Solana Jumps Over 48% Volume as Trump Calls For Fed Chair Termination

- Solana gains as trading volume spikes 48% amid rising Fed policy uncertainty.

- Bullish MACD and RSI suggest SOL may extend the rally if resistance at $143 is cleared.

- Political tension over Powell’s position triggers market focus on volatile assets like SOL.

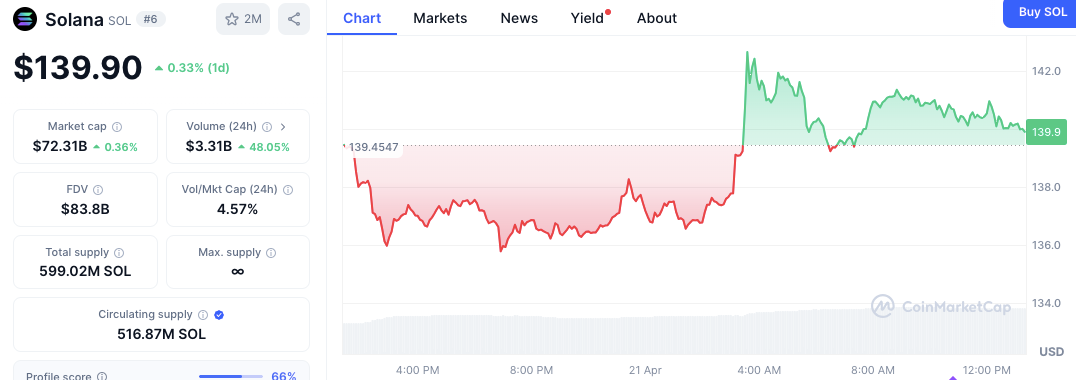

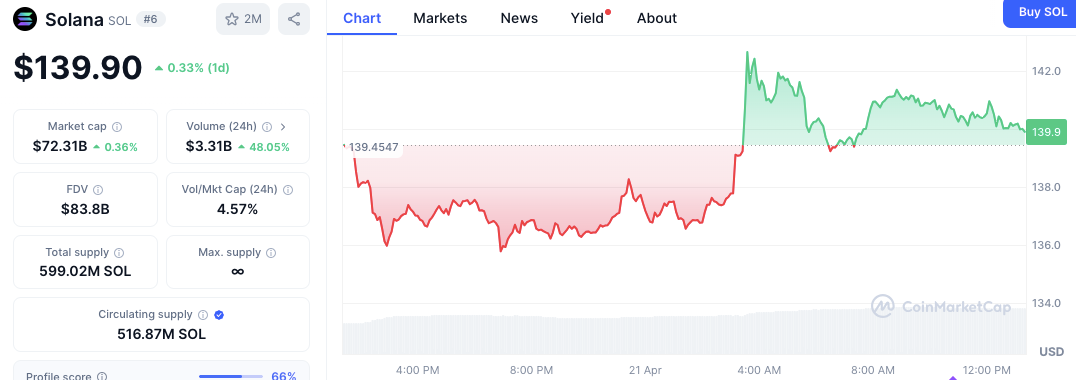

Solana (SOL) posted gains Monday, closing near $139.90 (+0.33% 24h) after a volatile session dipping below $136 then recovering strongly above $142. This price action coincided with high trading activity amid growing uncertainty over US monetary policy.

Market data showed Solana’s trading volume jumping over 48% ($3.31B), while its market cap reached $72.31B (Vol/Cap 4.57%). This points to heightened short-term trader participation, likely fueled by speculation surrounding the Federal Reserve’s leadership.

Related: Powell Speaks, Stocks Sink: Fed Chair Worried About Trump Tariff Fallout

Solana Technical Indicators Turn Bullish

On the technical side, Solana’s momentum has shifted in a favorable direction. The MACD shows a bullish crossover, with the MACD line at 2.87 crossing above the signal line at 2.35. The growing distance between the two lines and rising green…

The post Solana Jumps Over 48% Volume as Trump Calls For Fed Chair Termination appeared first on Coin Edition.

Читать больше

Whales Are Watching: Will $IMX Turn This Pump Into a Full-Blown Rally?

Solana Jumps Over 48% Volume as Trump Calls For Fed Chair Termination

- Solana gains as trading volume spikes 48% amid rising Fed policy uncertainty.

- Bullish MACD and RSI suggest SOL may extend the rally if resistance at $143 is cleared.

- Political tension over Powell’s position triggers market focus on volatile assets like SOL.

Solana (SOL) posted gains Monday, closing near $139.90 (+0.33% 24h) after a volatile session dipping below $136 then recovering strongly above $142. This price action coincided with high trading activity amid growing uncertainty over US monetary policy.

Market data showed Solana’s trading volume jumping over 48% ($3.31B), while its market cap reached $72.31B (Vol/Cap 4.57%). This points to heightened short-term trader participation, likely fueled by speculation surrounding the Federal Reserve’s leadership.

Related: Powell Speaks, Stocks Sink: Fed Chair Worried About Trump Tariff Fallout

Solana Technical Indicators Turn Bullish

On the technical side, Solana’s momentum has shifted in a favorable direction. The MACD shows a bullish crossover, with the MACD line at 2.87 crossing above the signal line at 2.35. The growing distance between the two lines and rising green…

The post Solana Jumps Over 48% Volume as Trump Calls For Fed Chair Termination appeared first on Coin Edition.

Читать больше