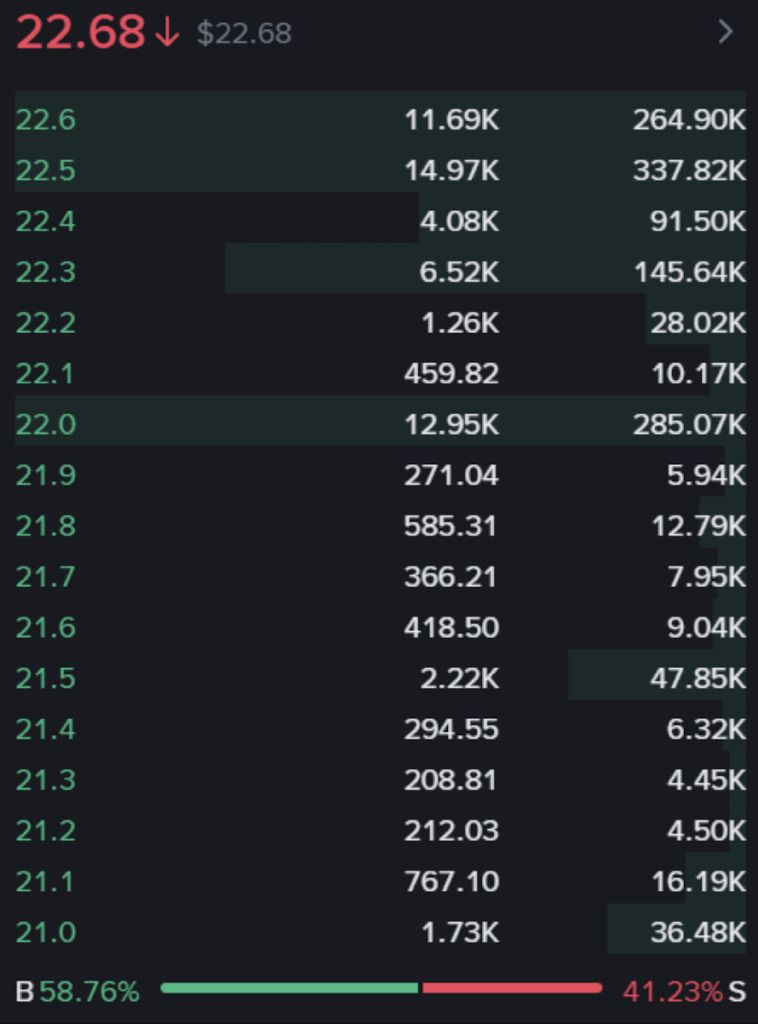

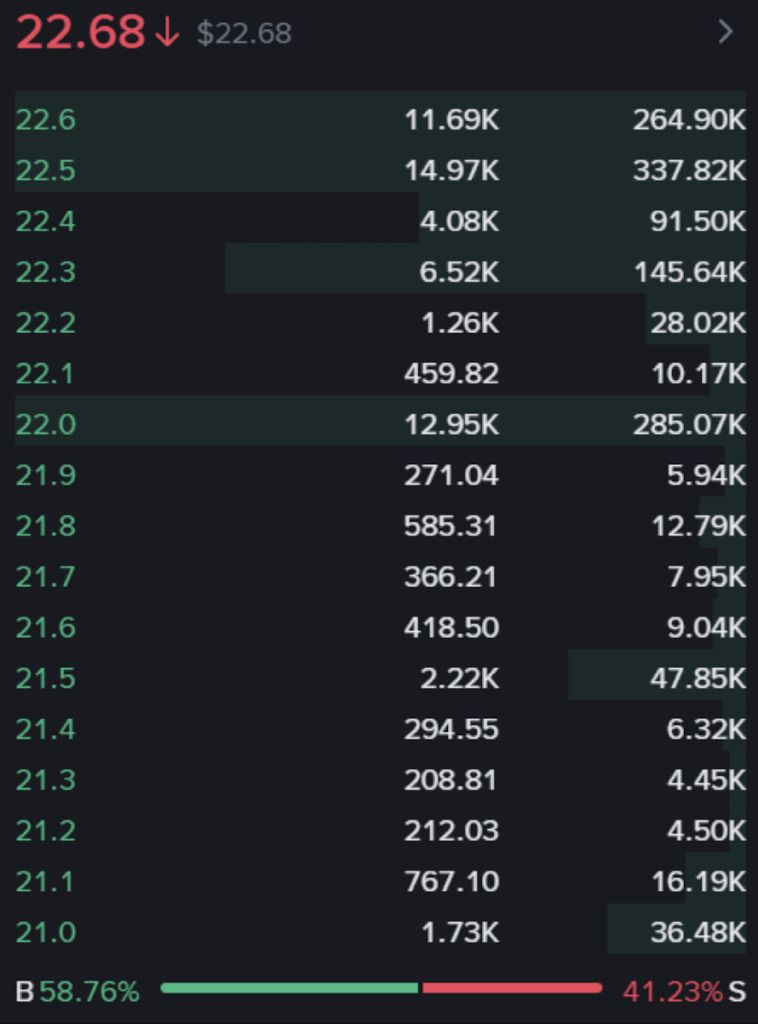

Fresh data from Jesse Peralta shows buy orders outweighing sell orders by about 60/40. That’s not just a blip — it’s a clear sign that smart money is treating this crash as a chance to load up, not exit.

