Nvidia (NVDA) Stock’s $4 Trillion Goal: AI Still Investors’ Friend Post-Earnings?

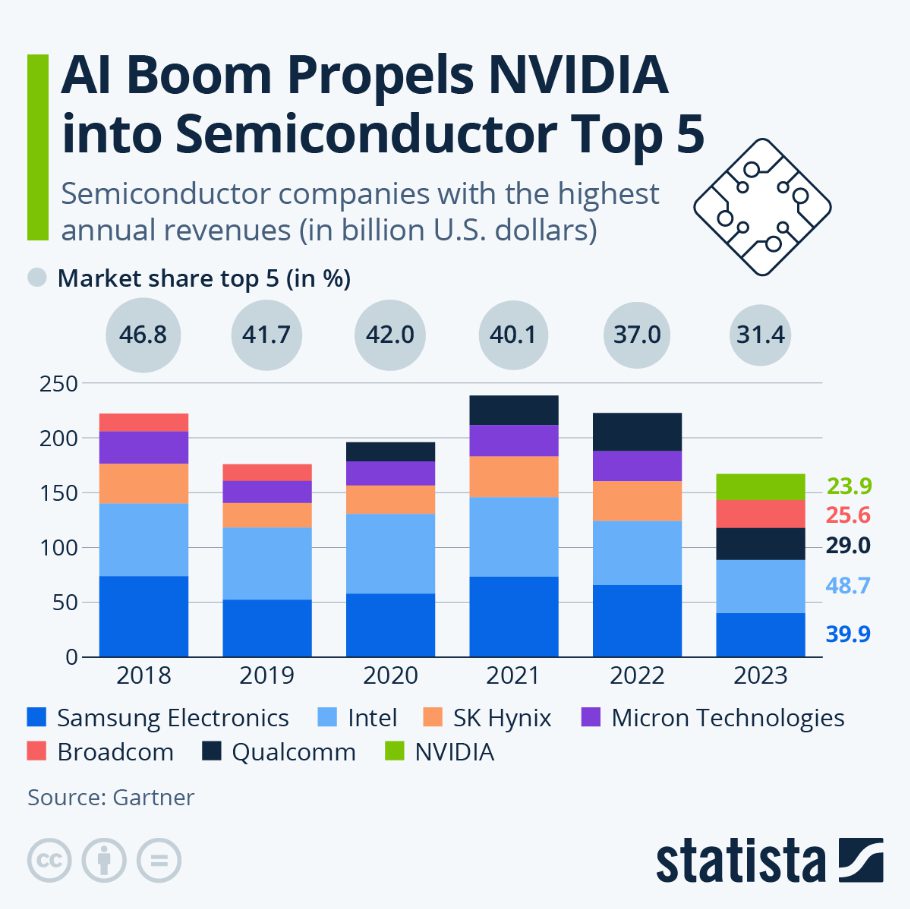

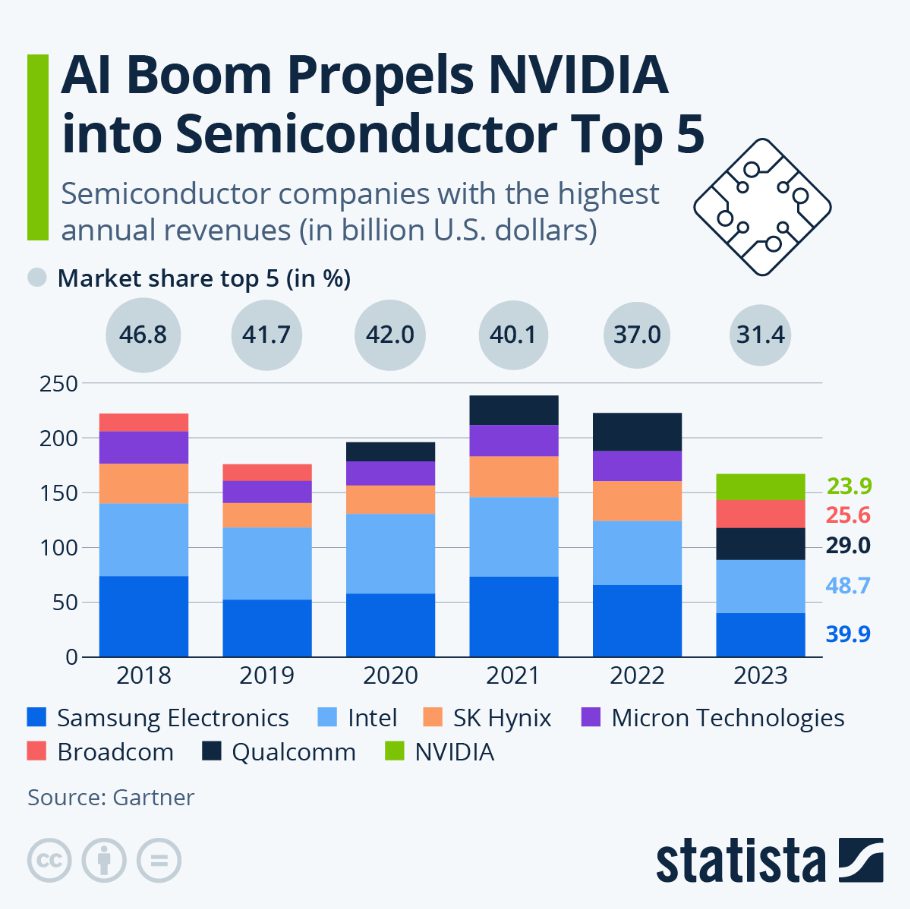

Nvidia dominates the AI chip market with record-breaking growth as NVDA stock moves toward a $4 trillion value mark. The chip maker’s revenue jumped 94% to $35.1 billion in Q3 2024, beating market estimates and proving its AI strategy works. This success cements Nvidia’s spot as the world’s top chipmaker, with its AI-driven investments delivering strong market gains.

Also Read: Should You Buy MSNBC Stock Before Elon Musk Acquires the News Channel?

Can Nvidia’s AI Strength Secure NVDA Stock’s Path to $4 Trillion?

