Bank of America Warns US Dollar Is Summer’s Biggest Pain Trade

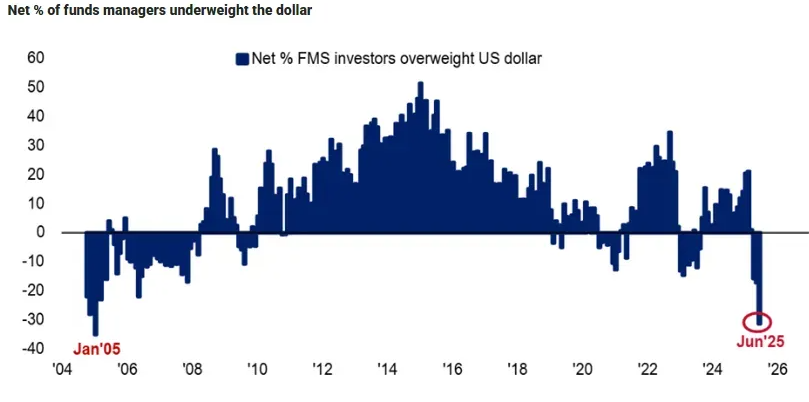

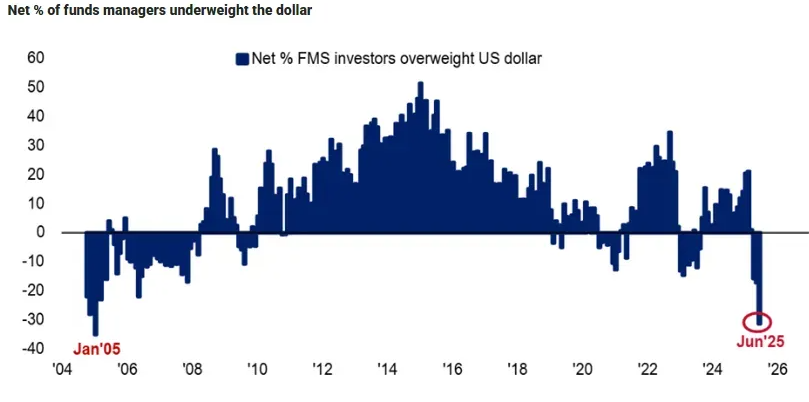

A new US dollar warning from Bank of America has professional investors scrambling right now, and the reasoning behind it is actually quite compelling. The Bank of America fund manager survey shows fund managers are currently the most underweight the dollar since January 2005, with analysts declaring it the “biggest summer pain trade” as global recession risks ease and dollar summer pain trade positioning reaches some pretty extreme levels.

Also Read: Bank of America Warns Dollar May Collapse After 10.8% Plunge

Why Bank Of America’s Dollar Warning Signals Global Risk Shift

The June 2025 Bank of America fund manager survey reveals what’s actually a dramatic shift in institutional sentiment right now. Fund managers controlling £523bn in assets are abandoning the dollar at unprecedented levels, and this US dollar warning reflects broader concerns about America’s fiscal position along with the international equities outlook that’s been improving lately.

Bank of America‘s analysts stated:

“Biggest summer pain trade is long the buck.”

Global Recession Risks Fade As Dollar Weakens

Global recession risks have been dramatically reassessed, with recession expectations falling from 42% in April to just 36% of fund managers now expecting economic contraction. This shift directly impacts the US dollar warning, as reduced recession fears typically weaken safe-haven demand for the greenback right now.

Soft landing expectations actually surged to 61% in June, marking the strongest consensus since October 2024. Hard landing forecasts collapsed from 49% to 13%, which reinforces why the dollar summer pain trade has become Bank of America’s primary concern at the time of writing.

International Equities Outlook Drives Dollar Exodus

The international equities outlook has fundamentally shifted, with 54% of fund managers expecting international stocks to outperform over five years – more than double the 23% backing US equities. This positioning validates the Bank of America fund manager survey findings and actually reinforces the US dollar warning that’s been making waves.