Deep bid clusters have appeared around the $22 range, suggesting that traders view this zone as high-value territory. When the order book leans this heavily bullish, it often sets the foundation for explosive recoveries. Avalanche has a track record of sharp rebounds when buyers dominate order flow like this — and this might just be another one of those moments.

Outlook: The Defining Rebound Zone

Right now, Avalanche sits at a crossroads. The $22 zone is acting as a make-or-break demand region. Sentiment is slowly shifting from fear to quiet accumulation, and that’s often where the best rallies begin.

If AVAX can reclaim $25 and stay above it, momentum could snowball quickly, pushing toward $30–$32 in the coming days. Holding this structure would not only confirm strength but also signal that Avalanche might be gearing up for its next major uptrend as the market cycle resets.

For now, all eyes are on that $22–$25 pocket — it’s the zone where panic could turn into opportunity.

The post Avalanche (AVAX) Stages a Wild Rebound After Sharp Sell-Off first appeared on BlockNews.

Читать больше

Pudgy Penguins (PENGU) Faces Selling Pressure But Hints at Strength Beneath the Surface

Avalanche (AVAX) Stages a Wild Rebound After Sharp Sell-Off

- AVAX plunged 70% before rebounding from its 2023 support zone.

- Buy orders dominate 60/40, signaling accumulation at $22.

- Reclaiming $25 could ignite a rally toward $30–$32 in the near term.

Avalanche had one of its wildest trading days in recent memory. The price of AVAX plunged nearly 70% in a single day before bouncing right back from its 2023 bear market lows — almost like it hit a springboard. The move was chaotic, but it also showed how quickly buyers stepped in once price tagged a critical support zone that’s held strong in past cycles.

At the time of writing, AVAX was hovering near $22.6, down about 19.8% on the day. But beneath all the noise, the setup looks a lot more interesting than it seems on the surface.

Revisiting 2023’s Support Zone

During the crash, Avalanche revisited the $12–$10 zone — the same demand area that marked the bottom of the last bear market. It’s a level that’s proven itself multiple times, and once price touched it again, the reaction was immediate. Buyers flooded in, driving AVAX back up with force.

Technically, this area is critical. It aligns with long-term horizontal support and sits right along the lower edge of the macro range. The bounce was sharp enough to shift short-term sentiment, but for bulls to truly gain traction, AVAX needs to build a higher low above $22 and keep that level intact.

Bulls Eyeing a Quick Recovery Toward $25

Despite the massive drop, traders don’t seem too shaken. Analyst Pound noted that Avalanche could bounce back toward $25 within 48 hours, pointing out that historically, AVAX tends to rebound fast once major liquidation zones are flushed out.

From a technical point of view, it’s not far-fetched. Early absorption signs are forming near the $22 region, and momentum oscillators show selling pressure is losing steam. If the price pushes above $23.80, it would confirm that a short-term bottom is already forming.

The next key resistances line up at $25.3, $27.5, and $30, which will likely act as checkpoints for the next leg up.

Buy Orders Tip the Scales Toward the Bulls

Fresh data from Jesse Peralta shows buy orders outweighing sell orders by about 60/40. That’s not just a blip — it’s a clear sign that smart money is treating this crash as a chance to load up, not exit.

Deep bid clusters have appeared around the $22 range, suggesting that traders view this zone as high-value territory. When the order book leans this heavily bullish, it often sets the foundation for explosive recoveries. Avalanche has a track record of sharp rebounds when buyers dominate order flow like this — and this might just be another one of those moments.

Outlook: The Defining Rebound Zone

Right now, Avalanche sits at a crossroads. The $22 zone is acting as a make-or-break demand region. Sentiment is slowly shifting from fear to quiet accumulation, and that’s often where the best rallies begin.

If AVAX can reclaim $25 and stay above it, momentum could snowball quickly, pushing toward $30–$32 in the coming days. Holding this structure would not only confirm strength but also signal that Avalanche might be gearing up for its next major uptrend as the market cycle resets.

For now, all eyes are on that $22–$25 pocket — it’s the zone where panic could turn into opportunity.

The post Avalanche (AVAX) Stages a Wild Rebound After Sharp Sell-Off first appeared on BlockNews.

Читать больше