Supply Constraints Mask True Demand

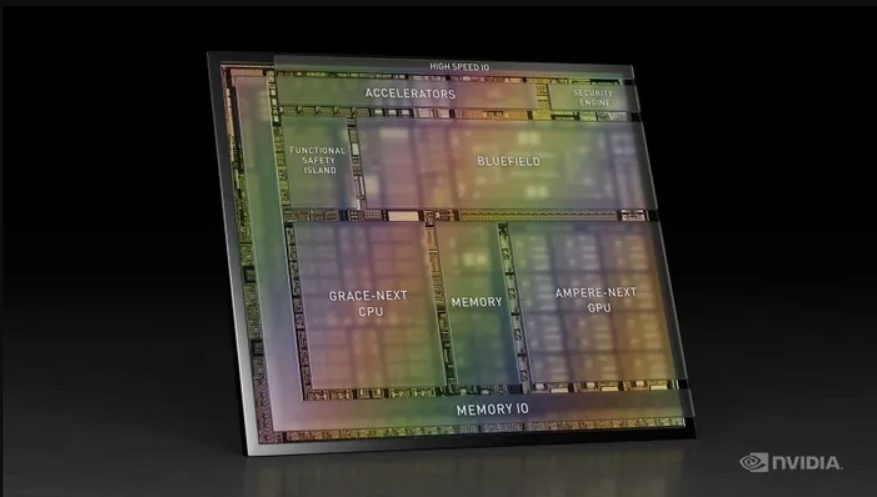

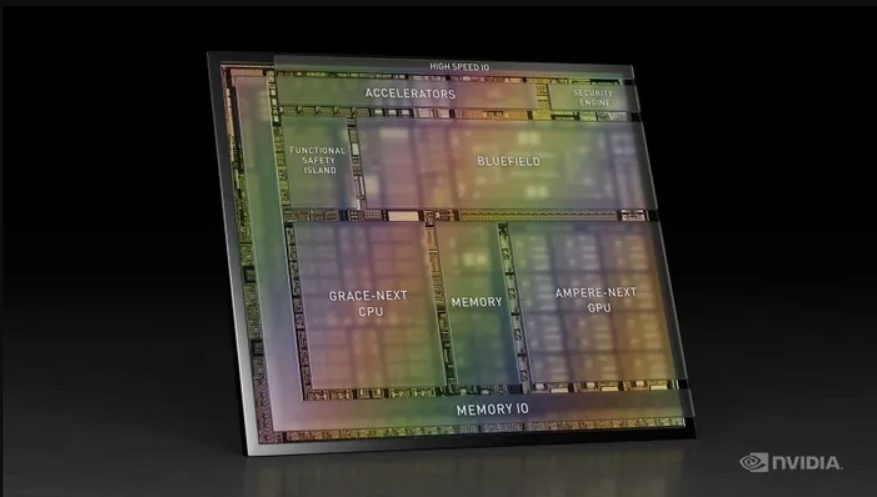

The chip giant sells every AI chip it can make, but production limits hold back growth. CFO Colette Kress described demand for the new Blackwell platform as “staggering” and Hopper platform demand as “exceptional.” While Taiwan Semiconductor Manufacturing can’t make enough chips, Nvidia’s AI strategy keeps beating competitors.

Competition Falls Short

AMD and Intel have new AI chips, but they haven’t made much impact. AMD’s job cuts and Intel’s business changes show how far ahead Nvidia stands. The firm’s data center sales now hit $120 billion yearly, helped by its special CUDA software tools, pushing NVDA stock higher.

Also Read: Shiba Inu: Top 3 Ways In Which SHIB Can Hit $0.001

Valuation and Growth Metrics

Nvidia’s stock trades at 55 times earnings, but this number misses the full growth story. Looking at Q3 earnings of $0.81 per share, future estimates show a better value at 34 times earnings, near market averages, despite faster growth. AI-driven investments keep driving sales across many business areas.

Political Landscape and Production Challenges

Making enough Blackwell chips remains a big challenge. New Trump policies might add taxes on overseas goods, affecting Nvidia’s work with TSMC and forcing more U.S. production. How the chip leader handles these issues will impact its path to $4 trillion.

Also Read: Romania Uses Blockchain for Presidential Votes: A New Era in Elections

The stock needs a 14% rise to hit $4 trillion. Strong demand and impressive quarterly results keep Nvidia leading in AI tech. With top technology, market control, and smart planning, more growth looks likely, though chip supply and political risks need watching.

Читать больше

Cramer says Broadcom stock is only ‘getting cheaper’ over time: explained here

Nvidia (NVDA) Stock’s $4 Trillion Goal: AI Still Investors’ Friend Post-Earnings?

