Over $678M in Crypto Liquidated in 24 Hours as Bitcoin Price Drops Below $54K

Bitcoin’s price fell to a four-month low on Friday after Japanese crypto exchange Mt. Gox transferred $2.7 billion worth of the crypto to a new wallet. The exchange also started paying back creditors, leading to further sales as leveraged traders played it safe due to market uncertainty.

Bitcoin Price Falls to Four-Month Low

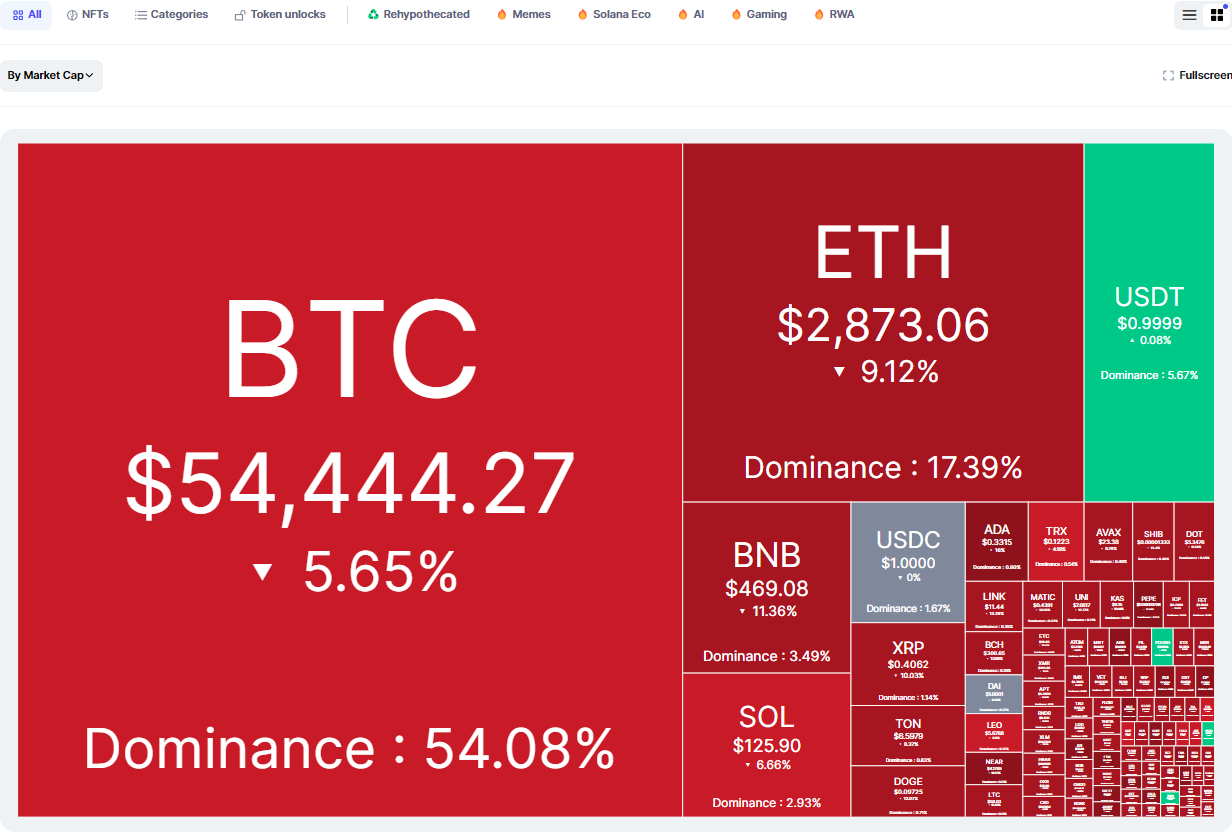

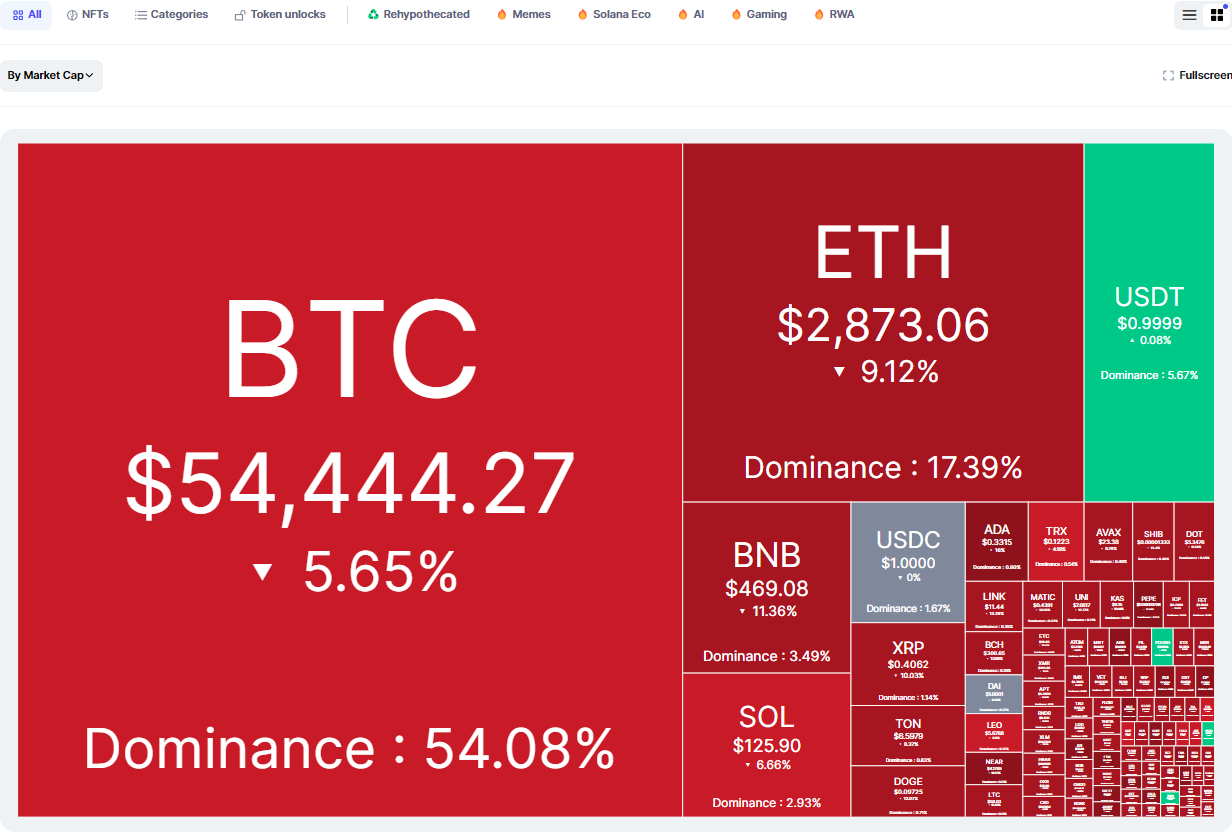

The asset dropped 5% to $53,806 before recovering slightly to about $54,658 as of 05:55 UTC. It has declined over 11% in the past week and fallen 22% in the last month.

Bitcoin’s plunge followed Arkham Intelligence’s report about Mt. Gox’s transfer. This transaction represents the exchange’s largest move since May, following smaller test transactions conducted Wednesday.

Exchange Repayment Plan Threatens Bitcoin Price Stability

Mt. Gox’s $2.7 billion transfer came just before the exchange began repaying creditors on Friday, aiming to distribute Bitcoin worth $9 billion in total. These creditors are widely expected to sell their holdings, given that these were worth only hundreds of dollars in 2014.

Analysts caution that such a substantial Bitcoin influx into the market could lead to price volatility and exert downward pressure on its value.

Bitcoin surged earlier this year after the US launched exchange-traded funds, reaching a peak over $73,000 in mid-March. However, those gains haven’t held, and the price has since tumbled.

Crypto Liquidations Surge to Two-Month High at $682.76 Million

Furthermore, crypto liquidations have risen to $682.76 million in the last 24 hours, marking the highest level in two months, according to CoinMarketCap. The liquidations amounted to $589.54 million from long positions and $93.2 million from short positions. Meanwhile, long BTC positions accounted for $185.08 million.

Market Concerns Amid Political Uncertainty

Analysts have also raised concerns about Joe Biden potentially being replaced as the Democratic presidential nominee. This concern arises after his shaky debate performance against rival candidate Donald Trump, with worries that Biden’s successor may be less supportive of cryptocurrencies.

Alex Kuptsikevich, FxPro senior market analyst, expects a further drop for Bitcoin. He mentioned that a 12% decline to $51.5K is more probable from the current level, rather than a similar 12% increase to $65.8K.