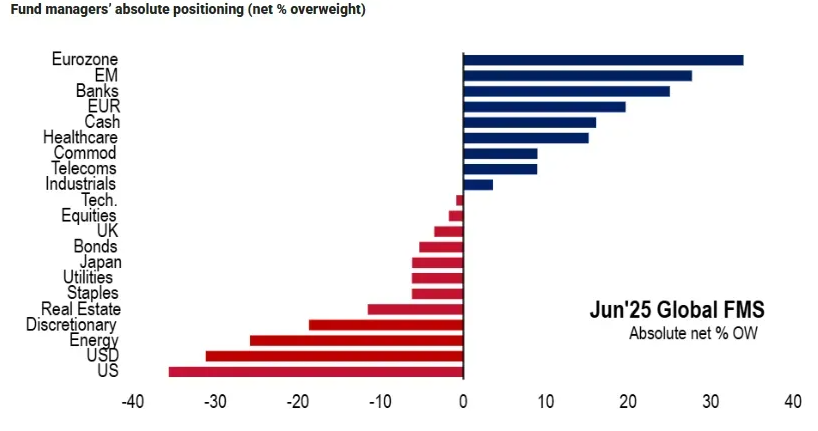

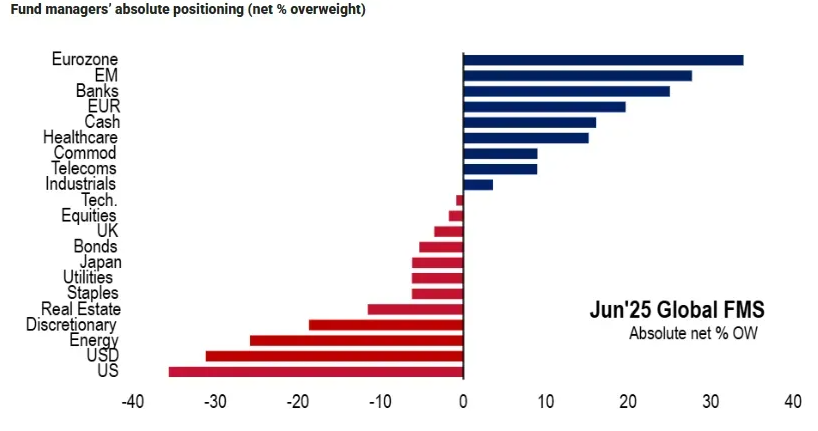

Fund managers are now deeply underweight US assets while overweighting eurozone and emerging market equities. This structural rotation away from dollar-denominated assets highlights why the dollar summer pain trade has become an important focal point for institutional investors right now.

Trade War Risks Still Dominate Despite Optimism

Despite improving sentiment, 47% of fund managers still view trade war-induced global recession as the primary tail risk. This concern, down from 80% in April, continues to influence the US dollar warning as policy uncertainty undermines dollar strength even now.

Also Read: De-Dollarization: Full List of Countries Dropping the US Dollar & Key Reasons

The Bank of America fund manager survey shows that while global recession risks have diminished, geopolitical tensions remain a key factor in the dollar summer pain trade. Secondary risks include inflation-driven rate hikes at 17% and credit events at 16%, both of which could impact the international equities outlook and dollar positioning going forward.

Bank of America Warns US Dollar Is Summer’s Biggest Pain Trade

A new US dollar warning from Bank of America has professional investors scrambling right now, and the reasoning behind it is actually quite compelling. The Bank of America fund manager survey shows fund managers are currently the most underweight the dollar since January 2005, with analysts declaring it the “biggest summer pain trade” as global recession risks ease and dollar summer pain trade positioning reaches some pretty extreme levels.

Also Read: Bank of America Warns Dollar May Collapse After 10.8% Plunge

Why Bank Of America’s Dollar Warning Signals Global Risk Shift

The June 2025 Bank of America fund manager survey reveals what’s actually a dramatic shift in institutional sentiment right now. Fund managers controlling £523bn in assets are abandoning the dollar at unprecedented levels, and this US dollar warning reflects broader concerns about America’s fiscal position along with the international equities outlook that’s been improving lately.

Bank of America‘s analysts stated:

“Biggest summer pain trade is long the buck.”

Global Recession Risks Fade As Dollar Weakens

Global recession risks have been dramatically reassessed, with recession expectations falling from 42% in April to just 36% of fund managers now expecting economic contraction. This shift directly impacts the US dollar warning, as reduced recession fears typically weaken safe-haven demand for the greenback right now.

Soft landing expectations actually surged to 61% in June, marking the strongest consensus since October 2024. Hard landing forecasts collapsed from 49% to 13%, which reinforces why the dollar summer pain trade has become Bank of America’s primary concern at the time of writing.

International Equities Outlook Drives Dollar Exodus

The international equities outlook has fundamentally shifted, with 54% of fund managers expecting international stocks to outperform over five years – more than double the 23% backing US equities. This positioning validates the Bank of America fund manager survey findings and actually reinforces the US dollar warning that’s been making waves.

Fund managers are now deeply underweight US assets while overweighting eurozone and emerging market equities. This structural rotation away from dollar-denominated assets highlights why the dollar summer pain trade has become an important focal point for institutional investors right now.

Trade War Risks Still Dominate Despite Optimism

Despite improving sentiment, 47% of fund managers still view trade war-induced global recession as the primary tail risk. This concern, down from 80% in April, continues to influence the US dollar warning as policy uncertainty undermines dollar strength even now.

Also Read: De-Dollarization: Full List of Countries Dropping the US Dollar & Key Reasons

The Bank of America fund manager survey shows that while global recession risks have diminished, geopolitical tensions remain a key factor in the dollar summer pain trade. Secondary risks include inflation-driven rate hikes at 17% and credit events at 16%, both of which could impact the international equities outlook and dollar positioning going forward.