Nvidia dominates the AI chip market with record-breaking growth as NVDA stock moves toward a $4 trillion value mark. The chip maker’s revenue jumped 94% to $35.1 billion in Q3 2024, beating market estimates and proving its AI strategy works. This success cements Nvidia’s spot as the world’s top chipmaker, with its AI-driven investments delivering strong market gains.

Also Read: Should You Buy MSNBC Stock Before Elon Musk Acquires the News Channel?

Can Nvidia’s AI Strength Secure NVDA Stock’s Path to $4 Trillion?

Supply Constraints Mask True Demand

The chip giant sells every AI chip it can make, but production limits hold back growth. CFO Colette Kress described demand for the new Blackwell platform as “staggering” and Hopper platform demand as “exceptional.” While Taiwan Semiconductor Manufacturing can’t make enough chips, Nvidia’s AI strategy keeps beating competitors.

Competition Falls Short

AMD and Intel have new AI chips, but they haven’t made much impact. AMD’s job cuts and Intel’s business changes show how far ahead Nvidia stands. The firm’s data center sales now hit $120 billion yearly, helped by its special CUDA software tools, pushing NVDA stock higher.

Also Read: Shiba Inu: Top 3 Ways In Which SHIB Can Hit $0.001

Valuation and Growth Metrics

Nvidia’s stock trades at 55 times earnings, but this number misses the full growth story. Looking at Q3 earnings of $0.81 per share, future estimates show a better value at 34 times earnings, near market averages, despite faster growth. AI-driven investments keep driving sales across many business areas.

Political Landscape and Production Challenges

Making enough Blackwell chips remains a big challenge. New Trump policies might add taxes on overseas goods, affecting Nvidia’s work with TSMC and forcing more U.S. production. How the chip leader handles these issues will impact its path to $4 trillion.

Also Read: Romania Uses Blockchain for Presidential Votes: A New Era in Elections

The stock needs a 14% rise to hit $4 trillion. Strong demand and impressive quarterly results keep Nvidia leading in AI tech. With top technology, market control, and smart planning, more growth looks likely, though chip supply and political risks need watching.

Читать больше