TRON Gains Momentum as TVL Hits $6.37B – Is a Breakout Coming?

- TRON’s TVL hit $6.37B and active addresses climbed past 18M, showing strong network growth.

- Spot Volume Bubble Map suggests smart money accumulation, a setup seen before big rallies.

- Breaking $0.35 resistance could push TRX toward $0.44, but failure risks a retest at $0.31.

TRON (TRX) has quietly held its place among the top 10 cryptocurrencies, boasting gains of more than 124% so far this year. Many holders already took profits during the market’s first-quarter swings, yet fresh on-chain data suggests the token might be gearing up for another acceleration phase. The timing, though, still feels uncertain — like the market’s holding its breath.

According to CoinMarketCap, TRX notched a modest +1.58% daily move while recently climbing as much as 28% over the past few weeks. That said, TRON remains one of the least-traded coins among its peers by daily volume, clocking in at about $840 million. For traders, that lower activity level sometimes sets the stage for sharp moves.

TRON’s TVL and Active Address Growth

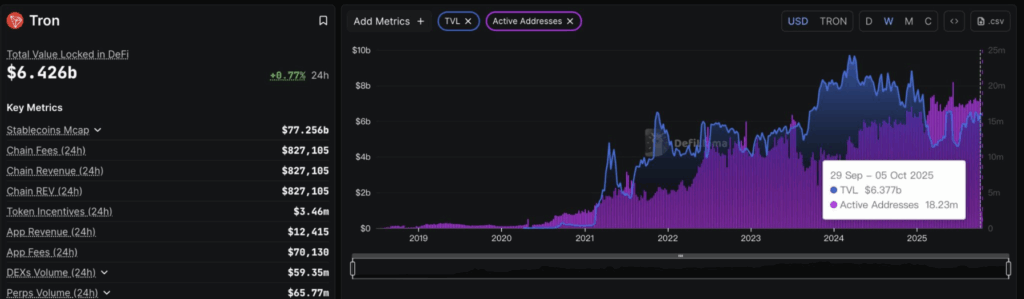

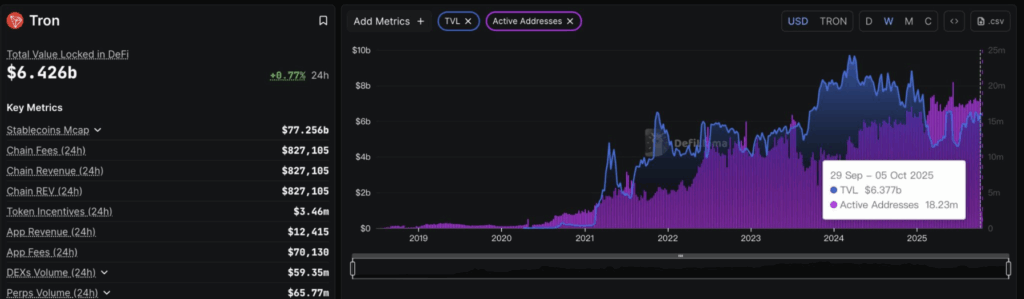

When it comes to spotting crypto rallies, on-chain metrics often whisper the story before the price chart shouts it. Lookonchain reported that TRON’s Total Value Locked (TVL) jumped to $6.37 billion last week, a 5.8% week-over-week gain.

Active addresses also inched higher to 18.23 million, up 2.24% in the same stretch. That uptick in activity supports the narrative of steady user growth rather than just speculative pumps.

And here’s the kicker: TRON recently overtook Ethereum in USDT issuance, with $77.26 billion worth of stablecoins now riding on its network. The reason’s simple — low fees and fast transaction speeds have made TRON the go-to stablecoin chain for many. Add consistent chain revenue and fees into the mix, and the ecosystem looks healthier than most expected.