Over $678M in Crypto Liquidated in 24 Hours as Bitcoin Price Drops Below $54K

Bitcoin’s price fell to a four-month low on Friday after Japanese crypto exchange Mt. Gox transferred $2.7 billion worth of the crypto to a new wallet. The exchange also started paying back creditors, leading to further sales as leveraged traders played it safe due to market uncertainty.

Bitcoin Price Falls to Four-Month Low

The asset dropped 5% to $53,806 before recovering slightly to about $54,658 as of 05:55 UTC. It has declined over 11% in the past week and fallen 22% in the last month.

Bitcoin’s plunge followed Arkham Intelligence’s report about Mt. Gox’s transfer. This transaction represents the exchange’s largest move since May, following smaller test transactions conducted Wednesday.

Exchange Repayment Plan Threatens Bitcoin Price Stability

Mt. Gox’s $2.7 billion transfer came just before the exchange began repaying creditors on Friday, aiming to distribute Bitcoin worth $9 billion in total. These creditors are widely expected to sell their holdings, given that these were worth only hundreds of dollars in 2014.

Analysts caution that such a substantial Bitcoin influx into the market could lead to price volatility and exert downward pressure on its value.

Bitcoin surged earlier this year after the US launched exchange-traded funds, reaching a peak over $73,000 in mid-March. However, those gains haven’t held, and the price has since tumbled.

Crypto Liquidations Surge to Two-Month High at $682.76 Million

Furthermore, crypto liquidations have risen to $682.76 million in the last 24 hours, marking the highest level in two months, according to CoinMarketCap. The liquidations amounted to $589.54 million from long positions and $93.2 million from short positions. Meanwhile, long BTC positions accounted for $185.08 million.

Market Concerns Amid Political Uncertainty

Analysts have also raised concerns about Joe Biden potentially being replaced as the Democratic presidential nominee. This concern arises after his shaky debate performance against rival candidate Donald Trump, with worries that Biden’s successor may be less supportive of cryptocurrencies.

Alex Kuptsikevich, FxPro senior market analyst, expects a further drop for Bitcoin. He mentioned that a 12% decline to $51.5K is more probable from the current level, rather than a similar 12% increase to $65.8K.