Spot Volume Bubble Map Signals Accumulation

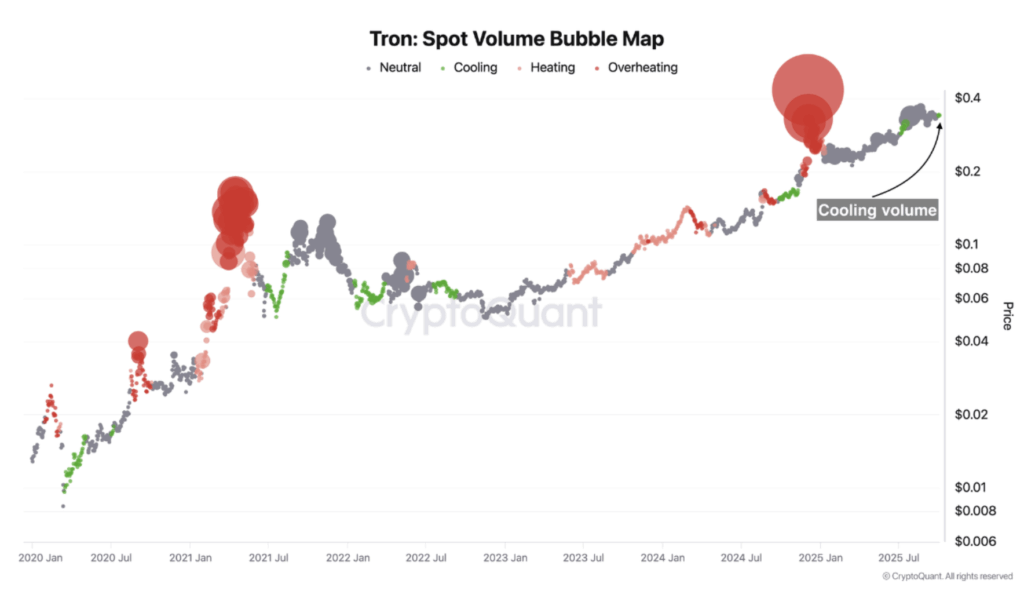

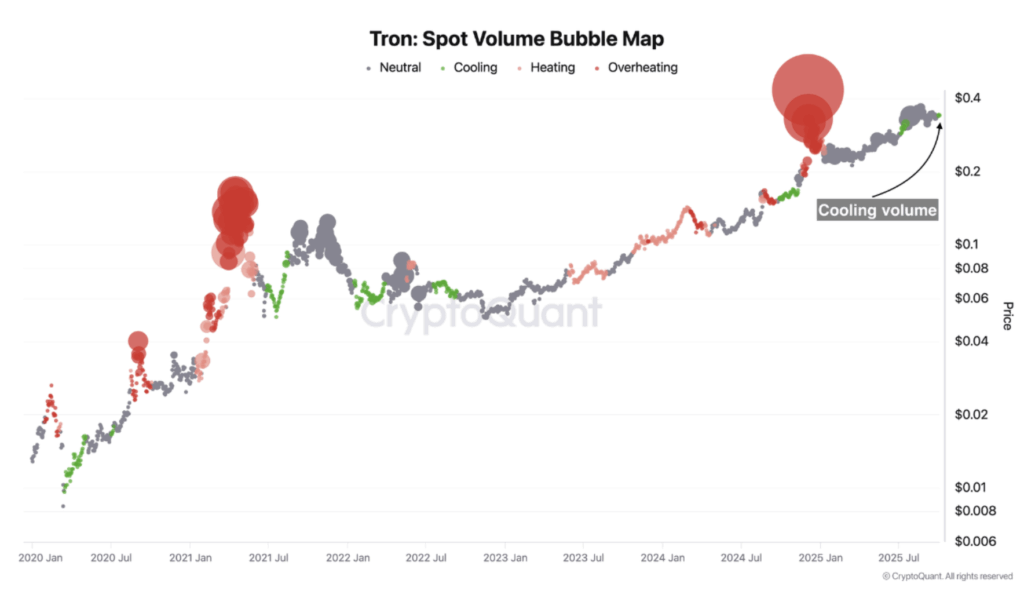

One curious sign has been the Spot Volume Bubble Map, which shows TRON’s trading volume cooling down. At first glance, that might seem bearish. But historically, such periods often come before rallies, as “smart money” quietly builds positions.

We’ve seen this movie before. In 2021, similar setups came right before TRON exploded from $0.05 to $0.12. Again in 2024, cooling volume marked the accumulation phase before TRX ripped from $0.15 to $0.43. If history even half-rhymes, we could be staring at the early stages of another rally.

TRX Price Outlook and Key Levels

The TRX chart lines up with that theory. Price action recently bounced off the 100 EMA, reinforcing a bullish structure, while an EMA cross on the daily chart flashed a reversal signal. Immediate resistance sits at $0.35 — a tough wall that bulls need to break.

If TRX clears that hurdle, the next target looms near $0.44, matching last year’s highs, with Q4 2025 shaping up as a possible window for that push. If not, consolidation between $0.31 and $0.35 could drag on, or worse, a breakdown might see the coin revisit deeper supports at $0.31 or below.

Final Thoughts

All in all, TRON looks like it’s coiling for a move. On-chain metrics show stronger participation, stablecoin dominance is leaning in its favor, and technical signals suggest a bullish setup. But, as always in crypto, the market wants confirmation. A breakout above $0.35 might unlock the next leg higher, while hesitation could keep TRX stuck in a range for now.

The post TRON Gains Momentum as TVL Hits $6.37B – Is a Breakout Coming? first appeared on BlockNews.

Читать больше

Sui Network Gains Momentum: Can SUI Break $5.30 Resistance on Path to $7?

TRON Gains Momentum as TVL Hits $6.37B – Is a Breakout Coming?

- TRON’s TVL hit $6.37B and active addresses climbed past 18M, showing strong network growth.

- Spot Volume Bubble Map suggests smart money accumulation, a setup seen before big rallies.

- Breaking $0.35 resistance could push TRX toward $0.44, but failure risks a retest at $0.31.

TRON (TRX) has quietly held its place among the top 10 cryptocurrencies, boasting gains of more than 124% so far this year. Many holders already took profits during the market’s first-quarter swings, yet fresh on-chain data suggests the token might be gearing up for another acceleration phase. The timing, though, still feels uncertain — like the market’s holding its breath.

According to CoinMarketCap, TRX notched a modest +1.58% daily move while recently climbing as much as 28% over the past few weeks. That said, TRON remains one of the least-traded coins among its peers by daily volume, clocking in at about $840 million. For traders, that lower activity level sometimes sets the stage for sharp moves.

TRON’s TVL and Active Address Growth

When it comes to spotting crypto rallies, on-chain metrics often whisper the story before the price chart shouts it. Lookonchain reported that TRON’s Total Value Locked (TVL) jumped to $6.37 billion last week, a 5.8% week-over-week gain.

Active addresses also inched higher to 18.23 million, up 2.24% in the same stretch. That uptick in activity supports the narrative of steady user growth rather than just speculative pumps.

And here’s the kicker: TRON recently overtook Ethereum in USDT issuance, with $77.26 billion worth of stablecoins now riding on its network. The reason’s simple — low fees and fast transaction speeds have made TRON the go-to stablecoin chain for many. Add consistent chain revenue and fees into the mix, and the ecosystem looks healthier than most expected.

Spot Volume Bubble Map Signals Accumulation

One curious sign has been the Spot Volume Bubble Map, which shows TRON’s trading volume cooling down. At first glance, that might seem bearish. But historically, such periods often come before rallies, as “smart money” quietly builds positions.

We’ve seen this movie before. In 2021, similar setups came right before TRON exploded from $0.05 to $0.12. Again in 2024, cooling volume marked the accumulation phase before TRX ripped from $0.15 to $0.43. If history even half-rhymes, we could be staring at the early stages of another rally.

TRX Price Outlook and Key Levels

The TRX chart lines up with that theory. Price action recently bounced off the 100 EMA, reinforcing a bullish structure, while an EMA cross on the daily chart flashed a reversal signal. Immediate resistance sits at $0.35 — a tough wall that bulls need to break.

If TRX clears that hurdle, the next target looms near $0.44, matching last year’s highs, with Q4 2025 shaping up as a possible window for that push. If not, consolidation between $0.31 and $0.35 could drag on, or worse, a breakdown might see the coin revisit deeper supports at $0.31 or below.

Final Thoughts

All in all, TRON looks like it’s coiling for a move. On-chain metrics show stronger participation, stablecoin dominance is leaning in its favor, and technical signals suggest a bullish setup. But, as always in crypto, the market wants confirmation. A breakout above $0.35 might unlock the next leg higher, while hesitation could keep TRX stuck in a range for now.

The post TRON Gains Momentum as TVL Hits $6.37B – Is a Breakout Coming? first appeared on BlockNews.

Читать больше